MoneyGram 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

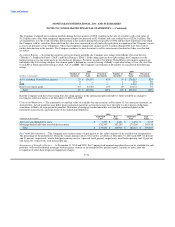

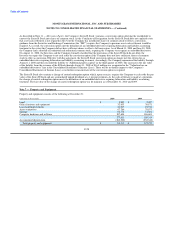

Note 6 — Derivative Financial Instruments

The Company uses forward contracts to hedge income statement exposure to foreign currency exchange risk arising from its assets and

liabilities denominated in foreign currencies. While these contracts economically hedge foreign currency risk, they are not designated as

hedges for accounting purposes. The "Transaction and operations support" line in the Consolidated Statements of Income (Loss) reflects

losses of $5.4 million, $5.3 million and $5.5 million in 2010, 2009 and 2008, respectively. These losses reflect changes in foreign

exchange rates on foreign-denominated receivables and payables, and are net of a gain of $1.8 million, a loss of $5.2 million, and a gain

of $4.3 million from the related forward contracts for 2010, 2009 and 2008, respectively. As of December 31, 2010 and 2009, the

Company had $123.8 million and $59.4 million, respectively, of outstanding notional amounts relating to its forward contracts.

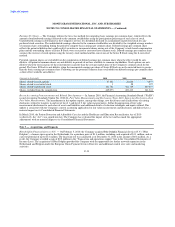

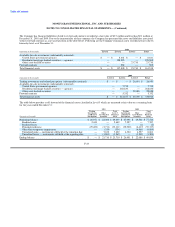

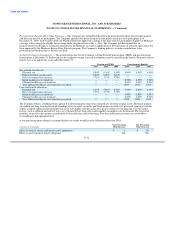

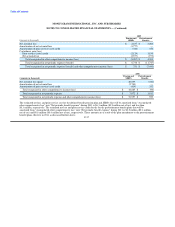

At December 31, the Company reflects the following fair values of derivative forward contract instruments in its Consolidated Balance

Sheets:

Balance Sheet Derivative Assets Derivative Liabilities

(Amounts in thousands) Location 2010 2009 2010 2009

Forward contracts Other assets $ 1,117 $ 5,361 $ 535 $ 29

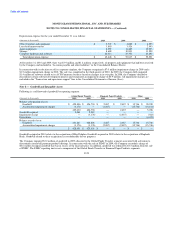

The Company is exposed to credit loss in the event of non-performance by counterparties to its derivative contracts. Collateral generally

is not required of the counterparties or of the Company. In the unlikely event a counterparty fails to meet the contractual terms of the

derivative contract, the Company's risk is limited to the fair value of the instrument. The Company actively monitors its exposure to

credit risk through the use of credit approvals and credit limits, and by selecting major international banks and financial institutions as

counterparties. The Company has not had any historical instances of non-performance by any counterparties, nor does it anticipate any

future instances of non-performance.

Historically, the Company entered into foreign currency forward contracts with 12-month durations to hedge forecasted foreign currency

money transfer transactions. The Company designated these forward contracts as cash flow hedges. All cash flow hedges matured in

2009. The Company recognized a gain of $2.4 million and a loss of $2.8 million for the years ended December 31, 2009 and 2008,

respectively, in the "Other" expense line in the non-operating section of the Consolidated Statements of Income (Loss), including

$0.8 million of unrealized gains and $2.2 million of unrealized losses reclassified from "Accumulated other comprehensive income

(loss)" upon the final settlement of these cash flow hedges for the years ending December 31, 2009 and 2008.

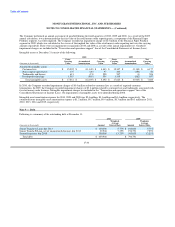

The Company historically used interest rate swaps to hedge the variability of cash flows from its floating rate debt, as well as its floating

rate commission payments to financial institution customers in the Financial Paper Products segment, primarily relating to the official

check product. In connection with its restructuring of the official check business in 2008, the Company terminated certain of its financial

institution customer relationships. The termination of the relationships led the Company to discontinue hedge accounting treatment in

2008 as the forecasted transaction would no longer occur. The commission swaps were terminated in 2008, resulting in a $27.7 million

loss being recognized in "Investment commissions expense" in the Consolidated Statements of Income (Loss). Additionally, as described

in Note 9 — Debt, the Company's senior facility was deemed extinguished as a result of the modifications made in connection with the

2008 Recapitalization. As a result, the Company discontinued hedge accounting treatment of its debt swap and terminated the swap in

2008. As a result of the swap termination, the Company recognized a $2.0 million loss in "Interest expense" in the Consolidated

Statements of Income (Loss).

F-27