MoneyGram 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

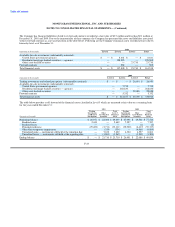

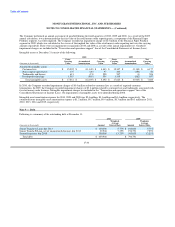

Note 5 — Investment Portfolio

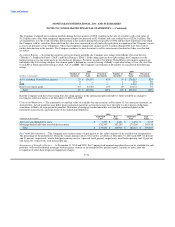

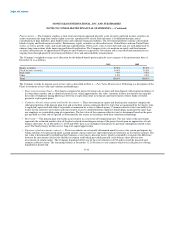

The Company's portfolio is invested in cash and cash equivalents, short-term investments, trading investments and available-for-sale

investments, all of which are substantially restricted as described in Note 2 — Summary of Significant Accounting Policies. Components

of the Company's investment portfolio as of December 31, are as follows:

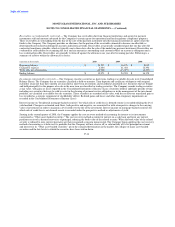

(Amounts in thousands) 2010 2009

Cash $ 1,042,381 $ 1,243,060

Money markets 1,818,138 1,933,764

Deposits 5,422 200,000

Cash and cash equivalents (substantially restricted) 2,865,941 3,376,824

Short-term investments (substantially restricted) 405,769 400,000

Trading investments and related put options (substantially restricted) — 26,951

Available-for-sale investments (substantially restricted) 160,936 298,633

Total investment portfolio $ 3,432,646 $ 4,102,408

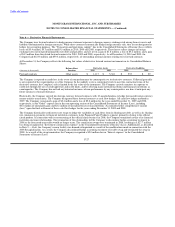

Cash and Cash Equivalents (substantially restricted) — Cash and cash equivalents consist of cash, money-market securities and time

deposits. Cash primarily consists of interest-bearing deposit accounts and non-interest bearing transaction accounts. The Company's

money-market securities are invested in six funds, all of which are AAA rated and consist of United States Treasury bills, notes or other

obligations issued or guaranteed by the United States government and its agencies, as well as repurchase agreements secured by such

instruments. Deposits consist of time deposits with original maturities of three months or less, and are issued from financial institutions

rated AA as of the date of this filing.

Short-Term Investments (substantially restricted) — Short-term investments consist of time deposits and certificates of deposit with

original maturities of greater than three months but no more than thirteen months, and are issued from financial institutions rated AA as

of the date of this filing.

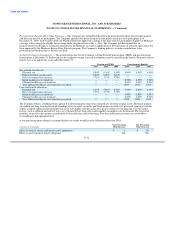

Trading Investments and Related Put Options (substantially restricted) — At December 31, 2009, the Company had one trading

investment with a fair value of $11.8 million on a par value of $29.4 million, and a related put option with a fair value of $15.2 million.

The trading investment was called at par in February 2010, resulting in a $2.4 million gain recorded in "Net securities (gains) losses," net

of the reversal of the related put option.

Two trading investments were called at par during 2009, resulting in a $7.6 million gain recorded in "Net securities (gains) losses," net of

the reversal of the related put options. The fair value of the remaining trading investment was $11.8 million on a par value of

$29.4 million as of December 31, 2009, which was unchanged from the prior year. The fair value of the related put option was

$15.2 million, reflecting a valuation gain of $4.3 million from the passage of time.

The Company recorded a $14.1 million net valuation loss on its trading investments and related put options during the year ended

December 31, 2008 due to market concerns regarding the capital position of the monoline insurers and their intent to pay dividends on

their preferred stock.

F-24