MoneyGram 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Note 12 — Stockholders' Deficit

Preferred Stock — The Company's Certificate of Incorporation provides for the issuance of up to 7,000,000 shares of preferred stock that

may be issued in one or more series, with each series to have certain rights and preferences as shall be determined by unlimited discretion

of the Company's Board of Directors, including, without limitation, voting rights, dividend rights, conversion rights, redemption

privileges and liquidation preferences. At December 31, 2010 and 2009, the Company had the following designations of preferred shares:

2,000,000 shares of Series A junior participating preferred stock ("Series A Stock"); 760,000 shares of B Stock; 500,000 shares of B-1

Stock; and 200,000 shares of Series D Stock. At December 31, 2010 and 2009, no Series A Stock or Series D Stock is issued or

outstanding. See Note 11 — Mezzanine Equity for further information on the B Stock, B-1 Stock and Series D Stock.

Common Stock — The Company's Certificate of Incorporation provides for the issuance of up to 1,300,000,000 shares of common stock

with a par value of $0.01. In connection with the spin-off, MoneyGram was recapitalized such that there were 88,556,077 shares of

MoneyGram common stock issued. The holders of MoneyGram common stock are entitled to one vote per share on all matters to be

voted upon by its stockholders. The holders of common stock have no preemptive or conversion rights or other subscription rights. There

are no redemption or sinking fund provisions applicable to the common stock. The determination to pay dividends on common stock will

be at the discretion of the Board of Directors and will depend on the Company's financial condition, results of operations, cash

requirements, prospects and such other factors as the Board of Directors may deem relevant. No dividends were paid in 2010. Under the

terms of the equity securities and debt issued in connection with the 2008 Recapitalization, the Company's ability to declare or pay

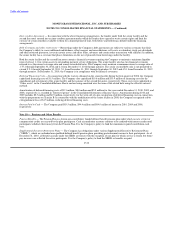

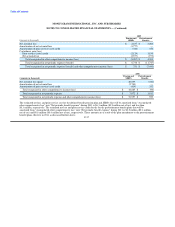

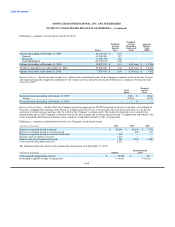

dividends or distributions to the stockholders of the Company's common stock is severely limited. The following is a summary of

common stock issued and outstanding at December 31:

(Amounts in thousands) 2010 2009

Common shares issued 88,556 88,556

Treasury stock (4,936) (6,041)

Common shares outstanding 83,620 82,515

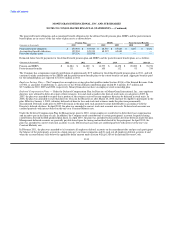

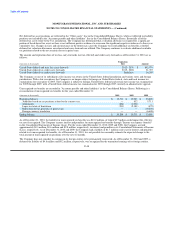

Treasury Stock — The Board of Directors has authorized the repurchase of a total of 12,000,000 shares. As of December 31, 2010, the

Company has repurchased 6,795,000 shares of common stock under this authorization and has remaining authorization to repurchase up

to 5,205,000 shares. There were no shares repurchased during 2010 or 2009. Following is a summary of treasury stock share activity:

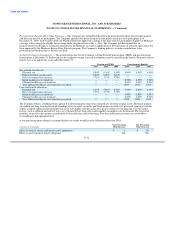

Treasury Stock

(Amounts in thousands) Shares

Balance at December 31, 2008 5,999

Submission of shares for withholding taxes upon release of restricted stock and

forfeiture of shares of restricted stock 42

Balance at December 31, 2009 6,041

Exercise of stock options and release of restricted stock, net of shares surrendered

for withholding taxes (1,105)

Balance at December 31, 2010 4,936

F-42