MoneyGram 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Table of contents

-

Page 1

MONEYGRAM INTERNATIONAL INC (MGI) 10-K Annual report pursuant to section 13 and 15(d) Filed on 03/16/2011 Filed Period 12/31/2010 -

Page 2

...computed by reference to the last sales price as reported on the New York Stock Exchange as of June 30, 2010, the last business day of the registrant's most recently completed second fiscal quarter, was $203.9 million. 83,620,522 shares of common stock were outstanding as of March 7, 2011. DOCUMENTS... -

Page 3

... Our Business Our Segments Global Funds Transfer Segment Financial Paper Products Segment Product and Infrastructure Development and Enhancements Sales and Marketing Competition Regulation Clearing and Cash Management Bank Relationships Intellectual Property Employees Executive Officers of... -

Page 4

... the world to transfer money and pay bills, helping them meet the financial demands of their daily lives. Our payment services also help businesses operate more efficiently and cost-effectively. Our principal executive offices are located at 2828 N. Harwood Street, Suite 1500, Dallas, Texas... -

Page 5

...'s bank account, mobile phone account or prepaid card. We typically pay both our "send" and "receive" agents a commission for the transaction. We provide money transfer services through our worldwide network of agents and through Company-owned retail locations in the United States and Western Europe... -

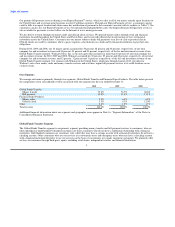

Page 6

... for Walmart's sale of our money order and money transfer services and real-time, urgent bill payment services at its retail locations on an exclusive basis. Our Segments We manage our business primarily through two segments: Global Funds Transfer and Financial Paper Products. The table below... -

Page 7

... UAE Exchange and Financial Services Limited and Thomas Cook India-Mumbai during 2010. The Bank of China now offers our services in 3,000 locations. We also expanded our agent locations in Morocco, Moldova, Indonesia, Nigeria, Philippines, Switzerland and Kazakhstan. We provide Global Funds Transfer... -

Page 8

... bills for credit to a biller, typically within two to three days. Financial Paper Products Segment Our Financial Paper Products segment provides money orders to consumers through our retail and financial institution agent locations in the United States and Puerto Rico, and provides official check... -

Page 9

...select regions. Our largest competitor in the money transfer market is Western Union, which also competes with our bill payment services and money order businesses. As new technologies for money transfer and bill payment services emerge that allow consumers to send and receive money and to pay bills... -

Page 10

... anti-money laundering regulations and implement policies and procedures to make our business practices flexible, so we can comply with the most current legal requirements. We offer our money transfer services through third-party agents with whom we contract and do not directly control. As a money... -

Page 11

... financial holding company. These new laws and regulations could also affect the ways our counterparties are generally required to do business with their customers, which may affect us, including potentially increased transaction and compliance costs. We continue to discuss alternatives with Goldman... -

Page 12

...limited number of international cash management banks with a network large enough to manage cash settlements for our entire agent base. In addition, some large international banks have opted not to bank money service businesses. As a result, we also utilize regional or country-based banking partners... -

Page 13

... 2010. Prior to joining MoneyGram, Mr. Lee was president of First Data Asia Pacific, a role he held since 2005. Previously, Mr. Lee served as regional vice president, financial services for EDS in Hong Kong. He has also held a variety of senior executive positions including CIO and Head of Strategy... -

Page 14

...management consulting, global project and practice leadership in performance measurement, cost reduction, merger integration and restructuring to the financial services industry for IBM Business Consulting Services, formerly PricewaterhouseCoopers. Available Information We make our reports on Forms... -

Page 15

...reduce the funds available to us for our operations, acquisitions, product development or other corporate initiatives; and • we may be required to pay significant fees to obtain the necessary consents from holders of our debt to amend or reduce our debt and/or preferred stock. Our credit rating is... -

Page 16

...of operations. • Clearing and cash management banks upon which we rely to conduct our official check, money order and money transfer businesses could fail or experience sustained deterioration in liquidity. This could lead to our inability to clear our payment service instruments and move funds on... -

Page 17

... our Global Funds Transfer agent or biller networks, our business, financial condition and results of operations could be adversely affected. Revenue from our money transfer and urgent bill payment services is derived from transactions conducted through our retail agent and biller networks. Many... -

Page 18

... check financial institution customers. The vast majority of our Global Funds Transfer segment is conducted through independent agents that provide our products and services to consumers at their business locations. Our agents receive the proceeds from the sale of our payment instruments and money... -

Page 19

...international banks for international cash management, ACH and wire transfer services to pay money transfers and settle with our agents. We also rely on domestic banks to provide clearing, processing and settlement functions for our paper-based instruments, including official checks and money orders... -

Page 20

... some cases increased, per-item and other fees for our official check and money order services. Due to the historically low interest rate environment, our official check financial institution customers have been receiving low or no commission payments from the issuance of payment service instruments... -

Page 21

... will have on our business, or the money transfer and bill payment industry in general. Money transfer, money order and bill payment services within our Global Funds Transfer segment compete in a concentrated industry, with a small number of large competitors and a large number of small, niche... -

Page 22

... may increase our costs of operations and may disrupt our business as we develop new business and compliance models. For example, the European Union's Payment Services Directive ("PSD") imposes potential liability on us for the conduct of our agents and the commission of third party fraud utilizing... -

Page 23

...more of these events could have a material adverse effect on our business, financial condition and results of operations. We conduct money transfer transactions through agents in some regions that are politically volatile or, in a limited number of cases, are subject to certain OFAC restrictions. We... -

Page 24

...to enhance our existing services and offer new services, is dependent on our information technology systems. If we are unable to effectively manage the technology associated with our business, we could experience increased costs, reductions in system availability and loss of agents or consumers. Any... -

Page 25

Table of Contents There are a number of risks associated with our international sales and operations that could adversely affect our business. We provide money transfer services between and among approximately 190 countries and territories and continue to expand in various international markets. ... -

Page 26

... of a bank or financial holding company. Money transmitters such as the Company will be required to provide additional consumer information and disclosures. The Bureau is charged with studying and drafting standards to address existing prices and fees at locations where our services are offered... -

Page 27

...in such a transaction may not have the opportunity to do so. If we cannot meet the New York Stock Exchange ("NYSE") continued listing requirements, the NYSE may delist our common stock. Our common stock is currently listed on the NYSE. The NYSE requires us to maintain an average closing price of our... -

Page 28

.... Item 2. Location UNRESOLVED SEC COMMENTS PROPERTIES Use Segment(s) Using Space Square Feet Lease Expiration Dallas, TX Minneapolis, MN Brooklyn Center, MN Lakewood, CO Corporate Headquarters Global Operations Center Global Operations Center Call Center Both Both Both Global Funds Transfer 34... -

Page 29

... a hearing on the settlement for June 18, 2010. The Stipulation of Settlement provides for changes to the Company's business, corporate governance and internal controls, some of which have already been implemented in whole or in part. The Company also agreed to pay attorney fees and expenses to the... -

Page 30

...the Settlement Agreement in October 2010. Patent Action - On September 25, 2009, the United States District Court for the Western District of Texas, Austin returned a jury verdict in a patent suit brought against the Company by Western Union on May 11, 2007, styled Western Union v. MoneyGram Payment... -

Page 31

... ISSUER PURCHASES OF EQUITY SECURITIES Our common stock is traded on the New York Stock Exchange under the symbol MGI. No dividends on our common stock were declared by our Board of Directors in 2010 or 2009. See "Management's Discussion and Analysis of Financial Condition and Results of Operations... -

Page 32

...peer group index of payment services companies consists of: Euronet Worldwide Inc., Fidelity National Information Services, Inc., Fiserv, Inc., Global Payments Inc., MasterCard, Inc., Online Resources Corporation, Total System Services, Inc., Visa, Inc. and The Western Union Company (the "Peer Group... -

Page 33

... of Operations - Basis of Presentation." YEAR ENDED DECEMBER 31, (Dollars and shares in thousands, except per share data) 2010 2009 2008 2007 2006 Operating Results Revenue Global Funds Transfer segment Financial Paper Products segment Other Total revenue Total operating expenses Operating income... -

Page 34

...with accounting principles generally accepted in the United States of America ("GAAP"). During the fourth quarter of 2010, the Company revised the presentation of its Consolidated Statements of Income (Loss) as a result of an internal review to enhance our external reporting and management reporting... -

Page 35

...the transaction, the originating location and the receiving location. Money order, bill payment and official check transaction fees are fixed per transaction. Foreign exchange revenue is derived from the management of currency exchange spreads on money transfer transactions involving different "send... -

Page 36

... drove the increase in money transfer fee and other revenue, partially offset by lower average money transfer fees per transaction due to the $50 price band introduced in the United States earlier in 2010 and the lower euro exchange rate. See further discussion under Table 2 - Fee and Other Revenue... -

Page 37

... increased $3.0 million, or 1 percent, in 2010 due to money transfer volume growth, partially offset by a decline in the euro exchange rate, lower average commission rates and lower commissions expense related to the Financial Paper Products segment and bill payment products. • Total operating... -

Page 38

..., or a $4.75 fee at a Walmart location. In the fourth quarter of 2010, we increased advertising for our domestic business and, in particular, promoted the new $50 price band to every MoneyGram location across the United States. As discussed further in Table 7 - Global Funds Transfer Segment, the $50... -

Page 39

... in the United States. Foreign exchange revenue of $113.2 million in 2010 increased $4.3 million from 2009. Bill payment revenue decreased from lower average fees per transaction due to industry mix and lower volumes. See Table 7 - Global Funds Transfer Segment and Table 8 - Financial Paper Products... -

Page 40

... low federal funds rate, most of our financial institution customers continue to be in a "negative" commission position as of December 31, 2010, meaning we do not owe any commissions to our customers. While the majority of our contracts require that the financial institution customers pay us... -

Page 41

... euro exchange rate decreased compensation and benefits by $2.1 million in 2009. Transaction and operations support - Transaction and operations support expense includes marketing, professional fees and other outside services, telecommunications and agent forms related to our products. Transaction... -

Page 42

... Union Payment Services Directive. Our provision for agent receivables increased by $9.0 million, primarily from the closure of an international agent during the year. Marketing costs decreased $12.7 million in 2009 from controlled spending, partially offset by higher costs from agent location... -

Page 43

...$2.7 million pro rata write-off of deferred financing costs and debt discount in connection with the prepayment of $185.0 million of debt in 2009. Based on our outstanding debt balances and interest rates in effect at December 31, 2010 and the expectation that we will continue to pay all interest in... -

Page 44

...performance of ongoing business operations, including our ability to service debt and fund capital expenditures, acquisitions and operations. These calculations are commonly used as a basis for investors, analysts and credit rating agencies to evaluate and compare the operating performance and value... -

Page 45

... charges and the benefits of cost savings initiatives, partially offset by higher stock-based compensation and a net curtailment gain recorded in 2009. Adjusted EBITDA for 2010 increased $7.1 million, or 3 percent, to $254.5 million from $247.4 million in 2009, primarily due to money transfer... -

Page 46

...used to hedge variable rate commissions were identified with the official check product in the Financial Paper Products segment, while forward foreign exchange contracts are identified with the money transfer product in the Global Funds Transfer segment. Any interest rate swaps related to our credit... -

Page 47

... in the Global Funds Transfer segment consists primarily of fees on money transfers and bill payment transactions. For 2010, Global Funds Transfer total revenue increased $27.8 million, or 3 percent, driven by money transfer volume growth, partially offset by a decline in bill payment revenue. 44 -

Page 48

... of fees paid to our third-party agents for money transfer and bill payment services, as well as the amortization of capitalized agent signing bonuses. In 2010, Global Funds Transfer commissions expense increased $8.5 million due primarily to $23.7 million of incremental expense from money transfer... -

Page 49

... from sends to India and Eastern Europe, as well as growth from our three largest agents in the United Kingdom. Greece had transaction growth of 14 percent through its receive markets in Eastern Europe. Spain had volume declines of 24 percent from local economic conditions. Bill payment fee and... -

Page 50

... and a settlement agreement with the Federal Trade Commission, a $5.2 million increase in stock-based compensation, a $7.1 million increase in provision for loss and a $3.2 million goodwill impairment related to discontinued bill payment product offerings, partially offset by the higher fee revenue... -

Page 51

... in 2011. Our growth has historically exceeded the World Bank projections. We expect our growth to be driven by agent expansion and increasing productivity in our existing agent locations through marketing support, customer acquisition and new product innovation. We anticipate money transfer revenue... -

Page 52

Table of Contents For our Financial Paper Products segment, we expect the decline in overall paper-based transactions to continue in 2011. As a result of the pricing initiatives undertaken in prior years, we have reduced the commission rates paid to our official check financial institution ... -

Page 53

... globally on a timely basis. On average, we pay over $1.0 billion a day to settle our payment service obligations. We generally receive a similar amount on a daily basis for the principal amount of our payment instruments sold and the related fees. We use the incoming funds from sales of new payment... -

Page 54

...limited number of international cash management banks with a network large enough to manage cash settlements for our entire agent base, and some of these large international banks have opted not to bank money service businesses. As a result, we also utilize regional or country-based banking partners... -

Page 55

... fees of 50 basis points on the daily unused availability under the revolving credit facility. The interest rate for Tranche B can be set at either the United States prime bank rate plus 400 basis points or the Eurodollar rate plus 500 basis points. Through 2009 and as of the date of this filing... -

Page 56

... defined by each state, for our regulated payment instruments, namely teller checks, agent checks, money orders and money transfers. The regulatory requirements do not require us to specify individual assets held to meet our payment service obligations, nor are we required to deposit specific assets... -

Page 57

... time as our business expands in that region. Assets used to meet these regulatory requirements support our payment service obligations, but are not available to satisfy other liquidity needs. As of December 31, 2010, we had approximately $50.2 million of cash deployed outside of the United States... -

Page 58

... these plans are not included in the above table as it is difficult to estimate the timing and amount of benefit payments and required contributions beyond the next 12 months. See Note 10 - Pensions and Other Benefits of the Notes to the Consolidated Financial Statements for further information. As... -

Page 59

... 2008, we used $4.7 billion of proceeds from the sale and normal maturity of available-for-sale securities and the 2008 Recapitalization to invest in cash equivalents and settle payment service obligations for instruments sold by departing official check financial institution customers in connection... -

Page 60

... and agent network to support future growth, enhance operating efficiencies and address regulatory trends. In 2010, we generated $7.5 million of proceeds from the sale of the corporate airplane and paid $0.3 million for the acquisition of Blue Dolphin net of cash acquired. In 2009, we received... -

Page 61

... the Notes to the Consolidated Financial Statements for information regarding the mezzanine equity. Stockholders' Deficit - On May 9, 2007, our Board of Directors approved a 5,000,000 share increase in our current authorization to purchase shares of common stock, bringing our total authorization to... -

Page 62

...banking system by guaranteeing newly issued senior unsecured debt of banks, thrifts and certain holding companies, and providing full coverage of non-interest bearing deposit transaction accounts, regardless of dollar amount. In addition, official checks issued by our financial institution customers... -

Page 63

... 92 percent invested in financial institutions located within the United States. Cash and cash equivalents held in financial institutions outside of the United States is placed to comply with local requirements or for operating use by our international entities. At December 31, 2010, our investment... -

Page 64

... embedded in our money transfer and retail money order point of sale equipment which provides credit risk management abilities. First, this software allows us to control both the number and dollar amount of transactions that can be completed by both agent and location in a particular timeframe... -

Page 65

... portfolio, particularly the high credit rating of financial institutions holding or issuing our cash, cash equivalents and short-term investments, along with the implicit guarantee of the U.S. government backing our money markets and majority of available-for-sale investments, we believe there... -

Page 66

Table of Contents In the second quarter of 2008, we repriced our official check product to an average of federal funds effective rate less 85 basis points to better match our investment commission rate with our lower yield realigned portfolio. In the current environment, the federal funds effective... -

Page 67

... of internal controls through risk-based audit procedures and reports on the effectiveness of internal controls to executive management and the Audit Committee of the Board of Directors. CRITICAL ACCOUNTING POLICIES The preparation of financial statements in conformity with GAAP requires estimates... -

Page 68

...are not actively traded, or for which there is not sufficient observable market information, we estimate fair value using broker quotes when available. When such quotes are not available, and to verify broker quotes received, we estimate fair value using industry-standard pricing models that utilize... -

Page 69

... value of our reporting units is estimated based on expected future cash flows discounted using a weighted-average cost of capital rate (the "discount rate"). Our discount rate is based on our debt and equity balances, adjusted for current market conditions and investor expectations of return on our... -

Page 70

... and appropriateness of our expected return. Our pension plan investment strategy is reviewed annually and is based upon plan obligations, an evaluation of market conditions, tolerance for risk and cash requirements for benefit payments. At December 31, 2010, the pension assets are composed of... -

Page 71

... FORWARD-LOOKING STATEMENTS This Annual Report on Form 10-K and the documents incorporated by reference herein may contain forward-looking statements with respect to the financial condition, results of operation, plans, objectives, future performance and business of MoneyGram International, Inc. and... -

Page 72

... to a significant decline in transaction volume. • International Migration Patterns. A material slow down or complete disruption of international migration patterns could adversely affect our money transfer volume and growth rate. • Retention of Global Funds Transfer Agents and Billers. We... -

Page 73

... Act of 2010, which will result in a new regulator with new and expanded compliance requirements, which is likely to increase our costs. • Operation in Politically Volatile Areas. Offering money transfer services through agents in regions that are politically volatile or, in a limited number of... -

Page 74

... to its partner set-up, settlement and partner servicing for the money transfer, bill payment and money order products. The new system will allow the Company to increase the flexibility of our back office, improve operating efficiencies and automate certain controls and compliance efforts. Other... -

Page 75

... to our Code of Ethics and our Always Honest policy. These documents are posted on our website at www.moneygram.com in the Investor Relations section, and are available in print free of charge to any stockholder who requests them at the address set forth below. We will disclose any amendments to, or... -

Page 76

...The financial statements listed in the "Index to Financial Statements and Schedules" are filed as part of this Annual Report on Form 10-K. All financial statement schedules are omitted because they are not applicable or the required information is included in the Consolidated Financial Statements or... -

Page 77

... duly authorized. MoneyGram International, Inc. (Registrant) Date: March 15, 2011 By: /s/ PAMELA H. PATSLEY Pamela H. Patsley Chairman and Chief Executive Officer (Principal Executive Officer) Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by... -

Page 78

*As attorney-in-fact 74 -

Page 79

... International, Inc., MoneyGram Payment Systems Worldwide, Inc., the other guarantors party thereto and Deutsche Bank Trust Company Americas, a New York banking corporation, as trustee and collateral agent (Incorporated by reference from Exhibit 4.1 to Registrant's Current Report on Form 8-K filed... -

Page 80

... February 17, 2010 (formerly known as the MoneyGram International, Inc. Management and Line of Business Incentive Plan) (Incorporated by reference from Exhibit 10.02 to Registrant's Current Report on Form 8-K filed on February 22, 1010). 10.8 Amended and Restated Trademark Security Agreement, dated... -

Page 81

... Inc., MoneyGram Payment Systems Worldwide, Inc., PropertyBridge, Inc., MoneyGram of New York LLC, and Deutsche Bank Trust Company Americas (Incorporated by reference from Exhibit 10.7 to Registrant's Current Report on Form 8-K filed on March 28, 2008). 10.34 Amended and Restated Purchase Agreement... -

Page 82

...MoneyGram International, Inc. and The Goldman Sachs Group, Inc. (Incorporated by reference from Exhibit 10.4 to Registrant's Current Report on Form 8-K filed on March 28, 2008). +10.39 Amended and Restated Note Purchase Agreement, dated as of March 17, 2008, among MoneyGram Payment Systems Worldwide... -

Page 83

... Current Report on Form 8-K filed on May 14, 2007). †10.54 Form of MoneyGram International, Inc. 2005 Omnibus Incentive Plan Non-Qualified Stock Option Agreement, effective August 11, 2009 (version 1) (Incorporated by reference from Exhibit 10.8 to Registrant's Quarterly Report on Form 10-Q filed... -

Page 84

...10.82 The MoneyGram International, Inc. Outside Directors' Deferred Compensation Trust (Incorporated by reference from Exhibit 99.05 to Registrant's Current Report on Form 8-K filed on November 22, 2005). 10.83 Money Services Agreement between Wal-Mart Stores, Inc. and MoneyGram Payment Systems, Inc... -

Page 85

... Form of MoneyGram International, Inc. Restricted Stock Unit Award Agreement (Incorporated by reference from Exhibit 10.11 to Registrant's Quarterly Report on Form 10-Q filed August 9, 2010). †10.96 MoneyGram International, Inc. Deferred Compensation Plan, as amended and restated February 16, 2011... -

Page 86

Table of Contents MoneyGram International, Inc. Annual Report on Form 10-K Items 8 and 15(a) Index to Financial Statements Management's Responsibility Statement Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheets as of December 31, 2010 and 2009 Consolidated ... -

Page 87

... with accounting principles generally accepted in the United States of America using, where appropriate, management's best estimates and judgments. The financial information presented throughout the Annual Report is consistent with that in the consolidated financial statements. Management is... -

Page 88

... of the Treadway Commission. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated financial statements as of and for the year ended December 31, 2010 of the Company and our report dated March 15, 2011 expressed an... -

Page 89

... (United States), the Company's internal control over financial reporting as of December 31, 2010, based on the criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated March 15, 2011 expressed... -

Page 90

Table of Contents MONEYGRAM INTERNATIONAL, INC. CONSOLIDATED BALANCE SHEETS AT DECEMBER 31, (Amounts in thousands, except share data) 2010 2009 ASSETS Cash and cash equivalents Cash and cash equivalents (substantially restricted) Receivables, net (substantially restricted) Short-term investments (... -

Page 91

... thousands, except per share data) 2010 2009 2008 REVENUE Fee and other revenue Investment revenue Total revenue EXPENSES Fee and other commissions expense Investment commissions expense Total commissions expense Compensation and benefits Transaction and operations support Occupancy, equipment and... -

Page 92

... INTERNATIONAL, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) FOR THE YEAR ENDED DECEMBER 31, (Amounts in thousands) 2010 2009 2008 $43,801 $(1,906) $(261,385) NET INCOME(LOSS) OTHER COMPREHENSIVE INCOME(LOSS) Net unrealized gains (losses) on available-for-sale securities: Net holding... -

Page 93

... restricted) Change in receivables, net (substantially restricted) Change in payment service obligations Net cash provided by (used in) operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Proceeds from sales of investments classified as available-for-sale (substantially restricted) Proceeds... -

Page 94

... liability Accrued dividends on preferred stock Accretion on preferred stock Employee benefit plans Net unrealized loss on available-for-sale securities Net unrealized gain on derivative financial instruments Amortization of prior service cost for pension and postretirement benefits, net of... -

Page 95

... of agents. The Financial Paper Products segment provides payment processing services, primarily official check outsourcing services, and money orders through financial institutions and agents. The Company's headquarters is located in Dallas, Texas, United States of America. References to "MoneyGram... -

Page 96

... rate on the preferred stock. Note 2 - Summary of Significant Accounting Policies Basis of Presentation - The consolidated financial statements of MoneyGram are prepared in conformity with accounting principles generally accepted in the United States of America ("GAAP"). The Consolidated Balance... -

Page 97

... money transfers. The regulatory payment service assets measure varies by state, but in all cases excludes investments rated below A-. The most restrictive states may also exclude assets held at banks that do not belong to a national insurance program, varying amounts of accounts receivable balances... -

Page 98

... amount of regulated payment service obligations upon presentment. Cash and cash equivalents, receivables and investments exceeding payment service obligations are generally available; however, management considers a portion of these amounts as providing additional assurance that business needs and... -

Page 99

... for operational and local regulatory compliance purposes. These receivables are outstanding from the day of the sale of the payment instrument until the financial institution or agent remits the funds to the Company. The Company provides an allowance for the portion of the receivable estimated to... -

Page 100

... of official check payment instruments, remittances and clearing adjustments; amounts owed to agents for funds paid to consumers on behalf of the Company; commissions owed to financial institution customers and agents for instruments sold; amounts owed to investment brokers for purchased securities... -

Page 101

... years. Goodwill and Intangible Assets - Goodwill represents the excess of the purchase price over the fair value of net assets acquired in business combinations and is assigned to the reporting unit in which the acquired business will operate. Intangible assets are recorded at their estimated fair... -

Page 102

... consist of transaction fees and foreign exchange revenue. • Transaction fees consist primarily of fees earned on money transfer, money order, bill payment and official check transactions. The money transfer transaction fees vary based on the principal value of the transaction and the locations in... -

Page 103

... bill payment services. In a money transfer transaction, both the agent initiating the transaction and the agent disbursing the funds receive a commission that is generally based on a percentage of the fee charged to the customer. The Company generally does not pay commissions to agents on the sale... -

Page 104

... and operations support" line in the Consolidated Statements of Income (Loss). The acquisition of Blue Dolphin provided the Company with the opportunity for further network expansion in the Netherlands and Belgium under the European Union Payment Services Directive and additional control over sales... -

Page 105

Table of Contents MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The Company finalized its purchase price allocation in 2010, resulting in $3.1 million of goodwill assigned to the Company's Global Funds Transfer segment, and the forgiveness ... -

Page 106

Table of Contents MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) In 2009, the Company finalized its purchase price allocation, resulting in goodwill of $4.3 million assigned to the Company's Global Funds Transfer segment and $1.4 million of ... -

Page 107

... Debt is carried at amortized cost; however, the Company estimates the fair value of debt for disclosure purposes. The fair value of debt is estimated using market quotations, where available, credit ratings, observable market indices and other market data. As of December 31, 2010, the fair value of... -

Page 108

... 31: 2010 (Amounts in thousands) Level 1 Level 2 Level 3 Total Available-for-sale investments (substantially restricted): United States government agencies Residential mortgage-backed securities - agencies Other asset-backed securities Forward contracts Total financial assets $ $ 8,641... -

Page 109

...and time deposits. Cash primarily consists of interest-bearing deposit accounts and non-interest bearing transaction accounts. The Company's money-market securities are invested in six funds, all of which are AAA rated and consist of United States Treasury bills, notes or other obligations issued or... -

Page 110

... the United States government and the Company expects to receive full par value upon maturity or pay-down, as well as all interest payments. The Other asset-backed securities continue to have market exposure. The Company has factored this risk into its fair value estimates, with the average price of... -

Page 111

...ratings from Moody's Investor Service ("Moody's"), Standard & Poors ("S&P") and Fitch Ratings ("Fitch"). If the rating agencies have split ratings, the Company uses the highest rating across the rating agencies for disclosure purposes. Securities issued or backed by United States government agencies... -

Page 112

...variability of cash flows from its floating rate debt, as well as its floating rate commission payments to financial institution customers in the Financial Paper Products segment, primarily relating to the official check product. In connection with its restructuring of the official check business in... -

Page 113

Table of Contents MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) As described in Note 11 - Mezzanine Equity, the Company's Series B Stock `contains a conversion option allowing the stockholder to convert the Series B Stock into shares of ... -

Page 114

... in the "Transaction and operations support" line in the Consolidated Statements of Income (Loss). Note 8 - Goodwill and Intangible Assets Following is a roll-forward of goodwill by reporting segment: (Amounts in thousands) Global Funds Transfer 2010 2009 Financial Paper Products 2010 2009 Other... -

Page 115

... of the retail money order reporting unit over the carrying amount of goodwill. There were no impairments recognized in 2010 and 2008 as a result of the annual impairment test. Goodwill impairment charges are included in the "Transaction and operations support" line of the Consolidated Statements of... -

Page 116

... the United States prime bank rate plus 400 basis points or the Eurodollar rate plus 500 basis points. Under the terms of the senior facility, the interest rate determined using the Eurodollar index has a minimum rate of 2.50 percent. Fees on the daily unused availability under the revolving credit... -

Page 117

... which no new service or compensation credits are accrued by the plan participants. Cash accumulation accounts continue to be credited with interest credits until participants withdraw their money from the Pension Plan. It is the Company's policy to fund the minimum required contribution each year... -

Page 118

... assumptions used in calculating the benefit obligation and net benefit cost as of and for the years ended December 31: Pension and SERPs 2010 2009 2008 Postretirement Benefits 2010 2009 2008 Net periodic benefit cost: Discount rate Expected return on plan assets Rate of compensation increase... -

Page 119

Table of Contents MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Pension Assets - The Company employs a total return investment approach whereby a mix of equity and fixed income securities are used to maximize the long-term return of plan ... -

Page 120

Table of Contents MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Following are the Plan's financial assets recorded at fair value by hierarchy level as of December 31: 2010 (Amounts in thousands) Level 1 Level 2 Level 3 Total Short-term ... -

Page 121

... the following components for the years ended December 31: (Amounts in thousands) 2010 Pension and SERPs 2009 2008 2010 Postretirement Benefits 2009 2008 Service cost Interest cost Expected return on plan assets Amortization of prior service cost (credit) Recognized net actuarial loss Curtailment... -

Page 122

Table of Contents MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 2009 Postretirement Benefits (Amounts in thousands) Pension and SERPs Net actuarial loss Amortization of net actuarial loss Amortization of prior service (cost) credit ... -

Page 123

Table of Contents MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The benefit obligation and plan assets, changes to the benefit obligation and plan assets, and the funded status of the defined benefit pension plan and SERPs and the ... -

Page 124

...the plan. Management deferred accounts are generally payable based upon the timing and method elected by the participant. In April 2010, the plan was amended to convert stock unit accounts to cash. Deferred cash accounts are credited quarterly with interest at the one-year Constant Maturity rate. In... -

Page 125

Table of Contents MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The deferred compensation plans are unfunded and unsecured, and the Company is not required to physically segregate any assets in connection with the deferred accounts. The ... -

Page 126

... during the term of the Equity Registration Rights Agreement. On December 14, 2010, we filed a shelf registration statement on Form S-3 with the Securities and Exchange Commission which would permit the offer and sale of the Registrable Securities, as required by the terms of the Equity Registration... -

Page 127

...Contents MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Note 12 - Stockholders' Deficit Preferred Stock - The Company's Certificate of Incorporation provides for the issuance of up to 7,000,000 shares of preferred stock that may be issued in... -

Page 128

... 2005 Omnibus Incentive Plan to increase the aggregate number of shares that may be granted to an eligible person in any calendar year from 10 million to 12 million shares, along with adding and clarifying provisions regarding certain limitations for performance awards denominated in shares and cash... -

Page 129

...-year United States Treasury yield in effect at the time of grant. Compensation cost, net of expected forfeitures, is recognized using a straight-line method over the vesting or service period. The following table provides weighted-average grant-date fair value and assumptions utilized to estimate... -

Page 130

Table of Contents MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Following is a summary of stock option activity for 2010: WeightedAverage Remaining Contractual Term Shares WeightedAverage Exercise Price Aggregate Intrinsic Value ($000) ... -

Page 131

Table of Contents MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Note 14 - Income Taxes The components of income (loss) before income taxes are as follows for the year ended December 31: (Amounts in thousands) 2010 2009 2008 United States ... -

Page 132

... were able to utilize to recover tax payments made for fiscal 2005 through 2007. During the second quarter of 2010, the IRS completed its examination of the Company's consolidated income tax returns for 2005 to 2007, and issued its Revenue Agent Report ("RAR") challenging the Company's tax position... -

Page 133

... a United States federal income tax examination for 2005 through 2007 currently in administrative appeals. Unrecognized tax benefits are recorded in "Accounts payable and other liabilities" in the Consolidated Balance Sheets. Following is a reconciliation of unrecognized tax benefits for the year... -

Page 134

... "Other assets" line in the Consolidated Balance Sheets. A net gain of $12.7 million and charges totaling $54.9 million, net of insurance recoveries, and $0.3 million were recorded in the "Transaction and operations support" line in the Consolidated Statements of Income (Loss) during 2010, 2009 and... -

Page 135

... United States District Court for the District of Minnesota captioned In re MoneyGram International, Inc. Derivative Litigation. The Consolidated Complaint in this action, which was filed on November 18, 2009 and arises out of the same matters at issue in the securities class action, alleges claims... -

Page 136

...the Settlement Agreement in October 2010. Patent Action - On September 25, 2009, the United States District Court for the Western District of Texas, Austin returned a jury verdict in a patent suit brought against the Company by Western Union on May 11, 2007, styled Western Union v. MoneyGram Payment... -

Page 137

... primarily manages its business through two reporting segments, Global Funds Transfer and Financial Paper Products. The Global Funds Transfer segment provides global money transfers and bill payment services to consumers through a network of agents and, in select markets, company-operated locations... -

Page 138

...CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The Global Funds Transfer segment is managed as two geographical regions or operating segments, the Americas and EMEAAP, to coordinate sales, agent management and marketing activities. The Americas region includes the United States, Canada, Mexico, the... -

Page 139

Table of Contents MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) (Amounts in thousands) 2010 2009 2008 Segment operating income: Global Funds Transfer Financial Paper Products Other Total segment operating income Net securities (gains) ... -

Page 140

... MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Note 17 - Subsequent Event On March 7, 2011, the Company entered into a Recapitalization Agreement with THL and Goldman Sachs pursuant to which (i) THL will convert all of the shares of B Stock... -

Page 141

Table of Contents MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 2010 Fiscal Quarters (Amounts in thousands, except per share data) First Second (1) Third (1) Fourth (1) Revenue Total operating expenses Operating income Total other expenses,... -

Page 142

Table of Contents MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following information represents condensed, consolidating Balance Sheets as of December 31, 2010 and 2009, along with condensed, consolidating Statements of Income (Loss) ... -

Page 143

... MONEYGRAM INTERNATIONAL, INC. CONDENSED, CONSOLIDATING BALANCE SHEETS FOR THE YEAR ENDED DECEMBER 31, 2010 (Amounts in thousands) Parent Subsidiary Guarantors NonGuarantors Eliminations Consolidated ASSETS Cash and cash equivalents Cash and cash equivalents (substantially restricted) Receivables... -

Page 144

Table of Contents MONEYGRAM INTERNATIONAL, INC. CONDENSED, CONSOLIDATING STATEMENTS OF INCOME(LOSS) FOR THE YEAR ENDED DECEMBER 31, 2010 (Amounts in thousands) Parent Subsidiary Guarantors NonGuarantors Eliminations Consolidated REVENUE Fee and other revenue Investment revenue Total revenue ... -

Page 145

Table of Contents MONEYGRAM INTERNATIONAL, INC. CONDENSED, CONSOLIDATING STATEMENTS OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31, 2010 (Amounts in thousands) Parent Subsidiary NonGuarantors Guarantors Eliminations Consolidated NET CASH (USED IN) PROVIDED BY OPERATING ACTIVITIES CASH FLOWS FROM ... -

Page 146

... Goodwill Other assets Equity investments in subsidiaries Intercompany receivables Total assets LIABILITIES AND STOCKHOLDERS' DEFICIT (EQUITY) Payment service obligations Debt Pension and other postretirement benefits Accounts payable and other liabilities Intercompany liabilities Total liabilities... -

Page 147

... Total revenue EXPENSES Fee and other commissions expense Investment commissions expense Total commissions expense Compensation and benefits Transaction and operations support Occupancy, equipment and supplies Depreciation and amortization Total operating expenses OPERATING (LOSS) INCOME Other... -

Page 148

Table of Contents MONEYGRAM INTERNATIONAL, INC. CONDENSED, CONSOLIDATING STATEMENTS OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31, 2009 (Amounts in thousands) Parent Subsidiary NonGuarantors Guarantors Eliminations Consolidated NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES CASH FLOWS FROM ... -

Page 149

... Total revenue EXPENSES Fee and other commissions expense Investment commissions expense Total commissions expense Compensation and benefits Transaction and operations support Occupancy, equipment and supplies Depreciation and amortization Total operating expenses OPERATING (LOSS) INCOME Other... -

Page 150

Table of Contents MONEYGRAM INTERNATIONAL, INC. CONDENSED, CONSOLIDATING STATEMENTS OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31, 2008 (Amounts in thousands) Parent Subsidiary Guarantors NonGuarantors Eliminations Consolidated NET CASH PROVIDED USED IN OPERATING ACTIVITIES CASH FLOWS FROM ... -

Page 151

Table of Contents (This page intentionally left blank.) F-66 -

Page 152

...International Limited (United Kingdom) MoneyGram International Pte. Ltd (Singapore) MoneyGram of New York LLC (Delaware) MoneyGram Overseas (Pty) Limited South Africa (South Africa) MoneyGram Payment Systems Bulgaria, EOOD (Bulgaria) MoneyGram Payment Systems Canada, Inc. (Ontario) MoneyGram Payment... -

Page 153

... the consolidated financial statements of MoneyGram International, Inc., and the effectiveness of MoneyGram International, Inc.'s internal control over financial reporting, appearing in the Annual Report on Form 10-K of MoneyGram International, Inc. for the year ended December 31, 2010. /s/ DELOITTE... -

Page 154

..., to sign MoneyGram International, Inc.'s Annual Report on Form 10-K for the fiscal year ended December 31, 2010, and any and all amendments thereto, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting... -

Page 155

...H. Patsley, certify that: 1. 2. I have reviewed this Annual Report on Form 10-K of MoneyGram International, Inc. for the fiscal year ended December 31, 2010; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make... -

Page 156

...E. Shields, certify that: 1. 2. I have reviewed this Annual Report on Form 10-K of MoneyGram International, Inc. for the fiscal year ended December 31, 2010; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make... -

Page 157

...In connection with the Annual Report on Form 10-K (the "Report"), of MoneyGram International, Inc. (the "Company") for the period ended December 31, 2010, as filed with the Securities and Exchange Commission on the date hereof I, Pamela H. Patsley, Chairman and Chief Executive Officer of the Company... -

Page 158

... with the Annual Report on Form 10-K (the "Report"), of MoneyGram International, Inc. (the "Company") for the period ended December 31, 2010, as filed with the Securities and Exchange Commission on the date hereof I, James E. Shields, Executive Vice President and Chief Financial Officer of the...