MoneyGram 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

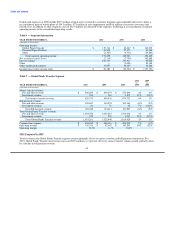

Unallocated expenses in 2009 include $20.3 million of legal reserves related to securities litigation and stockholder derivative claims, a

net curtailment gain on benefit plans of $14.3 million, $7.0 million of asset impairments and $4.4 million of executive severance and

related costs, in addition to other corporate costs of $12.9 million not allocated to the segments. Following is a reconciliation of segment

operating income to the consolidated operating results:

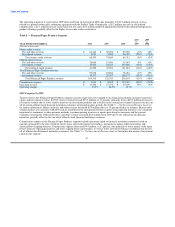

Table 6 — Segment Information

YEAR ENDED DECEMBER 31, 2010 2009 2008

(Amounts in thousands)

Operating income:

Global Funds Transfer $ 139,314 $ 82,647 $ 142,203

Financial Paper Products 36,508 27,372 30,169

Other (2,367) (4,316) (19,883)

Total segment operating income 173,455 105,703 152,489

Net securities (gains) losses (2,115) (7,790) 340,688

Interest expense 102,133 107,911 95,020

Other — (2,401) 20,304

Other unallocated expenses 15,057 30,305 33,668

Income (loss) before income taxes $ 58,380 $ (22,322) $ (337,191)

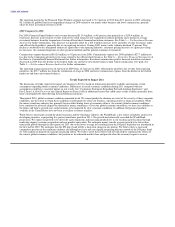

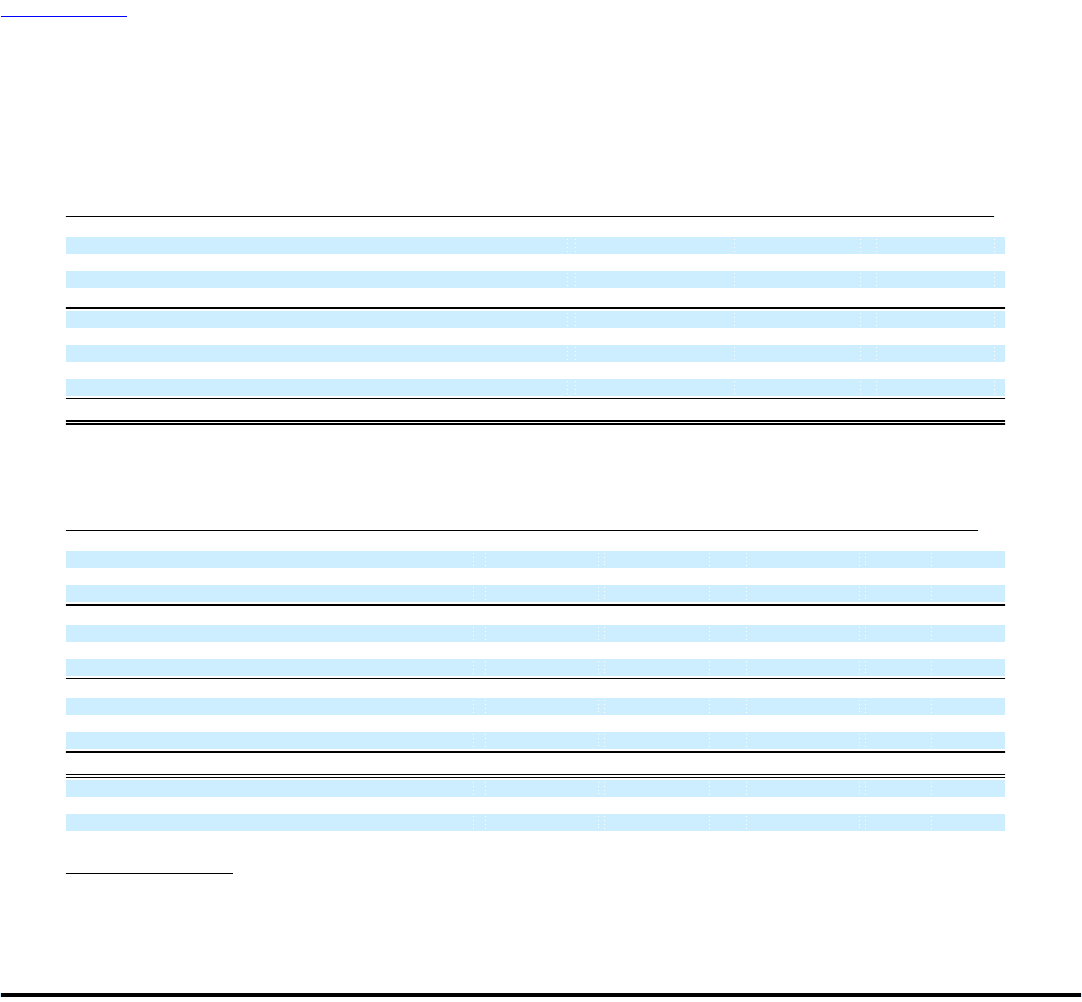

Table 7 — Global Funds Transfer Segment

2010 2009

vs. vs.

YEAR ENDED DECEMBER 31, 2010 2009 2008 2009 2008

(Amounts in thousands)

Money transfer revenue:

Fee and other revenue $ 926,489 $ 890,675 $ 872,849 4% 2%

Investment revenue 244 163 1,873 50% (91)%

Total money transfer revenue 926,733 890,838 874,722 4% 2%

Bill payment revenue:

Fee and other revenue 126,467 134,535 141,169 (6)% (5)%

Investment revenue 81 76 38 7% 100%

Total bill payment revenue 126,548 134,611 141,207 (6)% (5)%

Total Global Funds Transfer revenue:

Fee and other revenue 1,052,956 1,025,210 1,014,018 3% 1%

Investment revenue 325 239 1,911 36% (87)%

Total Global Funds Transfer revenue 1,053,281 1,025,449 1,015,929 3% 1%

Commissions expense $ 496,645 $ 488,116 $ 491,932 2% (1)%

Operating income $ 139,314 $ 82,647 $ 142,203 69% (42)%

Operating margin 13.2% 8.1% 14.0%

2010 Compared to 2009

Total revenue in the Global Funds Transfer segment consists primarily of fees on money transfers and bill payment transactions. For

2010, Global Funds Transfer total revenue increased $27.8 million, or 3 percent, driven by money transfer volume growth, partially offset

by a decline in bill payment revenue.

44