MoneyGram 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

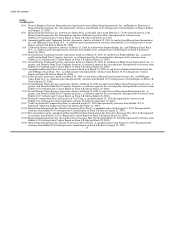

Table of Contents

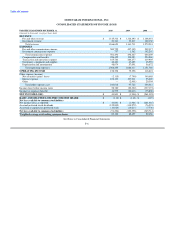

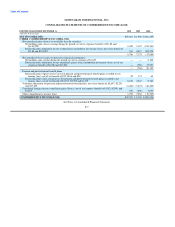

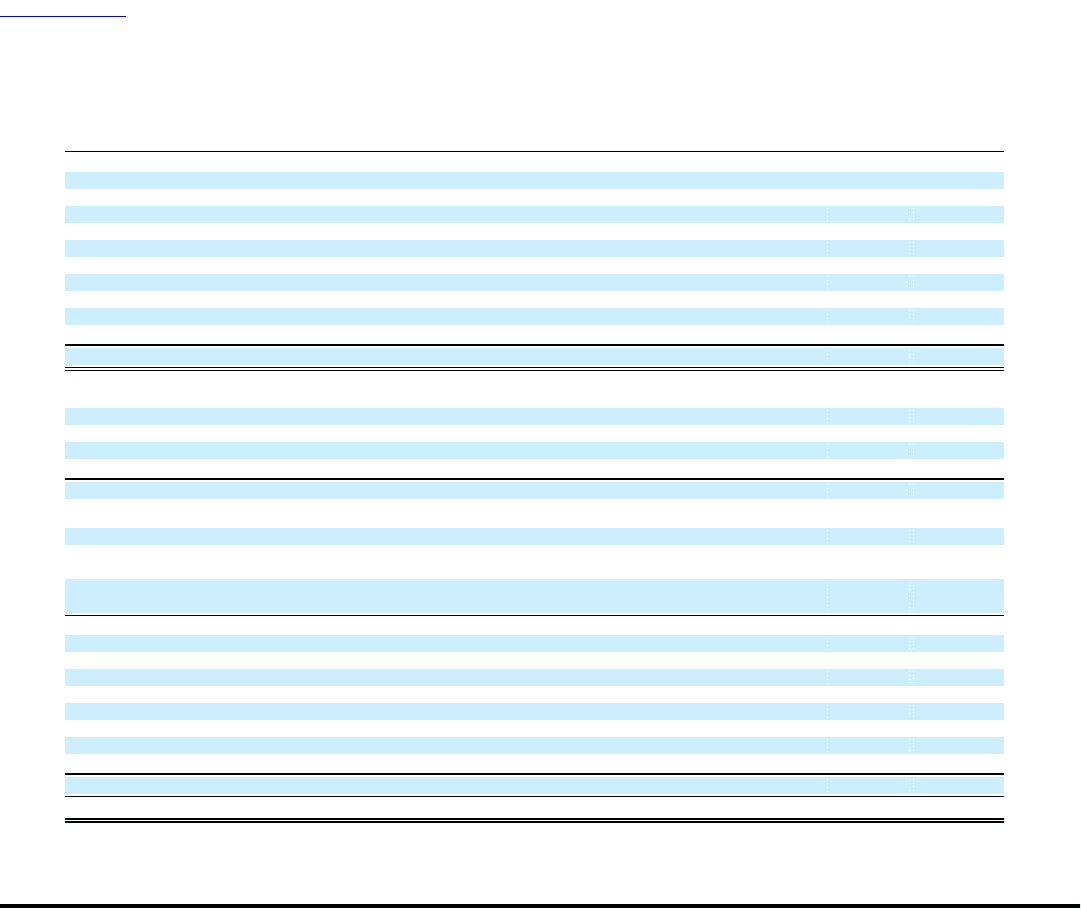

MONEYGRAM INTERNATIONAL, INC.

CONSOLIDATED BALANCE SHEETS

AT DECEMBER 31, 2010 2009

(Amounts in thousands, except share data)

ASSETS

Cash and cash equivalents $ — $ —

Cash and cash equivalents (substantially restricted) 2,865,941 3,376,824

Receivables, net (substantially restricted) 982,319 1,054,381

Short-term investments (substantially restricted) 405,769 400,000

Trading investments and related put options (substantially restricted) — 26,951

Available-for-sale investments (substantially restricted) 160,936 298,633

Property and equipment 115,111 127,972

Goodwill 428,691 425,630

Other assets 156,969 219,272

Total assets $5,115,736 $5,929,663

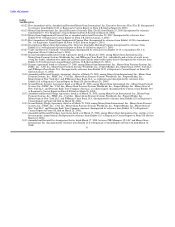

LIABILITIES

Payment service obligations $4,184,736 $4,843,454

Debt 639,946 796,791

Pension and other postretirement benefits 120,536 119,170

Accounts payable and other liabilities 113,647 188,933

Total liabilities 5,058,865 5,948,348

COMMITMENTS AND CONTINGENCIES (NOTE 15)

MEZZANINE EQUITY

Participating Convertible Preferred Stock-Series B, $0.01 par value, 760,000 shares authorized, 495,000 shares

issued and outstanding 628,199 539,084

Participating Convertible Preferred Stock-Series B-1, $0.01 par value, 500,000 shares authorized,

272,500 shares issued and outstanding 371,154 325,244

Total mezzanine equity 999,353 864,328

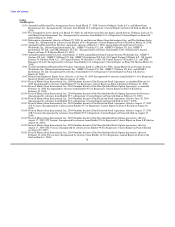

STOCKHOLDERS' DEFICIT

Preferred shares, $0.01 par value, none issued — —

Common shares, $0.01 par value, 1,300,000,000 shares authorized, 88,556,077 shares issued 886 886

Additional paid-in capital — —

Retained loss (771,544) (694,914)

Unearned employee benefits — (8)

Accumulated other comprehensive loss (31,879) (35,671)

Treasury stock: 4,935,555 and 6,040,958 shares in 2010 and 2009 (139,945) (153,306)

Total stockholders' deficit (942,482) (883,013)

Total liabilities, mezzanine equity and stockholders' deficit $5,115,736 $5,929,663

See Notes to Consolidated Financial Statements

F-5