MoneyGram 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

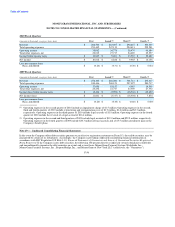

Note 15 — Commitments and Contingencies

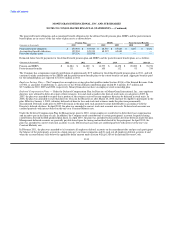

Operating Leases — The Company has various non-cancelable operating leases for buildings and equipment that terminate through 2021.

Certain of these leases contain rent holidays and rent escalation clauses based on pre-determined annual rate increases. The Company

recognizes rent expense under the straight-line method over the term of the lease. Any difference between the straight-line rent amounts

and amounts payable under the leases are recorded as deferred rent in "Accounts payable and other liabilities" in the Consolidated

Balance Sheets. Cash or lease incentives received under certain leases are recorded as deferred rent when the incentive is received and

amortized as a reduction to rent over the term of the lease using the straight-line method. Incentives received relating to tenant

improvements are recognized as a reduction of rent expense under the straight-line method over the term of the lease. Tenant

improvements are capitalized as leasehold improvements and depreciated over the shorter of the remaining term of the lease or 10 years.

At December 31, 2010, the deferred rent liability relating to these incentives was $1.9 million.

Rent expense under operating leases was $15.3 million, $13.8 million and $12.7 million during 2010, 2009 and 2008, respectively.

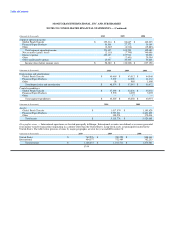

Minimum future rental payments for all non-cancelable operating leases with an initial term of more than one year are (amounts in

thousands):

2011 $ 11,782

2012 9,255

2013 7,137

2014 6,549

2015 5,887

Thereafter 7,073

Total $ 47,683

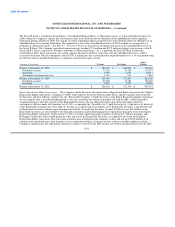

Legal Proceedings — The Company is involved in various claims, litigations and government inquiries that arise from time to time in the

ordinary course of the Company's business. All of these matters are subject to uncertainties and outcomes that are not predictable with

certainty. The Company accrues for these matters as any resulting losses become probable and can be reasonably estimated. Further, the

Company maintains insurance coverage for many claims and litigations alleged. Management does not believe that after final disposition

any of these matters is likely to have a material adverse impact on the Company's financial condition, results of operations and cash

flows.

In relation to various legal matters, including those described below, the Company had $2.3 million and $97.9 million of liability

recorded in the "Accounts payable and other liabilities" line in the Consolidated Balance Sheets as of December 31, 2010 and 2009,

respectively. As of December 31, 2009, the Company had a $61.0 million related receivable from insurance carriers in the "Other assets"

line in the Consolidated Balance Sheets. A net gain of $12.7 million and charges totaling $54.9 million, net of insurance recoveries, and

$0.3 million were recorded in the "Transaction and operations support" line in the Consolidated Statements of Income (Loss) during

2010, 2009 and 2008, respectively

F-49