MoneyGram 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

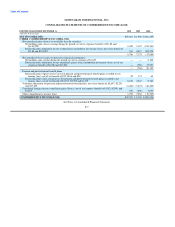

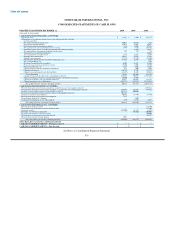

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

In connection with its credit facilities, one clearing bank agreement and the SPEs, the Company also has certain financial covenants that

require it to maintain pre-defined ratios of certain assets to payment service obligations. The financial covenants under the credit facilities

are described in Note 9 — Debt. One clearing bank agreement has financial covenants that include the maintenance of total cash, cash

equivalents, receivables and investments in an amount at least equal to payment service obligations, as disclosed in the Consolidated

Balance Sheets, as well as the maintenance of a minimum 103 percent ratio of total assets held at that bank to instruments estimated to

clear through that bank. Financial covenants related to the SPEs include the maintenance of specified ratios of cash, cash equivalents and

investments held in the SPE to the outstanding payment instruments issued by the related financial institution customer.

The regulatory and contractual requirements do not require the Company to specify individual assets held to meet its payment service

obligations, nor is the Company required to deposit specific assets into a trust, escrow or other special account. Rather, the Company

must maintain a pool of liquid assets sufficient to comply with the requirements. No third party places limitations, legal or otherwise, on

the Company regarding the use of its individual liquid assets. The Company is able to withdraw, deposit or sell its individual liquid assets

at will, with no prior notice or penalty, provided the Company maintains a total pool of liquid assets sufficient to meet the regulatory and

contractual requirements.

The Company is not regulated by state agencies for payment service obligations resulting from outstanding cashier's checks; however, the

Company restricts a portion of the funds related to these payment instruments due to contractual arrangements and Company policy.

Assets restricted for regulatory or contractual reasons are not available to satisfy working capital or other financing requirements.

Consequently, the Company considers a significant amount of cash and cash equivalents, receivables and investments to be restricted to

satisfy the liability to pay the principal amount of regulated payment service obligations upon presentment. Cash and cash equivalents,

receivables and investments exceeding payment service obligations are generally available; however, management considers a portion of

these amounts as providing additional assurance that business needs and regulatory requirements are maintained during the normal

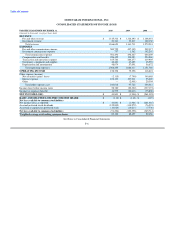

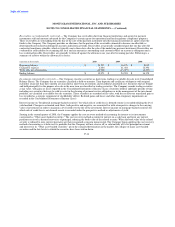

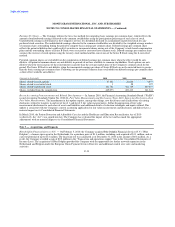

fluctuations in the value of the Company's payment service assets and obligations. The following table shows the amount of assets in

excess of payment service obligations at December 31:

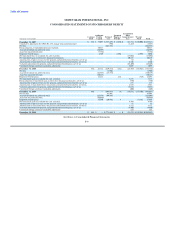

(Amounts in thousands) 2010 2009

Cash and cash equivalents (substantially restricted) $ 2,865,941 $ 3,376,824

Receivables, net (substantially restricted) 982,319 1,054,381

Short-term investments (substantially restricted) 405,769 400,000

Trading investments and related put options (substantially restricted) — 26,951

Available-for-sale investments (substantially restricted) 160,936 298,633

4,414,965 5,156,789

Payment service obligations (4,184,736) (4,843,454)

Assets in excess of payment service obligations $ 230,229 $ 313,335

Regulatory requirements also require MPSI to maintain positive net worth, with one state requiring that MPSI maintain positive tangible

net worth. In its most restrictive state, the Company had excess permissible investments of $423.2 million over the state's payment

service obligations measure at December 31, 2010, with substantially higher excess permissible investments for most other states. The

Company was in compliance with its contractual and financial regulatory requirements as of December 31, 2010.

Cash and Cash Equivalents (substantially restricted) — The Company defines cash and cash equivalents as cash on hand and all highly

liquid debt instruments with original maturities of three months or less at the purchase date.

F-13