MoneyGram 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

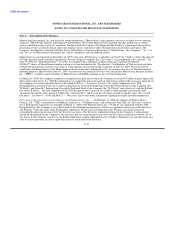

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

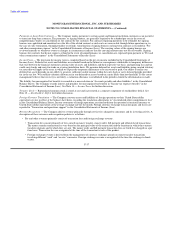

The Company has no obligation to Walmart or additional obligations to the Investors under the terms of the Participation Agreement.

However, as the Company indirectly benefited from the agreement, the Company recognizes the Participation Agreement in its

consolidated financial statements as if the Company itself entered into the agreement with Walmart. As Walmart may elect to receive any

payments under the Participation Agreement in cash, the agreement is accounted for as a liability award. The Company will recognize a

liability equal to the fair value of the Participation Agreement through a charge to the Consolidated Statements of Income (Loss) based

upon the probability that certain performance conditions will be met. The liability will be remeasured each period until settlement, with

changes in fair value recognized in the Consolidated Statements of Income (Loss). Walmart's ability to earn the award under the

Participation Agreement is conditioned upon the Investors receiving cash payments related to the Company's preferred stock in excess of

the Investors' original investment in the Company. While it is probable that performance conditions will be met at December 31, 2010,

the fair value of the liability is zero at this time as the Company's discount rate, based on contractual debt and equity rates of returns and

implied market premiums, exceeds the dividend rate on the preferred stock.

Note 2 — Summary of Significant Accounting Policies

Basis of Presentation — The consolidated financial statements of MoneyGram are prepared in conformity with accounting principles

generally accepted in the United States of America ("GAAP"). The Consolidated Balance Sheets are unclassified due to the short-term

nature of the settlement obligations, contrasted with the ability to invest cash awaiting settlement in long-term investment securities.

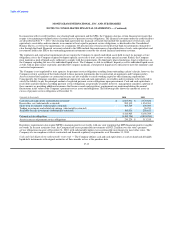

During the fourth quarter of 2010, the Company revised the presentation of its Consolidated Statements of Income (Loss) as a result of an

internal review to enhance external reporting and management reporting. As a result of this review, the Company will no longer present

net revenue, previously measured as total revenue less total commissions expense, as this measure was not found to be a meaningful

metric internally or to our external users. The Company will continue to separately disclose "Commissions expense." The Company has

also presented an operating income measure consistent with management reporting and to more clearly delineate operating and non-

operating items. As a result, certain items are now presented below the operating income line based on management's assessment of their

nature as non-operating, including securities (gains) losses, interest expense and (gains) losses related to cash flow hedges. In the

Consolidated Balance Sheets, the Company has reclassified amounts related to intangible assets into "Other assets" due to immateriality.

In the Consolidated Statements of Cash Flows, the Company has separately broken out "Signing bonus payments," which were

previously included in "Change in other assets," to enhance transparency. All prior periods have been reclassified to conform to this new

presentation.

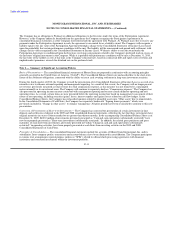

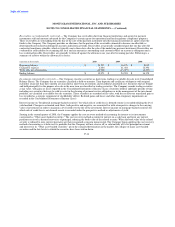

Correction of Presentation of Short-term Investments — The Company has corrected the presentation of certain investments in time

deposits and certificates of deposit in the 2009 and 2008 consolidated financial statements, reflecting the fact that these investments have

original maturities in excess of three months but no greater than thirteen months. In the accompanying Consolidated Balance Sheet as of

December 31, 2009, $400.0 million of investments previously presented as "Cash and cash equivalents (substantially restricted)" have

now been properly presented as "Short-term investments (substantially restricted)." In addition, the related gross purchases and gross

maturities of such short-term investments, previously presented net within "Change in cash and cash equivalents (substantially

restricted)" in operating activities, have been properly presented as cash flows from investing activities in the 2009 and 2008

Consolidated Statements of Cash Flows.

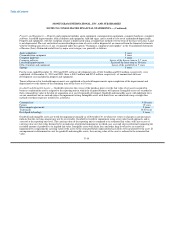

Principles of Consolidation — The consolidated financial statements include the accounts of MoneyGram International, Inc. and its

subsidiaries. Inter-company profits, transactions and account balances have been eliminated in consolidation. The Company participates

in various trust arrangements (special purpose entities or "SPEs") related to official check processing agreements with financial

institutions and structured investments within the investment portfolio.

F-11