MoneyGram 2010 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

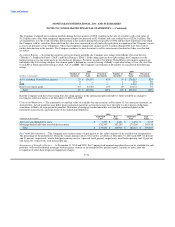

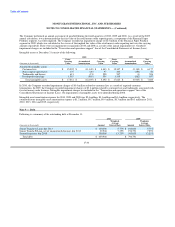

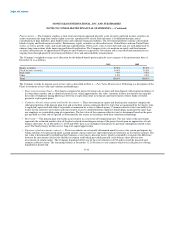

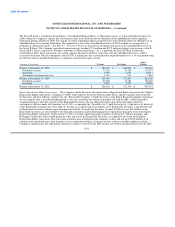

Plan Financial Information — Net periodic benefit expense (income) for the defined benefit pension plan and SERPs and postretirement

benefit plans includes the following components for the years ended December 31:

Pension and SERPs Postretirement Benefits

(Amounts in thousands) 2010 2009 2008 2010 2009 2008

Service cost $ — $ 894 $ 1,069 $ — $ 572 $ 543

Interest cost 11,876 12,659 12,678 253 837 822

Expected return on plan assets (8,664) (9,403) (10,275) — — —

Amortization of prior service cost (credit) 84 346 414 — (352) (352)

Recognized net actuarial loss 4,782 3,777 2,528 15 — —

Curtailment (gain) loss — (1,535) 658 — (12,804) —

Net periodic expense (benefit) $ 8,078 $ 6,738 $ 7,072 $ 268 $ (11,747) $ 1,013

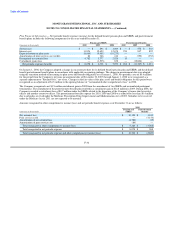

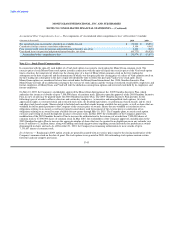

On January 1, 2008, the Company adopted a change in measurement date for its defined benefit pension plan and SERPs and the defined

benefit postretirement benefit plans in accordance with applicable accounting guidance. The change in measurement date was adopted

using the transition method of measuring its plan assets and benefit obligations as of January 1, 2008. Net periodic costs of $0.4 million

for the period from the Company's previous measurement date of November 30, 2007 through January 1, 2008 were recognized as a

separate adjustment to "Retained loss," net of tax. Changes in the fair value of the plan assets and benefit obligation for this period were

recognized as an adjustment of $1.5 million to the opening balance of "Accumulated other comprehensive loss" in 2008.

The Company recognized a net $1.5 million curtailment gain in 2009 from the amendment of two SERPs and accumulated participant

terminations. The amendment of the postretirement benefit plan resulted in a curtailment gain of $12.8 million in 2009. During 2008, the

Company recorded a curtailment loss of $0.7 million under the SERPs related to the departure of the Company's former chief executive

officer and another executive officer. The postretirement benefits expense for 2010, 2009 and 2008 was reduced by less than $0.4 million

due to subsidies received under the Medicare Prescription Drug, Improvement and Modernization Act of 2003. Subsidies to be received

under the Medicare Act in 2011 are not expected to be material.

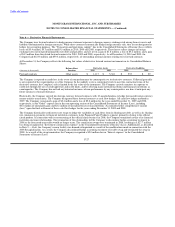

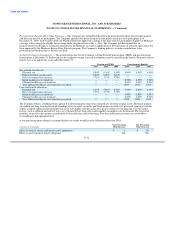

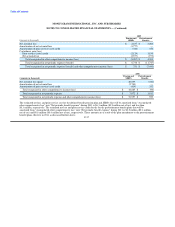

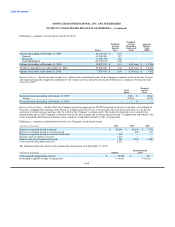

Amounts recognized in other comprehensive income (loss) and net periodic benefit expense as of December 31 are as follows:

2010

Pension and Postretirement

(Amounts in thousands) SERPs Benefits

Net actuarial loss $ 10,150 $ 1,100

Prior service credit — (4,153)

Amortization of net actuarial loss (4,782) (15)

Amortization of prior service cost (84) —

Total recognized in other comprehensive income (loss) $ 5,284 $ (3,068)

Total recognized in net periodic expense $ 8,078 $ 268

Total recognized in net periodic expense and other comprehensive income (loss) $ 13,362 $ (2,800)

F-36