MoneyGram 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

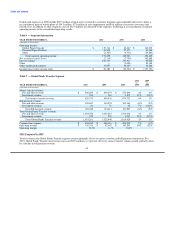

Table of Contents

Transaction and operations support costs increased $64.4 million, or 29 percent, in 2009 compared to 2008. We recorded legal reserves in

2009 of $20.3 million for securities litigation and stockholder derivative claims, $18.0 million for a settlement with the Federal Trade

Commission and $16.5 million for a patent lawsuit. Asset impairments totaling $18.3 million were recorded in 2009, reflecting an

increase of $9.5 million over 2008. Impairments in 2009 include a $7.0 million charge related to the decision to sell our airplane, a

$5.2 million impairment of goodwill and other assets from the decision to discontinue certain bill payment products and the sale of a non-

core business and a $6.1 million impairment of goodwill and intangible assets related to our money order product due to continued

declines in that business. Professional fees increased by $9.5 million in 2009, primarily due to litigation fees and the implementation of

the European Union Payment Services Directive. Our provision for agent receivables increased by $9.0 million, primarily from the

closure of an international agent during the year. Marketing costs decreased $12.7 million in 2009 from controlled spending, partially

offset by higher costs from agent location growth. In addition, expense in 2008 reflected $9.5 million of costs related to the 2008

Recapitalization and restructuring of the official check business. As reflected in each of the amounts discussed above, the decrease in the

euro exchange rate decreased transaction and operations support expense by $1.7 million in 2009.

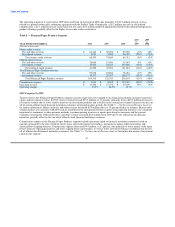

Occupancy, equipment and supplies — Occupancy, equipment and supplies expense includes facilities rent and maintenance costs,

software and equipment maintenance costs, freight and delivery costs and supplies. Expenses in 2010 decreased $0.9 million, or

2 percent, compared to 2009 due to lower delivery, postage and freight costs from controlled spending and the timing of agent roll-outs,

partially offset by $1.6 million of facility cease-use and related charges associated with restructuring activities. As reflected in the

amounts discussed above, the decrease in the euro exchange rate decreased occupancy, equipment and supplies expense by $0.6 million

in 2010.

Occupancy, equipment and supplies increased $1.4 million, or 3 percent, in 2009 compared to 2008. Software maintenance and office

rent increased $2.3 million and $1.5 million, respectively, to support the growth of the business. The timing of the roll out of new agent

locations and controlled spending resulted in a $2.8 million reduction of agent costs. As reflected in each of the amounts discussed above,

the decrease in the euro exchange rate decreased occupancy, equipment and supplies expense by $0.4 million in 2009.

Depreciation and amortization — Depreciation and amortization expense includes depreciation on point of sale equipment, agent

signage, computer hardware and software, capitalized software development costs, office furniture, equipment and leasehold

improvements and amortization of intangible assets. Depreciation and amortization decreased $9.0 million, or 16 percent, in 2010

compared to 2009, primarily from lower depreciation expense on point of sale equipment, computer hardware and other equipment, signs

and amortization of capitalized software. As reflected in the amounts discussed above, the decrease in the euro exchange rate decreased

depreciation and amortization expense by $0.5 million in 2010.

Depreciation and amortization was flat in 2009 compared to 2008 as a $3.2 million increase in depreciation from capital investments in

point of sale equipment, purchased software and other fixed assets to support the growth of the business was mostly offset by a

$2.8 million decrease in amortization of capitalized software, intangible assets and other assets. As reflected in the amounts discussed

above, the decrease in the euro exchange rate decreased depreciation and amortization expense by $0.6 million in 2009.

We implemented a new system in the third quarter of 2010 to increase the flexibility of our back office and improve operating

efficiencies. In 2010 and 2009, we capitalized software costs of approximately $8.4 million and $4.3 million, respectively, related to this

system. In connection with our global transformation initiative, we plan to make further investments in our infrastructure to enhance

operating efficiencies and support our continued growth. As a result of these investments, depreciation and amortization expense may

increase in the future.

39