Duke Energy 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

PART II

its investments against certain indices and by maintaining, and periodically

reviewing, target allocation percentages for various asset classes. Accounting

for nuclear decommissioning recognizes that costs are recovered through retail

rates; therefore, fl uctuations in equity prices do not affect their Consolidated

Statements of Operations as changes in the fair value of these investments are

deferred as regulatory assets or regulatory liabilities pursuant to an Order by the

NCUC, PSCSC and FPSC. Earnings or losses of the fund will ultimately impact the

amount of costs recovered through retail rates. See Note 9 to the Consolidated

Financial Statements, “Asset Retirement Obligations” for additional information

regarding nuclear decommissioning costs. See Note 15 to the Consolidated

Financial Statements, “Investments in Debt and Equity Securities” for additional

information regarding NDTF assets.

Foreign Currency Risk

Duke Energy is exposed to foreign currency risk from investments in

international businesses owned and operated in foreign countries and from

certain commodity-related transactions within domestic operations that are

denominated in foreign currencies. To mitigate risks associated with foreign

currency fl uctuations, contracts may be denominated in or indexed to the U.S.

dollar and/or local infl ation rates, or investments may be naturally hedged

through debt denominated or issued in the foreign currency. Duke Energy may

also use foreign currency derivatives, where possible, to manage its risk related

to foreign currency fl uctuations. To monitor its currency exchange rate risks,

Duke Energy uses sensitivity analysis, which measures the impact of devaluation

of the foreign currencies to which it has exposure.

Duke Energy’s primary foreign currency rate exposure is to the Brazilian

Real. The table below summarizes the potential effect of foreign currency

devaluations on Duke Energy’s Consolidated Statement of Operations and

Consolidated Balance Sheets, based on a sensitivity analysis performed as of

December 31, 2014 and December 31, 2013.

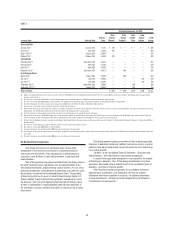

Summary of Sensitivity Analysis for Foreign Currency Risks

Assuming 10 percent devaluation in the currency

exchange rates in all exposure currencies

As of December 31,

(in millions) 2014 2013

Income Statement impact(a) $ (20) $ (20)

Balance Sheet impact(b) $ (98) $(140)

(a) Amounts represent the potential annual net pretax loss on the translation of local currency earnings to the

U.S. dollar in 2014 and 2013, respectively.

(b) Amounts represent the potential impact to the currency translation through Accumulated Other

Comprehensive Income (AOCI) on the Consolidated Balance Sheets.

OTHER MATTERS

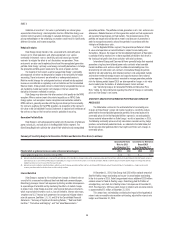

Ratios of Earnings to Fixed Charges

The Duke Energy Registrants’ ratios of earnings to fi xed charges, as

calculated using SEC guidelines, are included in the table below.

Years Ended December 31,

2014 2013 2012

Duke Energy(a) 3.2 3.0 2.4

Duke Energy Carolinas 4.6 4.4 3.8

Progress Energy 2.7 2.2 1.6

Duke Energy Progress 3.5 3.7 2.3

Duke Energy Florida 4.1 2.9 2.3

Duke Energy Ohio 2.1 2.2 1.7

Duke Energy Indiana 4.1 4.1 0.3

(a) Includes the results of Progress Energy beginning on July 2, 2012.

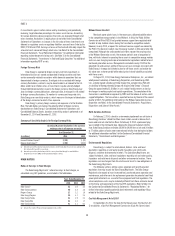

Midwest Generation Exit

Merchant power plants have, in the recent past, delivered volatile returns

in the competitive energy markets in the Midwest. In Ohio, the Public Utilities

Commission of Ohio (PUCO) had granted revenue support from regulated retail

markets to help stabilize returns during the transition to competitive markets.

However, in early 2014, a request for continued revenue support was denied by

the PUCO. This decision made it clear the energy markets in Ohio were to be fully

unregulated. Although the undiscounted cash fl ows recover the carrying value

of the Midwest Generation assets, the recovery period is over a long period of

time, with risks inherent in operating these assets in competitive energy markets

and in an ever changing landscape of environmental regulations related to fossil

fuel based generation sources. Management concluded in early 2014 that the

projected risk and earnings profi le of these assets was no longer consistent with

Duke Energy’s strategy and initiated a plan to sell these assets and realize the

fair value over a shorter period while reducing the risk and volatility associated

with these assets.

On August 21, 2014, Duke Energy Commercial Enterprises, Inc., an indirect

wholly owned subsidiary of Duke Energy Corporation, and Duke Energy SAM,

LLC, a wholly owned subsidiary of Duke Energy Ohio, entered into a PSA with

a subsidiary of Dynegy whereby Dynegy will acquire Duke Energy’s Disposal

Group for approximately $2.8 billion in cash subject to adjustments at closing

for changes in working capital and capital expenditures. The completion of the

transaction is conditioned on approval by FERC and the release of certain credit

support obligations. The transaction is expected to close by the end of the second

quarter of 2015. For additional information on the Midwest generation business

disposition see Note 2 to the Consolidated Financial Statements, “Acquisitions,

Dispositions and Sales of Other Assets.”

North Carolina Ash Basins

On February 2, 2014, a break in a stormwater pipe beneath an ash basin at

Duke Energy Carolinas’ retired Dan River steam station caused a release of ash

basin water and ash into the Dan River. On February 8, 2014, a permanent plug

was installed in the stormwater pipe, stopping the release of materials into the

river. Duke Energy Carolinas estimates 30,000 to 39,000 tons of ash and 24 million

to 27 million gallons of basin water were released into the river during the incident.

For additional information see Note 5 to the Condensed Consolidated Financial

Statements, “Commitments and Contingencies.”

Environmental Regulations

Duke Energy is subject to international, federal, state, and local

regulations regarding air and water quality, hazardous and solid waste

disposal, and other environmental matters. The Subsidiary Registrants are

subject to federal, state, and local regulations regarding air and water quality,

hazardous and solid waste disposal and other environmental matters. These

regulations can be changed from time to time and result in new obligations of

the Duke Energy Registrants.

The following sections outline various proposed and recently enacted

regulations that may impact the Duke Energy Registrants. The Duke Energy

Registrants also expect to incur increased fuel, purchased power, operation and

maintenance, and other costs for replacement generation for potential coal-fi red

power plant retirements as a result of these proposed and fi nal regulations. The

actual compliance costs may be materially different from these estimates based

on the timing and requirements of the fi nal EPA regulations. Refer to Note 4 to

the Condensed Consolidated Financial Statements, “Regulatory Matters,” for

further information regarding potential plant retirements and regulatory fi lings

related to the Duke Energy Registrants.

Coal Ash Management Act of 2014

On September 20, 2014, the Coal Ash Act became law. The Coal Ash Act

(i) establishes a Coal Ash Management Commission (Coal Ash Commission)