MoneyGram 2010 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

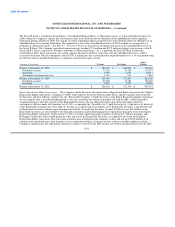

Federal Securities Class Actions — As previously disclosed, on March 9, 2010, the Company and certain of its present and former

officers and directors entered into a Settlement Agreement, subject to final approval of the court, to settle a consolidated class action case

originally filed on October 3, 2008 in the United States District Court for the District of Minnesota captioned In re MoneyGram

International, Inc. Securities Litigation. The settlement provides for a cash payment of $80.0 million, all but $20.0 million of which

would be paid by the Company's insurance carriers. At a hearing on June 18, 2010, the Court issued a final order and judgment approving

the settlement. The settlement became effective on July 26, 2010, when the time to appeal the Court's final order and judgment expired

without any appeal having been filed. The Company paid $20.0 million into an escrow account in March 2010 and the insurance carrier

paid $60.0 million in April 2010, resulting in full settlement of the Company's liability in this matter.

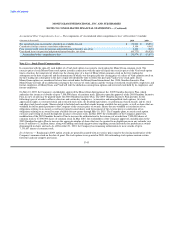

Minnesota Stockholder Derivative Claims — Certain of the Company's present and former officers and directors were defendants in a

consolidated stockholder derivative action in the United States District Court for the District of Minnesota captioned In re MoneyGram

International, Inc. Derivative Litigation. The Consolidated Complaint in this action, which was filed on November 18, 2009 and arises

out of the same matters at issue in the securities class action, alleges claims on behalf of the Company for, among other things, breach of

fiduciary duties, unjust enrichment, abuse of control, and gross mismanagement. On February 24, 2010, the parties entered into a non-

binding Memorandum of Understanding pursuant to which they agreed, subject to final approval of the parties and the court, to settle this

action. On March 31, 2010, the parties entered into a Stipulation of Settlement agreeing to settle the case on terms largely consistent with

the Memorandum of Understanding. On April 1, 2010, the Court issued an Order that preliminarily approved the settlement, providing

for notice to stockholders and scheduled a hearing on the settlement for June 18, 2010. The Stipulation of Settlement provides for

changes to the Company's business, corporate governance and internal controls, some of which have already been implemented in whole

or in part. The Company also agreed to pay attorney fees and expenses to the plaintiff's counsel in the amount of $1.3 million, with

$1.0 million to be paid by the Company's insurance carriers. On June 21, 2010, the Court denied an objection to the settlement filed by a

MoneyGram shareholder, Russell L. Berney, and issued a final order and judgment approving the settlement. On July 20, 2010,

Mr. Berney filed a notice of appeal of the final order and judgment in the United States Court of Appeals for the Eighth Circuit. On

October 5, 2010, the Company entered into a Settlement Agreement to settle the claims brought individually by Mr. Berney in this

proceeding and the California Action discussed below.

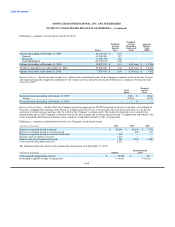

ERISA Class Action — On April 22, 2008, Delilah Morrison, on behalf of herself and all other MoneyGram 401(k) Plan participants,

brought an action in the United States District Court for the District of Minnesota. The complaint alleged claims under the Employee

Retirement Income Security Act of 1974, as amended ("ERISA"), including claims that the defendants breached fiduciary duties by

failing to manage the plan's investment in Company stock, and by continuing to offer Company stock as an investment option when the

stock was no longer a prudent investment. The complaint also alleged that defendants failed to provide complete and accurate information

regarding Company stock sufficient to advise plan participants of the risks involved with investing in Company stock and breached

fiduciary duties by failing to avoid conflicts of interests and to properly monitor the performance of plan fiduciaries and fiduciary

appointees. Finally, the complaint alleged that to the extent that the Company is not a fiduciary, it is liable for knowingly participating in

the fiduciary breaches as alleged. On August 7, 2008, plaintiff amended the complaint to add an additional plaintiff, name additional

defendants and additional allegations. For relief, the complaint sought damages based on what the most profitable alternatives to

Company stock would have yielded, unspecified equitable relief, costs and attorneys' fees. On March 25, 2009, the Court granted in part

and denied in part defendants' motion to dismiss. On April 30, 2010, plaintiffs filed a motion for class certification, which defendants

opposed in a brief filed May 28, 2010. On June 8, 2010, defendants filed a motion for partial summary judgment. Both motions were

scheduled for hearing before the Court on October 22, 2010. On October 13, 2010, the Company entered into a Settlement Agreement

which provides for a cash payment of $4.5 million, all but approximately $0.7 million of which was paid by the Company's insurance

carrier. The Court issued a final judgment and order approving the Settlement Agreement in October 2010.

F-50