MoneyGram 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Foreign Currency Risk

We are exposed to foreign currency risk in the ordinary course of business as we offer our products and services through a network of

agents and financial institutions with locations in 190 countries and operate subsidiaries in 11 countries. As this risk may have an adverse

effect on our earnings and equity, we hedge material transactional exposures when feasible using forward or option contracts. Translation

risk, generated from translating foreign currency-denominated earnings into U.S. dollars for reporting purposes, is not hedged as this is

not considered an economic exposure. In 2010, the decline of the euro exchange rate (net of hedging activities) resulted in a net decrease

to our operating results of $3.0 million over 2009. By policy, we do not speculate in foreign currencies; all currency trades relate to

underlying transactional exposures.

Our primary source of transactional currency risk is the money transfer business in which funds are frequently transferred cross-border

and we settle with agents in multiple currencies. Although this risk is somewhat limited due to the fact that these transactions are short-

term in nature, we currently manage some of this risk with forward contracts to protect against potential short-term market volatility. In

addition, we buy and sell in the spot market daily to settle transactions. The primary currency pairs, based on volume, that are traded

against the dollar in the spot and forward markets include the European euro, Mexican peso, British pound and Indian rupee. The duration

of forward contracts is typically less than one month.

Realized and unrealized gains or losses on transactional currency risk hedges and any associated revaluation of balance sheet exposures

are recorded in "Transaction and operations support" in the Consolidated Statement of Income (Loss). The fair market value of any open

hedges at period end are recorded in "Other assets" in the Consolidated Balance Sheets. The net effect of changes in foreign exchange

rates and the related forward contracts for the year ended December 31, 2010 was a loss of $5.4 million. We do not currently have any

forward contracts that are designated as hedges for accounting purposes.

Had the euro appreciated/depreciated relative to the U.S. dollar by 20 percent from actual exchange rates for 2010, pre-tax operating

income would have increased/decreased $11.1 million for the year. This sensitivity analysis does not consider the impact of our hedging

program.

Operational Risk

Operational risk represents the potential for loss resulting from our operations. This may include, but is not limited to the risk of fraud by

employees or external parties, business continuation and disaster recovery, errors related to transaction processing and technology,

unauthorized transactions and breaches of information security and compliance requirements. This risk may also include the potential

legal actions that could arise as a result of an operational deficiency or as a result of noncompliance with applicable regulatory

requirements. Management has direct responsibility for identifying, controlling and monitoring operational risks within their business.

Business managers maintain a system of controls to provide transaction authorization and execution, safeguarding of assets from misuse

or theft, and to ensure the quality of financial and other data. Our Business Resiliency group works with each business function to

develop plans to support business resumption activities including technology, networks and data centers. Our internal audit function tests

the system of internal controls through risk-based audit procedures and reports on the effectiveness of internal controls to executive

management and the Audit Committee of the Board of Directors.

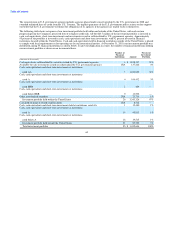

CRITICAL ACCOUNTING POLICIES

The preparation of financial statements in conformity with GAAP requires estimates and assumptions that affect the reported amounts of

assets, liabilities, revenues, expenses and related disclosures in the consolidated financial statements. Actual results could differ from

those estimates. On a regular basis, management reviews its accounting policies, assumptions and estimates to ensure that our financial

statements are presented fairly and in accordance with GAAP. See Note 2 — Summary of Significant Accounting Policies of the Notes to

Consolidated Financial Statements for a comprehensive list of our accounting policies.

64