MoneyGram 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

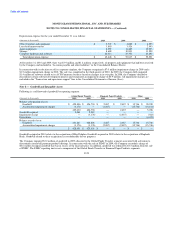

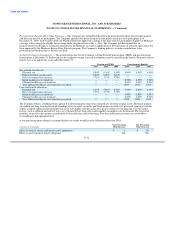

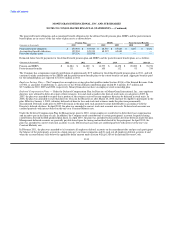

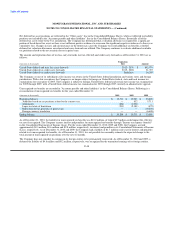

The projected benefit obligation and accumulated benefit obligation for the defined benefit pension plan, SERPs and the postretirement

benefit plans are in excess of the fair value of plan assets as shown below:

Pension Plan SERPs Postretirement Benefits

(Amounts in thousands) 2010 2009 2010 2009 2010 2009

Projected benefit obligation $ 152,904 $ 145,933 $ 68,587 $ 65,683 $ 1,027 $ 4,521

Accumulated benefit obligation 152,904 145,933 68,587 65,683 — —

Fair value of plan assets 107,136 102,908 — — — —

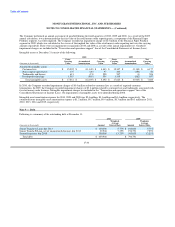

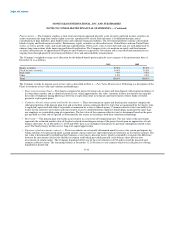

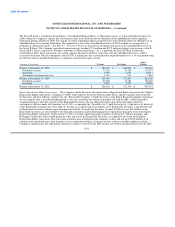

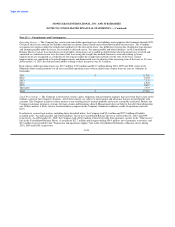

Estimated future benefit payments for the defined benefit pension plan and SERPs and the postretirement benefit plans are as follows:

(Amounts in thousands) 2011 2012 2013 2014 2015 2016-20

Pension and SERPs $ 14,284 $ 14,602 $ 14,393 $ 14,478 $ 20,000 $ 74,274

Postretirement benefits 111 95 105 112 93 334

The Company has a minimum required contribution of approximately $7.9 million for the defined benefit pension plan in 2011, and will

continue to make contributions to the SERPs and the postretirement benefit plans to the extent benefits are paid. Aggregate benefits paid

for the unfunded plans are expected to be $4.6 million in 2011.

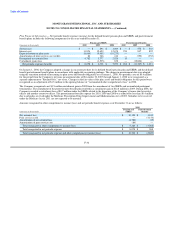

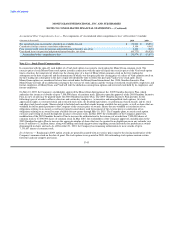

Employee Savings Plan — The Company has an employee savings plan that qualifies under Section 401(k) of the Internal Revenue Code

of 1986, as amended. Contributions to, and costs of, the 401(k) defined contribution plan totaled $3.4 million, $3.7 million and

$3.7 million in 2010, 2009 and 2008, respectively. MoneyGram does not have an employee stock ownership plan.

Deferred Compensation Plans — Under the Deferred Compensation Plan for Directors of MoneyGram International, Inc., non-employee

directors were allowed to defer all or part of their retainers, fees and stock awards in the form of stock units or cash prior to 2009. In

2007, the plan was amended to require that a portion of the retainer received by non-employee directors be deferred in stock units. In

2008, the plan was amended to state that directors who join the Board on or after March 24, 2008 shall not be eligible to participate in the

plan. Effective January 1, 2009, voluntary deferrals of director fees and stock unit retainers under the plan were permanently

discontinued. Deferrals made prior to 2009 will remain in the plan until such amounts become distributable in accordance with the

Director's deferral elections. In April 2010, the plan was amended to convert stock unit accounts into cash. Deferred cash accounts are

credited quarterly with interest based on the one-year Constant Maturity rate.

Under the Deferred Compensation Plan for Management, prior to 2010, certain employees could elect to defer their base compensation

and incentive pay in the form of cash. In addition, the Company made contributions to certain participants' accounts for profit sharing

contributions beyond the IRS qualified plan limits. In April 2010, the plan was amended to discontinue all future deferrals under the plan.

Management deferred accounts are generally payable based upon the timing and method elected by the participant. In April 2010, the

plan was amended to convert stock unit accounts to cash. Deferred cash accounts are credited quarterly with interest at the one-year

Constant Maturity rate.

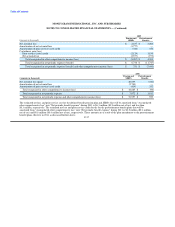

In February 2011, the plan was amended to (a) terminate all employee deferral accounts on the amendment date and pay each participant

the balance of the participant's account in a lump sum one year from termination and (b) cash out all employer deferral accounts if and

when the account balance falls below the applicable dollar amount under Section 402(g)(1)(B) of the Internal Revenue Code.

F-39