MoneyGram 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Credit Facilities — Our credit facilities consist of a senior facility and second lien notes. See Note 9 — Debt of the Notes to the

Consolidated Financial Statements for further information. During 2010, we repaid $165.0 million of outstanding Tranche B debt under

our senior facility. Combined with previous debt repayments, we have repaid $351.9 million of our outstanding debt since January 1,

2009, including the repayment of the full $145.0 million balance on our revolving credit line, $205.0 million of prepayments on

Tranche B debt and $1.9 million of scheduled quarterly principal payments on Tranche B debt. We continue to evaluate further

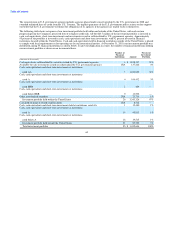

reductions of our outstanding debt ahead of scheduled maturities. Following is a summary of our outstanding debt at December 31:

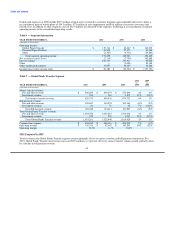

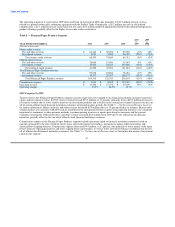

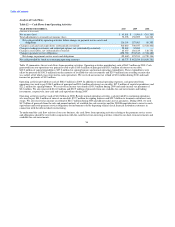

Table 10 — Schedule of Credit Facilities

Interest Rate Facility Outstanding 2011

(Amounts in thousands) for 2010 Size 2010 2009 Interest

Tranche A, due 2013 5.75% $ 100,000 $ 100,000 $ 100,000 $ 5,750

Tranche B, net of unamortized discount, due 2013 7.25% 250,000 39,946 196,791 2,991

Revolving credit facility, due 2013 5.75% 250,000 — — —

First lien senior secured debt 600,000 139,946 296,791 8,741

Second lien notes, due 2018 13.25% 500,000 500,000 500,000 66,250

Total debt $ 1,100,000 $ 639,946 $ 796,791 $ 74,991

(1) Reflects the interest that will be paid in 2011 using the rates in effect on December 31, 2010, assuming no prepayments of principal

and the continued payment of interest on the second lien notes.

Our revolving credit facility has $243.2 million of borrowing capacity as of December 31, 2010, net of $6.8 million of outstanding letters

of credit issued. Amounts outstanding under the senior facility are due upon maturity in 2013. As a result of our debt prepayments, there

are no mandatory principal payments required on Tranche B until maturity in 2013. We may elect an interest rate for the senior facility at

each reset period based on either the United States prime bank rate or the Eurodollar rate, with a minimum rate of 250 basis points set for

the Eurodollar option. The interest rate election may be made individually for each term loan and each draw under the revolving credit

facility. For the revolving credit facility and Tranche A, the interest rate is either the United States prime bank rate plus 250 basis points

or the Eurodollar rate plus 350 basis points. In addition, we incur fees of 50 basis points on the daily unused availability under the

revolving credit facility. The interest rate for Tranche B can be set at either the United States prime bank rate plus 400 basis points or the

Eurodollar rate plus 500 basis points. Through 2009 and as of the date of this filing, our interest rates have been set based on the United

States prime bank rate.

Amounts outstanding under the second lien notes are due upon maturity in 2018. The interest rate on the second lien notes is

13.25 percent per year. Prior to March 25, 2011, we have the option to capitalize interest at a rate of 15.25 percent. If interest is

capitalized, 0.50 percent of the interest is payable in cash and 14.75 percent is capitalized into the outstanding principal balance. We have

paid the interest on the second lien notes through December 31, 2010, and we anticipate that we will pay the interest on the second lien

notes that is due March 25, 2011.

Our credit facilities contain various financial and non-financial covenants. A violation of these covenants could negatively impact our

liquidity by restricting our ability to borrow under the revolving credit facility and/or causing acceleration of amounts due under the

credit facilities. The financial covenants in our credit facilities measure leverage, interest coverage and liquidity. Leverage is measured

through a senior secured debt ratio calculated as consolidated indebtedness to consolidated earnings before interest, taxes, depreciation

and amortization ("EBITDA"), adjusted for certain items such as net securities (gains) losses, stock-based compensation expense, certain

legal settlements and asset impairments, among other items ("adjusted EBITDA"). This measure is similar, but not identical, to the

measure discussed under Table 5 — EBITDA and Adjusted EBITDA. Interest coverage is calculated as adjusted EBITDA to net cash

interest expense. Liquidity is measured as assets in excess of payment service obligations, as shown in Table 9, adjusted for various

exclusions. We are in compliance with all financial covenants as of December 31, 2010.

52