MoneyGram 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

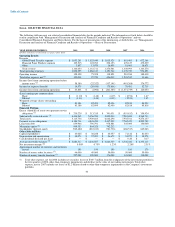

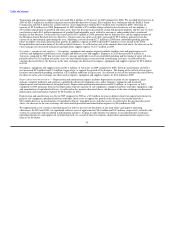

RESULTS OF OPERATIONS

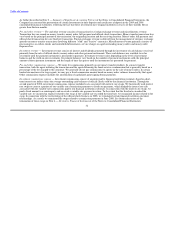

Table 1 — Results of Operations

2010 2009 2010 2009

vs. vs. vs. vs.

YEAR ENDED DECEMBER 31, 2010 2009 2008 2009 2008 2009 2008

($) ($) (%) (%)

(Amounts in thousands)

Revenue

Fee and other revenue $ 1,145,312 $ 1,128,492 $ 1,108,451 $ 16,820 $ 20,041 1% 2%

Investment revenue 21,341 33,219 162,130 (11,878) (128,911) (36)% (80)%

Total revenue 1,166,653 1,161,711 1,270,581 4,942 (108,870) 0% (9)%

Expenses

Fee and other commissions

expense 500,759 497,105 502,317 3,654 (5,212) 1% (1)%

Investment commissions

expense 737 1,362 102,292 (625) (100,930) (46)% (99)%

Total commissions

expense 501,496 498,467 604,609 3,029 (106,142) 1% (18)%

Compensation and benefits 226,422 199,053 224,580 27,369 (25,527) 14% (11)%

Transaction and operations

support 185,782 284,277 219,905 (98,495) 64,372 (35)% 29%

Occupancy, equipment and

supplies 46,481 47,425 45,994 (944) 1,431 (2)% 3%

Depreciation and

amortization 48,074 57,091 56,672 (9,017) 419 (16)% 1%

Total operating expenses 1,008,255 1,086,313 1,151,760 (78,058) (65,447) (7)% (6)%

Operating income 158,398 75,398 118,821 83,000 (43,423) 110% (37)%

Other expense (income)

Net securities (gains) losses (2,115) (7,790) 340,688 5,675 (348,478) NM NM

Interest expense 102,133 107,911 95,020 (5,778) 12,891 (5)% 14%

Other — (2,401) 20,304 2,401 (22,705) NM NM

Total other expense, net 100,018 97,720 456,012 2,298 (358,292) 2% (79)%

Income (loss) before income

taxes 58,380 (22,322) (337,191) 80,702 314,869 NM NM

Income tax expense (benefit) 14,579 (20,416) (75,806) 34,995 55,390 NM NM

Net income (loss) $ 43,801 $ (1,906) $ (261,385) $ 45,707 $ 259,479 NM NM

NM = Not meaningful

Following is a summary of our operating results in 2010 as compared to 2009:

• Total fee and other revenue increased $16.8 million, or 1 percent, in 2010 due to an increase in money transfer fee and other

revenue, partially offset by lower revenue from bill payment products and the Financial Paper Products segment, as well as the

impact of certain businesses and products that were discontinued in 2009. Volume growth of 9 percent drove the increase in money

transfer fee and other revenue, partially offset by lower average money transfer fees per transaction due to the $50 price band

introduced in the United States earlier in 2010 and the lower euro exchange rate. See further discussion under Table 2 — Fee and

Other Revenue and Commissions Expense.

• Investment revenue decreased $11.9 million, or 36 percent, in 2010 due to lower yields earned on our investment portfolio and a

decline in average investment balances.

33