MoneyGram 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

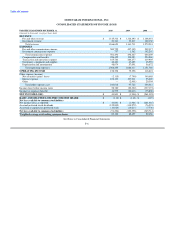

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1 — Description of the Business

MoneyGram International, Inc. and its wholly owned subsidiaries ("MoneyGram") offers products and services under its two reporting

segments: Global Funds Transfer and Financial Paper Products. The Global Funds Transfer segment provides global money transfer

services and bill payment services to consumers through a network of agents. The Financial Paper Products segment provides payment

processing services, primarily official check outsourcing services, and money orders through financial institutions and agents. The

Company's headquarters is located in Dallas, Texas, United States of America. References to "MoneyGram," the "Company," "we," "us"

and "our" are to MoneyGram International, Inc. and its subsidiaries and consolidated entities.

MoneyGram was incorporated on December 18, 2003 in the state of Delaware as a subsidiary of Viad Corp ("Viad") to effect the spin-off

of Viad's payment services business operated by Travelers Express Company, Inc. ("Travelers") to its stockholders (the "spin-off"). On

June 30, 2004 (the "Distribution Date"), Travelers was merged with a subsidiary of MoneyGram and Viad then distributed

88,556,077 shares of MoneyGram common stock in a tax-free distribution (the "Distribution"). Stockholders of Viad received one share

of MoneyGram common stock for every share of Viad common stock owned on the record date of June 24, 2004. Due to the relative

significance of MoneyGram to Viad, MoneyGram is the divesting entity and treated as the "accounting successor" to Viad for financial

reporting purposes. Effective December 31, 2005, the entity that was formerly Travelers was merged into MoneyGram Payment Systems,

Inc. ("MPSI"), a wholly owned subsidiary of MoneyGram, with MPSI remaining as the surviving corporation.

On March 25, 2008, the Company completed a recapitalization, pursuant to which the Company received $1.5 billion of gross equity and

debt capital (collectively, the "2008 Recapitalization") to support the long-term needs of the business and provide necessary capital due to

the Company's investment portfolio losses as described in Note 5 — Investment Portfolio. The equity component of the 2008

Recapitalization consisted of the sale in a private placement of Series B Participating Convertible Preferred Stock of the Company (the

"B Stock") and Series B-1 Participating Convertible Preferred Stock of the Company (the "B-1 Stock," and collectively with the B Stock,

the "Series B Stock"). The debt component of the 2008 Recapitalization consisted of a senior secured amended and restated credit

agreement entered into with a group of lenders (the "senior facility") and the issuance of senior secured second lien notes (the "second

lien notes"). See Note 9 — Debt and Note 11 — Mezzanine Equity for further information regarding the equity and debt components.

Participation Agreement between the Investors and Walmart Stores, Inc. — On February 11, 2008, the affiliates of Thomas H. Lee

Partners, L.P. ("THL") and affiliates of Goldman, Sachs & Co. ("Goldman Sachs," and collectively with THL, the "Investors") entered

into a Participation Agreement (as amended on March 17, 2008) with Walmart Stores, Inc. ("Walmart") in connection with the 2008

Recapitalization. The Company is not a direct party to the Participation Agreement, which was negotiated solely between the Investors

and Walmart. Under the terms of the Participation Agreement, the Investors are obligated to pay Walmart certain percentages of

accumulated cash payments received by the Investors in excess of the Investors' original investment in the Company. Cash payments

include dividends paid by the Company to the Investors and any cash payments received by the Investors in connection with the sale of

any shares of the Company's stock to an unaffiliated third party or upon redemption by the Company. Walmart, in its sole discretion, may

elect to receive payments in cash or equivalent shares of stock held by the Investors.

F-10