MoneyGram 2010 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Note 17 — Subsequent Event

On March 7, 2011, the Company entered into a Recapitalization Agreement with THL and Goldman Sachs pursuant to which (i) THL

will convert all of the shares of B Stock into shares of common stock in accordance with the Certificate of Designations, Preferences and

Rights of Series B Participating Convertible Preferred Stock of MoneyGram International, Inc., (ii) Goldman Sachs will convert all of the

shares of B-1 Stock into shares of D Stock in accordance with the Certificate of Designations, Preferences and Rights of Series B-1

Participating Convertible Preferred Stock of MoneyGram International, Inc., and (iii) THL will receive approximately 28.2 million

additional shares of common stock and $140.8 million in cash, and Goldman Sachs will receive approximately 15,504 additional shares

of D Stock (equivalent to approximately 15.5 million shares of common stock) and $77.5 million in cash (such transactions, collectively,

the "2011 Recapitalization").

Concurrently with entering into the Recapitalization Agreement, Worldwide and the Company entered into a Consent Agreement with the

holders of the second lien notes in which the parties have agreed to enter into a supplemental indenture to the indenture governing the

second lien notes that will, among other things, amend the indenture in order to permit the 2011 Recapitalization. In addition, the

Company is currently working with certain of its relationship banks to put in place a new senior secured credit facility comprised of a

revolver and a term loan, which would refinance the Company's existing senior secured credit facility and provide the funding for the

2011 Recapitalization.

The 2011 Recapitalization has been approved unanimously by the Company's board of directors following the recommendation of a

special committee comprised of independent and disinterested members of our board of directors, and is subject to various conditions

contained in the Recapitalization Agreement, including the approval of the 2011 Recapitalization or any other matter that requires

approval under the Recapitalization Agreement (collectively the "Stockholder Approval Matters") by the affirmative vote of a majority of

the outstanding shares of our common stock and B Stock (on an as-converted basis), voting as a single class, and the affirmative vote of a

majority of the outstanding shares of our common stock (not including the B Stock or any other stock of the Company held by any

Investor), in each case voting on the Stockholder Approval Matters and the Company's receipt of sufficient financing to consummate the

2011 Recapitalization.

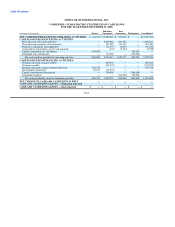

If the 2011 Recapitalization is completed as intended, all amounts included in mezzanine equity would be converted into components of

stockholders' deficit. Unamortized transaction costs and discounts related to the mezzanine equity would be charged against additional

paid-in capital to the extent available, with the remaining amount charged to retained loss. The conversion of the B Stock would result in

an increase to common stock and additional paid-in capital, while the conversion of the B-1 Stock would result in the recognition of the

D Stock within stockholders' deficit. The shares of common stock and D Stock issued as additional consideration, along with additional

consideration to be paid in cash, would be charged against retained loss and would reduce the amount of income available to common

stockholders in the calculation of earnings per share for the period in which the conversion is completed. Upon entering into a new senior

secured credit facility, the Company anticipates that the unamortized discounts and deferred financing costs related to the existing senior

facility would be expensed in 2011.

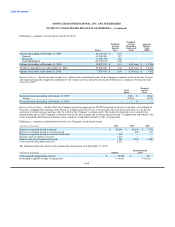

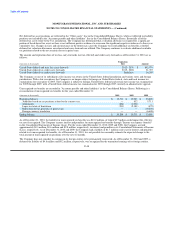

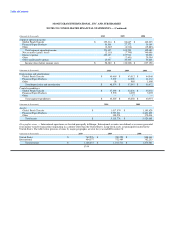

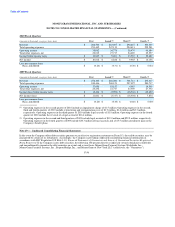

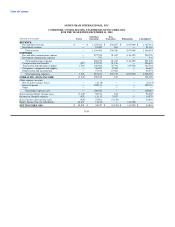

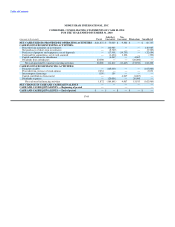

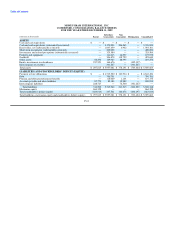

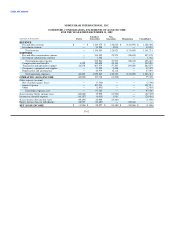

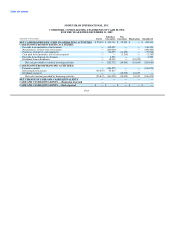

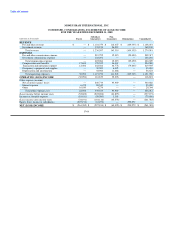

Note 18 — Quarterly Financial Data (Unaudited)

The summation of quarterly earnings per share may not equate to the calculation for the full year as quarterly calculations are performed

on a discrete basis.

F-55