MoneyGram 2010 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

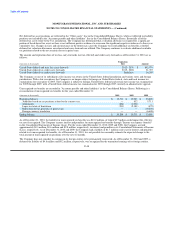

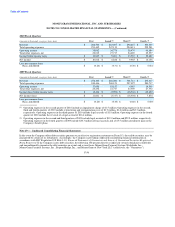

We had tax expense of $14.6 million in 2010, including the release of $11.9 million of valuation allowances on deferred tax assets in the

U.S. jurisdiction. The decrease in the tax reserve in 2010 was driven by the favorable settlement or closing of years subject to state audit.

"Other" for 2010 includes a change in the tax treatment of the Medicare subsidy under the 2010 federal healthcare legislation and

adjustments to the deferred taxes on fixed assets. Changes in facts and circumstances in the future may cause us to record additional tax

benefits as further deferred tax valuation allowances are released and carry-forwards are utilized.

We had a tax benefit of $20.4 million in 2009, primarily reflecting the release of $17.6 million of valuation allowances on deferred tax

assets. Our pre-tax net loss of $22.3 million, when adjusted for our estimated book to tax differences, resulted in taxable income, which

allowed us to release some valuation allowances on our tax loss carryovers. These book to tax differences include impairments on

securities and other assets and accruals related to separated employees, litigation and unrealized foreign exchange losses. The decrease in

tax reserve in 2009 was driven by the favorable settlement or closing of years subject to state audit. Included in "Other" for 2009 is

$1.6 million of expense for the reversal of tax benefits upon the forfeiture of share-based awards and $2.3 million of expense on asset

impairments.

In 2008, we had a $75.8 million tax benefit, primarily reflecting the recognition of a $90.5 million benefit in the fourth quarter of 2008

upon the completion of an evaluation of the technical merits of tax positions with respect to part of the net securities losses in 2008 and

2007. The $90.5 million benefit relates to the amount of tax carry-back we were able to utilize to recover tax payments made for fiscal

2005 through 2007.

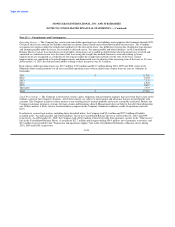

During the second quarter of 2010, the IRS completed its examination of the Company's consolidated income tax returns for 2005 to

2007, and issued its Revenue Agent Report ("RAR") challenging the Company's tax position relating to net securities losses and

disallowing $687.0 million of deductions taken in the 2007 tax return. The Company disagrees with the RAR regarding the net securities

losses and filed a protest letter. The Company has had initial conferences with the IRS Appeals Office in 2010, and will continue these

conferences in 2011. As of December 31, 2010, the Company has recognized a cumulative benefit of approximately $95.0 million

relating to its net securities losses.

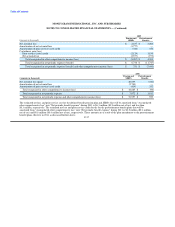

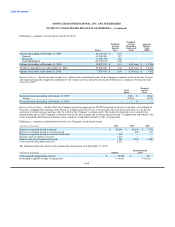

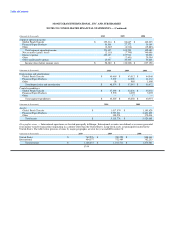

The Company's deferred tax assets and liabilities at December 31 are composed of the following:

(Amounts in thousands) 2010 2009

Deferred tax assets:

Postretirement benefits and other employee benefits $ 54,754 $ 49,145

Tax loss carryovers 328,398 319,005

Tax credit carryovers 47,602 46,577

Basis difference in revalued investments 106,863 114,708

Bad debt and other reserves 7,185 8,990

Other — 22,703

Valuation allowance (485,790) (496,149)

Total deferred tax asset 59,012 64,979

Deferred tax liabilities:

Depreciation and amortization (63,316) (61,520)

Gross deferred tax liability (63,316) (61,520)

Net deferred tax (liability) asset $ (4,304) $ 3,459

F-47