MoneyGram 2010 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

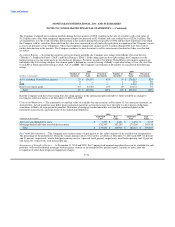

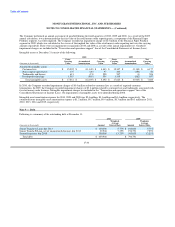

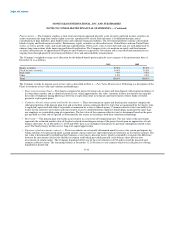

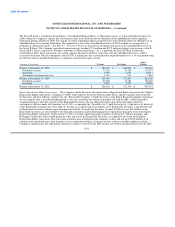

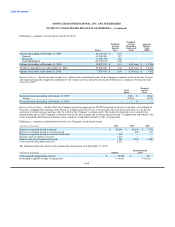

Following are the Plan's financial assets recorded at fair value by hierarchy level as of December 31:

2010

(Amounts in thousands) Level 1 Level 2 Level 3 Total

Short-term investment fund $ 1,949 $ — $ — $ 1,949

Common collective trust — equity securities

Large Cap securities — 47,178 — 47,178

Small Cap securities — 10,641 — 10,641

International securities — 6,282 — 6,282

Common collective trust — fixed income securities

Core fixed income 4,943 13,949 — 18,892

Long duration fixed income — 17,973 — 17,973

Real estate — — 4,194 4,194

Experience fund investment contracts — 27 — 27

Total financial assets $ 6,892 $ 96,050 $ 4,194 $ 107,136

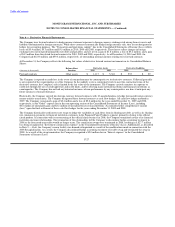

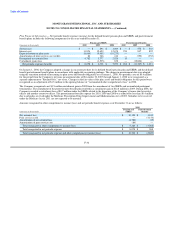

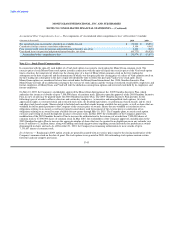

2009

(Amounts in thousands) Level 1 Level 2 Level 3 Total

Short-term investment fund $ 2,298 $ — $ — $ 2,298

Common collective trust — equity securities

Large Cap securities — 38,326 — 38,326

Small Cap securities — 9,681 — 9,681

International securities — 9,237 — 9,237

Common collective trust — fixed income securities

Core fixed income 5,008 24,323 — 29,331

Long duration fixed income — 6,655 — 6,655

Real estate — — 5,688 5,688

Experience fund investment contracts — 1,692 — 1,692

Total financial assets $ 7,306 $ 89,914 $ 5,688 $ 102,908

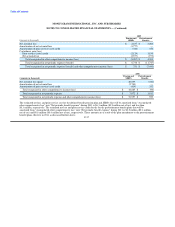

The Company's pension plan assets include one security that the Company considers to be a Level 3 asset for valuation purposes. This

security is an investment in a real estate joint venture and requires the use of unobservable inputs in its fair value measurement. The fair

value of this asset as of December 31, 2010 and 2009 was $4.2 million and $5.7 million, respectively. The change in reported net asset

value for this asset resulted in an unrealized loss of $1.5 million for 2010 and an unrealized gain of $0.9 million for 2009.

F-35