MoneyGram 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

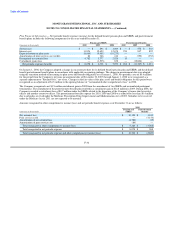

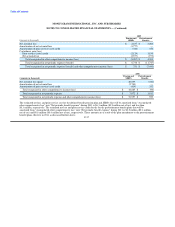

Pension Assets — The Company employs a total return investment approach whereby a mix of equity and fixed income securities are

used to maximize the long-term return of plan assets for a prudent level of risk. Risk tolerance is established through careful

consideration of plan liabilities, plan funded status and corporate financial condition. The investment portfolio contains a diversified

blend of equity and fixed income securities. Furthermore, equity securities are diversified across United States and non-United States

stocks, as well as growth, value, and small and large capitalizations. Other assets, such as real estate and cash, are used judiciously to

enhance long-term returns while improving portfolio diversification. The Company strives to maintain an equity and fixed income

securities allocation mix of approximately 60 percent and 40 percent, respectively. Investment risk is measured and monitored on an

ongoing basis through quarterly investment portfolio reviews and annual liability measurements.

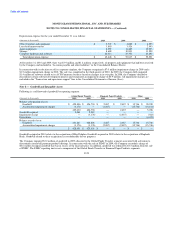

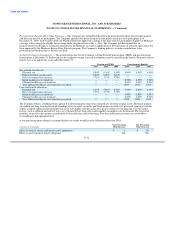

The Company's weighted-average asset allocation for the defined benefit pension plan by asset category at the measurement date of

December 31 is as follows:

2010 2009

Equity securities 59.8% 55.6%

Fixed income securities 34.4% 35.0%

Real estate 3.9% 5.5%

Other 1.9% 3.9%

Total 100.0% 100.0%

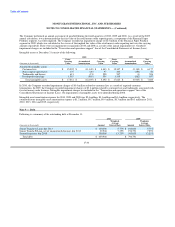

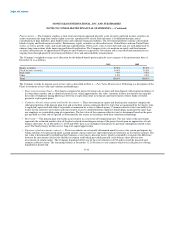

The Company records its pension assets at fair value as described in Note 4 — Fair Value Measurement. Following is a description of the

Plan's investments at fair value and valuation methodologies:

• Short-term investment fund — This fund is comprised of interest-bearing cash accounts and time deposits with original maturities of

less than three months, and is valued at historical cost, which approximates fair value. Amounts in these investments are typically

the result of temporary timing differences between receipts from other investments and reinvestment of those funds or benefit

payments to plan participants.

• Common collective trusts issued and held by the trustee — These investments in equity and fixed income securities comprise the

substantial portion of the pension plan trust and are held in various common/collective trusts that are maintained by the trustee, who

is regulated, supervised and subject to periodic examination by a state or federal agency. Common collective trusts are held by the

trustee for the collective investment and reinvestment of assets contributed from employee benefit plans maintained by more than

one employer or a controlled group of corporations. The fair value of the common collective trust is determined based on the price

per unit held as of the end of a period as determined by the trustee in accordance with their valuation methodology.

• Real estate — The pension plan trust holds an investment in a real estate development project. The fair value of this investment

represents the estimated market value of the plan's related ownership percentage of the project based upon an appraisal as of each

balance sheet date. As of December 31, 2010 and 2009, there is no unfunded commitment or potential redemptions related to this

asset. The fund strategy for this asset is long-term capital appreciation.

• Experience fund investment contracts — These investments are actuarially determined annuity reserves for certain participants for

whom annuities were purchased under a group annuity contract and were superseded and converted into an investment contract. The

fair value is determined by multiplying their balances at cost times a discount factor, which is intended to recognize the difference

between the investment yield at cost and the investment yield which prevailed generally at the balance sheet date for new

investments of similar nature. The Company liquidated all but one of these investments in 2010 and invested the proceeds into

common collective trusts. The remaining balance at December 31, 2010 relates to one contract which was in the process of being

liquidated at period-end.

F-34