MoneyGram 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

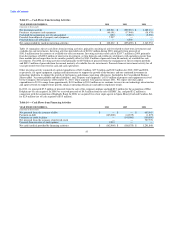

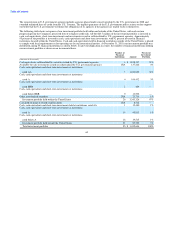

Table 14 summarizes the net cash flows from financing activities. In 2010, financing activities used $165.0 million of cash for

prepayments on Tranche B of our senior facility, and provided $2.0 million of cash from the exercise of stock options. In 2009, we made

payments totaling $145.0 million to pay our revolving credit facility in full. We also made payments totaling $41.9 million on Tranche B

of our senior facility, consisting of a $40.0 million prepayment and $1.9 million of mandatory quarterly payments. In 2008, financing

activities generated $1.4 billion of cash from the 2008 Recapitalization, net of $100.0 million of related transaction costs. From these

proceeds, we paid $101.9 million toward the senior facility; the remaining proceeds were invested in cash and cash equivalents as shown

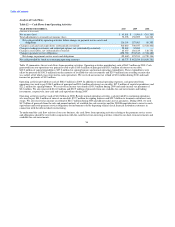

in Table 12 — Cash Flows from Operating Activities.

Mezzanine Equity and Stockholders' Deficit

Mezzanine Equity — See Note 11 — Mezzanine Equity of the Notes to the Consolidated Financial Statements for information regarding

the mezzanine equity.

Stockholders' Deficit — On May 9, 2007, our Board of Directors approved a 5,000,000 share increase in our current authorization to

purchase shares of common stock, bringing our total authorization to 12,000,000 shares. We suspended the buyback program in the

fourth quarter of 2007. As of December 31, 2010, we had repurchased a total of 6,795,000 shares of our common stock under this

authorization and have remaining authorization to purchase up to 5,205,000 shares.

Under the terms of the equity instruments and debt issued in connection with the 2008 Recapitalization, we are limited in our ability to

pay dividends on our common stock. No dividends were paid on our common stock in 2010 and we do not anticipate declaring any

dividends on our common stock during 2011.

ENTERPRISE RISK MANAGEMENT

Risk is an inherent part of any business. Our most prominent risk exposures are credit, interest rate, foreign currency exchange and

operational risk. See Part 1, Item 1A "Risk Factors" for a description of the principal risks to our business. Appropriately managing risk

is important to the success of our business, and the extent to which we effectively manage each of the various types of risk is critical to

our financial condition and profitability. Our risk management objective is to monitor and control risk exposures to produce steady

earnings growth and long-term economic value.

Management implements policies approved by our Board of Directors that cover our investment, capital, credit and foreign currency

practices and strategies. The Board receives periodic reports regarding each of these areas and approves significant changes to policy and

strategy. An Asset/Liability Committee, composed of senior management, routinely reviews investment and risk management strategies

and results. A Credit Committee, composed of senior management, routinely reviews credit exposure to our agents.

Following is a discussion of the strategies we use to manage and mitigate the risks we have deemed most critical to our business. While

containing forward-looking statements related to risks and uncertainties, this discussion and related analyses are not predictions of future

events. MoneyGram's actual results could differ materially from those anticipated due to various factors discussed under "Cautionary

Statements Regarding Forward-Looking Statements'' and under "Risk Factors" in Part 1, Item 1A of this Annual Report on Form 10-K.

Credit Risk

Credit risk, or the potential risk that we may not collect amounts owed to us, affects our business primarily through receivables,

investments and derivative financial instruments. In addition, the concentration of our cash, cash equivalents and investments at large

financial institutions exposes us to credit risk.

58