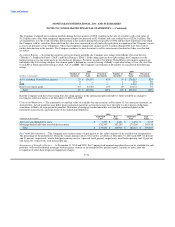

MoneyGram 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

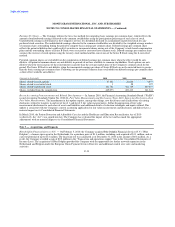

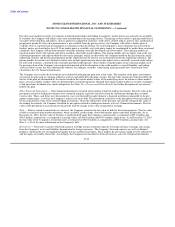

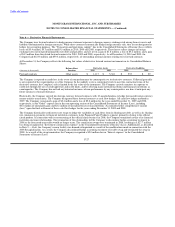

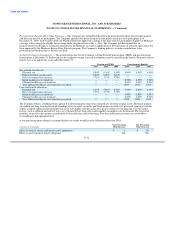

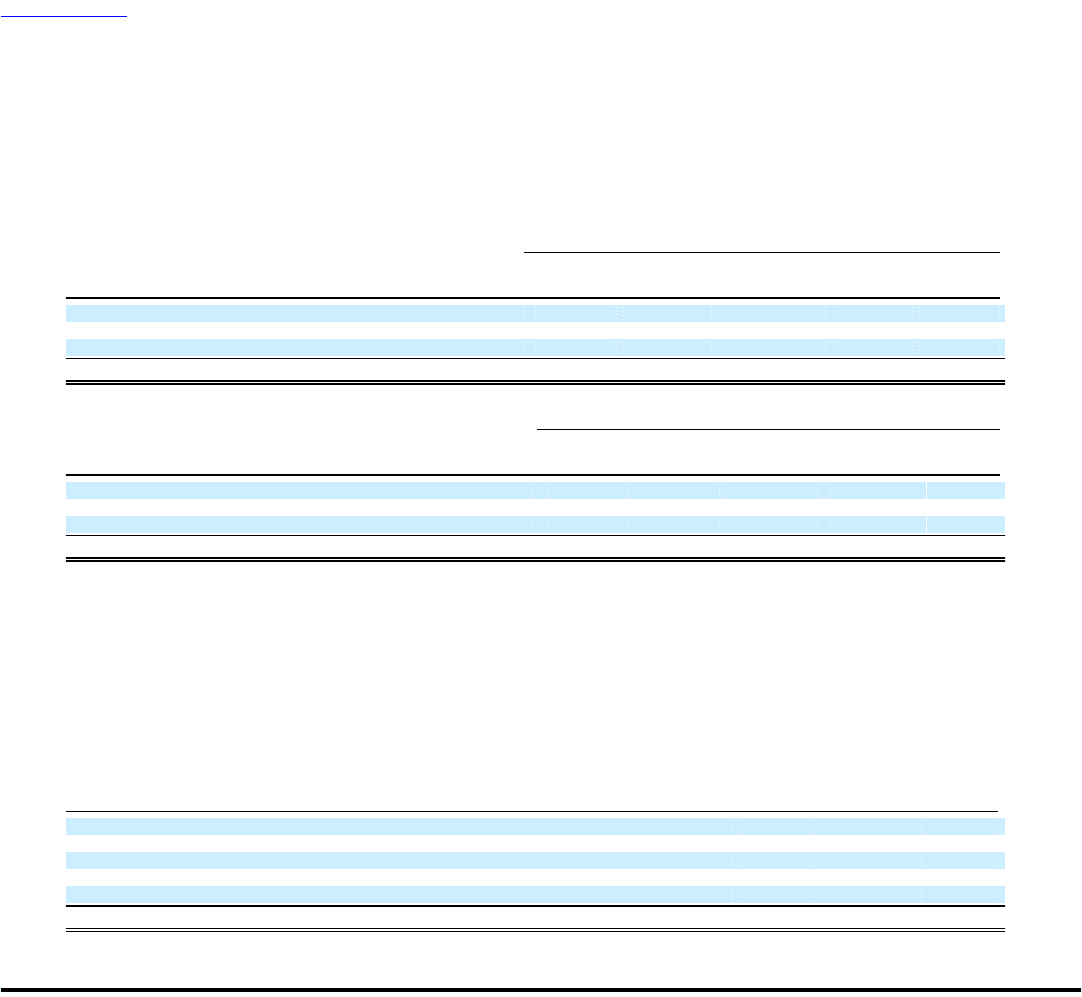

Available-for-sale Investments (substantially restricted) — Available-for-sale investments consist of mortgage-backed securities, asset-

backed securities and agency debenture securities. After other-than-temporary impairment charges, the amortized cost and fair value of

available-for-sale investments are as follows at December 31:

2010

Gross Gross Net

Amortized Unrealized Unrealized Fair Average

(Amounts in thousands, except net average price) Cost Gains Losses Value Price

Residential mortgage-backed securities-agencies $ 121,677 $ 7,001 $ (93) $ 128,585 $ 106.37

Other asset-backed securities 10,690 13,020 — 23,710 4.68

United States government agencies 7,273 1,368 — 8,641 96.01

Total $ 139,640 $ 21,389 $ (93) $ 160,936 $ 25.27

2009

Gross Gross Net

Amortized Unrealized Unrealized Fair Average

(Amounts in thousands, except net average price) Cost Gains Losses Value Price

Residential mortgage-backed securities — agencies $ 259,563 $ 9,296 $ (29) $ 268,830 $ 104.13

Other asset-backed securities 15,706 6,382 — 22,088 3.74

United States government agencies 6,854 861 — 7,715 85.72

Total $ 282,123 $ 16,539 $ (29) $ 298,633 $ 34.84

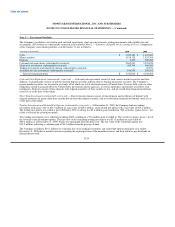

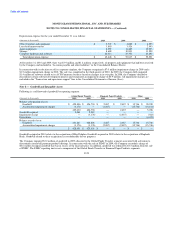

At December 31, 2010 and 2009, approximately 85 percent and 93 percent, respectively, of the available-for-sale portfolio is invested in

debentures of United States government agencies or securities collateralized by United States government agency debentures. These

securities have always had the implicit backing of the United States government and the Company expects to receive full par value upon

maturity or pay-down, as well as all interest payments. The Other asset-backed securities continue to have market exposure. The

Company has factored this risk into its fair value estimates, with the average price of an asset-backed security at $0.05 per dollar of par at

December 31, 2010.

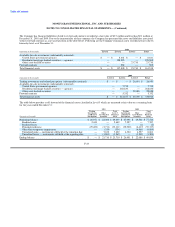

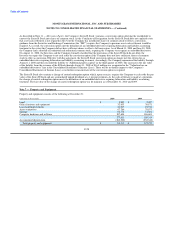

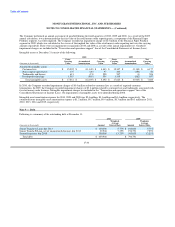

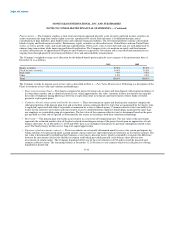

Gains and Losses and Other-Than-Temporary Impairments — At December 31, 2010 and 2009, net unrealized gains of $21.3 million

and $16.5 million, respectively, are included in the Consolidated Balance Sheets in "Accumulated other comprehensive loss." During

2010, 2009 and 2008, net losses of $0.3 million, $4.1 million and $326.6 million, respectively, were reclassified from "Accumulated

other comprehensive loss" to "Net securities (gains) losses" in connection with other-than-temporary impairments and realized gains and

losses recognized during the year. "Net securities (gains) losses" were as follows for the year ended December 31:

(Amounts in thousands) 2010 2009 2008

Realized gains from available-for-sale investments $ — $ — $ (34,200)

Realized losses from available-for-sale investments — 2 290,498

Other-than-temporary impairments from available-for-sale investments 334 4,069 70,274

Valuation (gains) losses on trading investments and related put options — (4,304) 14,116

Realized gains from trading investments and related put options (2,449) (7,557) —

Net securities (gains) losses $ (2,115) $ (7,790) $ 340,688

F-25