MoneyGram 2010 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Due to the early stage of these other matters, the Company is unable to predict the outcome or the possible loss, or range of loss, if any,

resulting therefrom.

In connection with its agreement with the Federal Trade Commission ("FTC"), the Company is making enhancements to its consumer

anti-fraud program and, in 2009, paid $18.0 million into an FTC-administered fund to refund consumers who have been victimized

through third-party fraud.

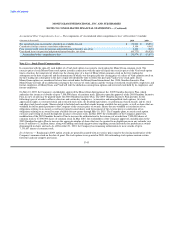

Credit Facilities — At December 31, 2010, the Company has overdraft facilities through its senior facility consisting of $6.8 million of

letters of credit to assist in the management of investments and the clearing of payment service obligations. All of these letters of credit

are outstanding as of December 31, 2010. These overdraft facilities reduce amounts available under the senior facility. Fees on the letters

of credit are paid in accordance with the terms of the senior facility described in Note 9 — Debt.

Other Commitments — The Company has agreements with certain co-investors to provide funds related to investments in limited

partnership interests. As of December 31, 2010, the total amount of unfunded commitments related to these agreements was $0.3 million.

The amortization expense was recognized as part of "Transaction and operations support" expense in the Consolidated Statements of

Income (Loss).

Minimum Commission Guarantees — In limited circumstances as an incentive to new or renewing agents, the Company may grant

minimum commission guarantees for a specified period of time at a contractually specified amount. Under the guarantees, the Company

will pay to the agent the difference between the contractually specified minimum commission and the actual commissions earned by the

agent. Expense related to the guarantee is recognized in the "Fee commissions expense" line in the Consolidated Statements of Income

(Loss).

As of December 31, 2010, the liability for minimum commission guarantees is $0.3 million and the maximum amount that could be paid

under the minimum commission guarantees is $2.2 million over a weighted average remaining term of 1.7 years. The maximum payment

is calculated as the contractually guaranteed minimum commission times the remaining term of the contract and, therefore, assumes that

the agent generates no money transfer transactions during the remainder of its contract. However, under the terms of certain agent

contracts, the Company may terminate the contract if the projected or actual volume of transactions falls beneath a contractually specified

amount. With respect to minimum commission guarantees expiring in 2010 and 2009, the Company paid $0.5 million and $0.7 million,

respectively, or 22 percent and 18 percent, respectively, of the estimated maximum payment for the year.

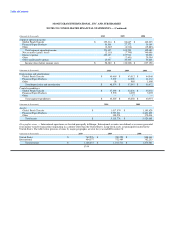

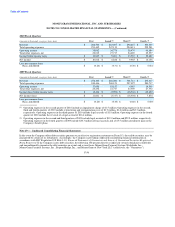

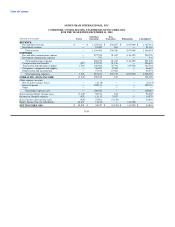

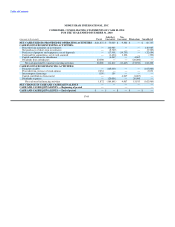

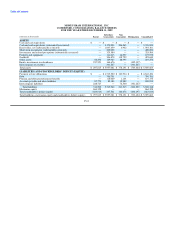

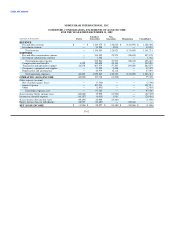

Note 16 — Segment Information

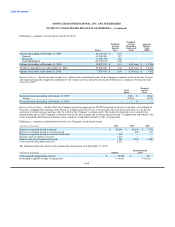

The Company's reporting segments are primarily organized based on the nature of products and services offered and the type of consumer

served. The Company primarily manages its business through two reporting segments, Global Funds Transfer and Financial Paper

Products. The Global Funds Transfer segment provides global money transfers and bill payment services to consumers through a network

of agents and, in select markets, company-operated locations. The Financial Paper Products segment provides money orders to consumers

through retail and financial institution locations in the United States and Puerto Rico, and provides official check services to financial

institutions in the United States. One agent of both the Global Funds Transfer segment and the Financial Paper Products segment

accounted for 30 percent, 29 percent and 26 percent of total revenue in 2010, 2009 and 2008, respectively. Businesses which are not

operated within these segments are categorized as "Other," and primarily relate to discontinued products and businesses. Segment pre-tax

operating income and segment operating margin are used to review operating performance and allocate resources.

F-52