MoneyGram 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

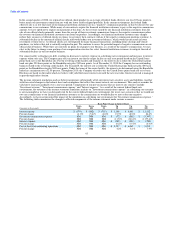

Our pension plan assets are primarily invested in interest-bearing cash accounts and commingled trust funds issued or sponsored by the

plan trustee. Our investments are periodically realigned in accordance with the investment guidelines. The expected return on pension

plan assets is based on our historical market experience, our pension plan investment strategy and our expectations for long-term rates of

return. We also consider peer data and historical returns to assess the reasonableness and appropriateness of our expected return. Our

pension plan investment strategy is reviewed annually and is based upon plan obligations, an evaluation of market conditions, tolerance

for risk and cash requirements for benefit payments. At December 31, 2010, the pension assets are composed of approximately 60 percent

in U.S. domestic and international equity stock funds, approximately 34 percent in fixed income securities such as global bond funds and

corporate obligations, approximately 4 percent in a real estate limited partnership interest and approximately 2 percent in other securities.

The actual rate of return on average pension assets in 2010 was 4.8 percent, as compared to a 4.5 percent rate of return in 2009. We

believe the 2010 returns indicate continued stabilization in the markets, and anticipate a return to historical long-term norms in the future.

This is consistent with the widely accepted capital market principle that assets with higher volatility generate greater long-term returns

and the historical cyclicality of the investment markets. Accordingly, we do not believe that the actual return for 2010 is significantly

different from the long-term expected return used to estimate the benefit obligation. In addition, the participants of our plans are relatively

young, providing the plan assets with sufficient time to recover to historical return rates.

Our assumptions reflect our historical experience and management's best judgment regarding future expectations. Certain of the

assumptions, particularly the discount rate and expected return on plan assets, require significant judgment and could have a material

impact on the measurement of our pension obligation. Changing the discount rate by 50 basis points would have increased/decreased

2010 pension expense by $0.4 million. Changing the expected rate of return by 50 basis points would have increased/decreased 2010

pension expense by $0.5 million.

Income Taxes — We are subject to income taxes in the United States and various foreign jurisdictions. In determining taxable income,

income or losses before taxes are adjusted for various differences between local tax laws and generally accepted accounting principles.

The determination of taxable income in any jurisdiction requires the interpretation of the related tax laws and regulations and the use of

estimates and assumptions regarding significant future events, such as the amount, timing and character of deductions and the sources and

character of income and tax credits. Changes in tax laws, regulations, agreements and treaties, foreign currency exchange restrictions or

our level of operations or profitability in each taxing jurisdiction could have an impact on the amount of income taxes that we provide

during any given year.

Deferred tax assets and liabilities are recorded based on the future tax consequences attributable to temporary differences that exist

between the financial statement carrying value of assets and liabilities and their respective tax basis, and operating loss and tax credit

carry-backs and carry-forwards on a taxing jurisdiction basis. We measure deferred tax assets and liabilities using enacted statutory tax

rates that will apply in the years in which we expect the temporary differences to be recovered or paid.

We establish valuation allowances for our deferred tax assets based on a more likely than not threshold. In assessing the need for a

valuation allowance, we consider both positive and negative evidence related to the likelihood that the deferred tax assets will be realized.

If, based on the weight of available evidence, it is deemed more likely than not that the deferred tax assets will not be realized, we

establish or maintain a valuation allowance. We weigh the positive and negative evidence commensurate with the extent it may be

objectively verified. It is generally difficult for positive evidence regarding projected future taxable income, exclusive of reversing

taxable temporary differences, to outweigh objective negative evidence, particularly cumulative losses. Our assessment of whether a

valuation allowance is required or should be adjusted requires judgment and is completed on a taxing jurisdiction basis. We consider,

among other matters: the nature, frequency and severity of any cumulative financial reporting losses; the ability to carry back losses to

prior years; future reversals of existing taxable temporary differences; tax planning strategies; and projections of future taxable income.

The accounting treatment of our deferred taxes represents our best estimate of these items. A valuation allowance established or revised

as a result of our assessment is recorded through "Income tax expense (benefit)" in our Consolidated Statements of Income (Loss).

Changes in our current estimates due to unanticipated events, or other factors, could have a material effect on our financial condition and

results of operations.

67