MoneyGram 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

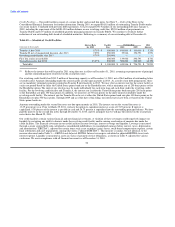

Agents who only sell money orders typically have longer remit timeframes than other agents; in addition, the per transaction revenue

tends to be smaller for money orders than for money transfers. As part of our review of the money order business, we evaluated our

money order only agents to identify agents where the credit risk outweighs the revenue potential. The Company considered various

mitigation actions for the identified agents, including termination of relationships, reductions in permitted transaction volumes and

dollars, repricing the fees charged to the agent and prefunding by the agent of average remittances.

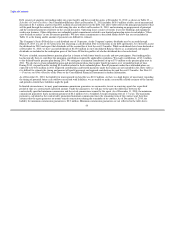

Derivative Financial Instruments — Credit risk related to our derivative financial instruments relates to the risk that we are unable to

collect amounts owed to us by the counterparties to our derivative agreements. With the termination of our interest rate swaps in the

second quarter of 2008, our derivative financial instruments are used solely to manage exposures to fluctuations in foreign currency

exchange rates. If the counterparties to any of our derivative financial instruments were to default on payments or experience credit rating

downgrades, the value of the derivative financial instruments would decline and adversely impact our operating income. We manage

credit risk related to derivative financial instruments by entering into agreements with only major financial institutions and regularly

monitoring the credit ratings of these financial institutions. We also only enter into agreements with financial institutions that are

experienced in the foreign currency upon which the agreement is based.

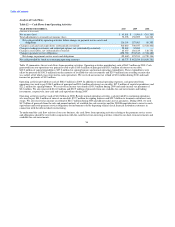

Interest Rate Risk

Interest rate risk represents the risk that our operating results are negatively impacted, and our investment portfolio declines in value, due

to changes in interest rates. Given the nature of the realigned investment portfolio, particularly the high credit rating of financial

institutions holding or issuing our cash, cash equivalents and short-term investments, along with the implicit guarantee of the U.S.

government backing our money markets and majority of available-for-sale investments, we believe there is a low risk that the value of

these securities would decline such that we would have a material adverse change in our operating results. As of December 31, 2010, the

Company held $538.6 million, or 16%, of the investment portfolio in fixed rate investments.

At December 31, 2010, the Company's "Other asset-backed securities" are priced on average at five cents on the dollar for a total fair

value of $23.7 million. While the Company does believe its "Other asset-backed securities" are at a risk of further decline, the 2008

Recapitalization completed on March 25, 2008 included funds to cover all losses on these securities, as well as the trading investments.

Accordingly, any resulting adverse movement in our stockholders' equity or assets in excess of payment service obligations from further

declines in investments would not result in regulatory or contractual compliance exceptions.

Our operating results are primarily impacted by interest rate risk through our net investment margin, which is investment revenue less

commissions expense. As the money transfer business is not materially affected by investment revenue and pays commissions that are not

tied to an interest rate index, interest rate risk has the most impact on our money order and official check businesses. After the portfolio

realignment, we are invested primarily in interest-bearing cash accounts, deposit accounts, time deposits and certificates of deposit, and

U.S. government money market funds. These types of investments have minimal risk of declines in fair value from changes in interest

rates, with the interest rate resetting frequently, if not daily. Our commissions paid to financial institution customers are variable rate,

based primarily on the federal funds effective rate and are reset daily. Accordingly, both our investment revenue and our investment

commissions expense will decrease when rates decline and increase when rates rise. As a result of our repricing initiative, described

below, and the frequent resetting of interest rates earned on the investment portfolio, we believe that investment revenue and investment

commissions would increase or decrease approximately in tandem. In addition, the investment portfolio and commission interest rates

may differ, resulting in basis risk. We do not believe this risk is material and therefore do not currently employ any hedging strategies to

address the basis risk between our commission rates and our investment portfolio, nor do we currently expect to employ such hedging

strategies. As a result, our net investment margin may be adversely impacted if changes in the commission rate move by a larger

percentage than the yield on our investment portfolio.

62