MoneyGram 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

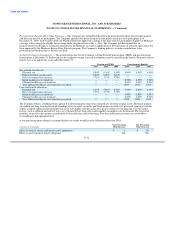

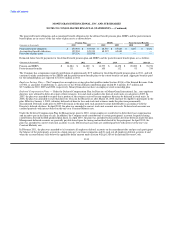

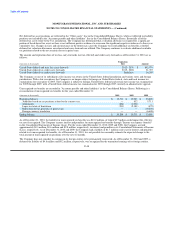

Accumulated Other Comprehensive Loss — The components of "Accumulated other comprehensive loss" at December 31 include:

(Amounts in thousands) 2010 2009

Net unrealized gains on securities classified as available-for-sale $ 21,296 $ 16,510

Cumulative foreign currency translation adjustments 5,194 4,962

Prior service credit (cost) for pension and postretirement benefits, net of tax 2,404 (223)

Unrealized losses on pension and postretirement benefits, net of tax (60,773) (56,920)

Accumulated other comprehensive loss $ (31,879) $ (35,671)

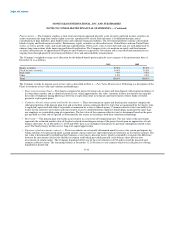

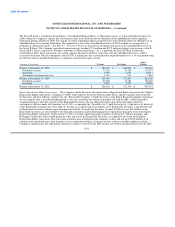

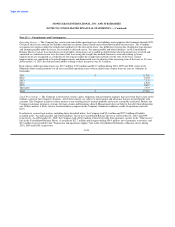

Note 13 — Stock-Based Compensation

In connection with the spin-off, each holder of a Viad stock option was issued a stock option for MoneyGram common stock. The

exercise price of each MoneyGram stock option issued in connection with the spin-off equals the exercise price of the Viad stock option

times a fraction, the numerator of which was the closing price of a share of MoneyGram common stock on the first trading day

subsequent to the date of spin-off and the denominator of which was that price plus the closing price of a share of Viad common stock on

the first trading day subsequent to the date of spin-off (divided by four to reflect the post-spin Viad reverse stock split). These

MoneyGram options are considered to have been issued under the MoneyGram International, Inc. 2004 Omnibus Incentive Plan.

MoneyGram will take all tax deductions relating to the exercise of stock options and the vesting of restricted stock held by employees and

former employees of MoneyGram, and Viad will take the deductions arising from options and restricted stock held by its employees and

former employees.

On May 10, 2005, the Company's stockholders approved the MoneyGram International, Inc. 2005 Omnibus Incentive Plan, which

authorizes the issuance of awards of up to 7,500,000 shares of common stock. Effective upon the approval of the 2005 Omnibus Incentive

Plan, no new awards may be granted under the 2004 Omnibus Incentive Plan. The 2005 Omnibus Incentive Plan provides for the

following types of awards to officers, directors and certain key employees: (a) incentive and nonqualified stock options; (b) stock

appreciation rights; (c) restricted stock and restricted stock units; (d) dividend equivalents; (e) performance based awards; and (f) stock

and other stock-based awards. Shares related to forfeited and cancelled awards become available for new grants, as well as shares that are

withheld for full or partial payment to the Company of the exercise price of awards. Shares that are withheld as satisfaction of tax

obligations relating to an award, as well as previously issued shares used for payment of the exercise price or satisfaction of tax

obligations relating to an award, become available for new grants through May 10, 2015. The Company plans to satisfy stock option

exercises and vesting of awards through the issuance of treasury stock. In May 2009, the stockholders of the Company approved a

modification of the 2005 Omnibus Incentive Plan to increase the authorization for the issuance of awards from 7,500,000 shares of

common stock to 47,000,000 shares of common stock. In May 2010, the stockholders of the Company approved a modification to the

2005 Omnibus Incentive Plan to increase the aggregate number of shares that may be granted to an eligible person in any calendar year

from 10 million to 12 million shares, along with adding and clarifying provisions regarding certain limitations for performance awards

denominated in shares and cash. As of December 31, 2010, the Company has remaining authorization to issue awards of up to

7,170,657 shares of common stock.

Stock Options — Beginning in 2009, option awards are generally granted with an exercise price equal to the closing market price of the

Company's common stock on the date of grant. No stock options were granted in 2008. All outstanding stock options contain certain

forfeiture and non-compete provisions.

F-43