MoneyGram 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

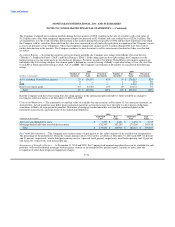

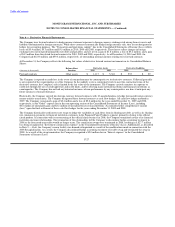

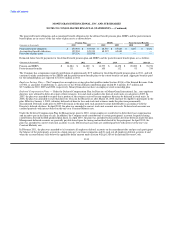

The Company performed an annual assessment of goodwill during the fourth quarters of 2010, 2009 and 2008. As a result of the 2009

annual assessment, it was determined that the fair value of the retail money order reporting unit, a component of the Financial Paper

Products segment, was fully impaired. The Company recorded an impairment charge of $2.5 million to the Financial Paper Products

segment in 2009, which was calculated as the excess of the implied fair value of the retail money order reporting unit over the carrying

amount of goodwill. There were no impairments recognized in 2010 and 2008 as a result of the annual impairment test. Goodwill

impairment charges are included in the "Transaction and operations support" line of the Consolidated Statements of Income (Loss).

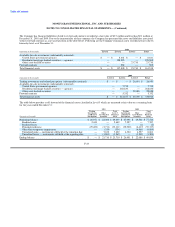

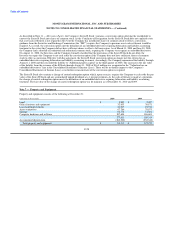

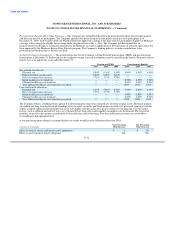

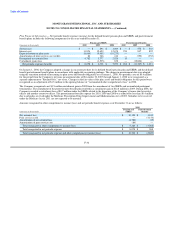

Intangible assets at December 31 consist of the following:

2010 2009

Gross Net Gross Net

Carrying Accumulated Carrying Carrying Accumulated Carrying

(Amounts in thousands) Value Amortization Value Value Amortization Value

Amortized intangible assets:

Customer lists $ 15,592 $ (11,149) $ 4,443 $ 15,307 $ (9,130) $ 6,177

Non-compete agreements 137 (40) 97 200 (150) 50

Trademarks and license 613 (15) 598 597 (1) 596

Developed technology 1,519 (965) 554 1,519 (662) 857

Total intangible assets $ 17,861 $ (12,169) $ 5,692 $ 17,623 $ (9,943) $ 7,680

In 2010, the Company recorded impairment charges of $0.4 million related to customer lists as a result of acquired customer

terminations. In 2009, the Company recorded impairment charges of $3.6 million related to customer lists and trademarks associated with

its retail money order business. Intangible impairment charges are included in the "Transaction and operations support" line of the

Consolidated Statements of Income (Loss). No impairments of intangible assets were identified during 2008.

Intangible asset amortization expense for 2010, 2009 and 2008 was $2.4 million, $3.3 million and $4.4 million, respectively. The

estimated future intangible asset amortization expense is $1.2 million, $0.7 million, $0.4 million, $0.3 million and $0.3 million for 2011,

2012, 2013, 2014 and 2015, respectively.

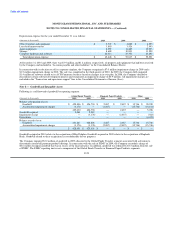

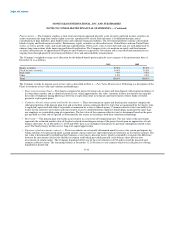

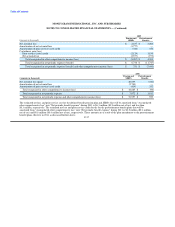

Note 9 — Debt

Following is a summary of the outstanding debt at December 31:

2010 2009

Weighted- Weighted-

Average Average

(Amounts in thousands) Amount Interest Rate Amount Interest Rate

Senior Tranche A Loan, due 2013 $ 100,000 5.75% $ 100,000 5.75%

Senior Tranche B Loan, net of unamortized discount, due 2013 39,946 7.25% 196,791 7.25%

Second lien notes, due 2018 500,000 13.25% 500,000 13.25%

Total debt $ 639,946 $ 796,791

F-30