Duke Energy 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

PART II

Credit ratings are intended to provide credit lenders a framework for

comparing the credit quality of securities and are not a recommendation to buy,

sell or hold. The Duke Energy Registrants’ credit ratings are dependent on the

rating agencies’ assessments of their ability to meet their debt principal and

interest obligations when they come due. If, as a result of market conditions

or other factors, the Duke Energy Registrants are unable to maintain current

balance sheet strength, or if earnings and cash fl ow outlook materially

deteriorates, credit ratings could be negatively impacted.

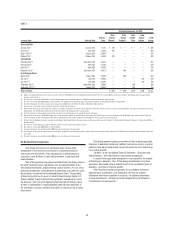

Cash Flow Information

The following table summarizes Duke Energy’s cash fl ows for the three

most recently completed fi scal years.

(in millions)

Years Ended December 31,

2014 2013 2012

Cash fl ows provided by (used in):

Operating activities $ 6,586 $ 6,382 $ 5,244

Investing activities (5,373) (4,978) (6,197)

Financing activities (678) (1,327)267

Net increase (decrease) in cash and cash

equivalents 535 77 (686)

Cash and cash equivalents at beginning of period 1,501 1,424 2,110

Cash and cash equivalents at end of period $ 2,036 $ 1,501 $ 1,424

OPERATING CASH FLOWS

The following table summarizes key components of Duke Energy’s

operating cash fl ows for the three most recently completed fi scal year.

(in millions)

Years Ended December 31,

2014 2013 2012

Net income $ 1,889 $ 2,676 $ 1,782

Non-cash adjustments to net income 5,366 4,876 3,769

Contributions to qualifi ed pension plans —(250) (304)

Working capital (669) (920) (3)

Net cash provided by operating activities $ 6,586 $ 6,382 $ 5,244

For the year ended December 31, 2014 compared to 2013, the variance

was driven primarily by:

• A $204 million increase due to prior year contributions to qualifi ed

pension plans, favorable retail pricing and rate riders and favorable

weather, partially offset by current year under collection of fuel and

purchased power costs and timing of cash payments for operations and

maintenance expenses.

For the year ended December 31, 2013 compared to 2012, the variance

was driven primarily by:

• A $2,001 million increase in net income after non-cash adjustments,

mainly due to the inclusion of Progress Energy’s results for fi rst six

months of 2013 and the impact of revised rates and lower operation and

maintenance expenses, partially offset by;

• A $917 million decrease in operating cash fl ows from increased

investments in traditional working capital, mainly due to the timing of

receivables and accruals, lower incentive accruals, net of current year

payments and reserve reductions and the prior year overallocation of the

Carolinas’ fuels costs. These decreases were partially offset by the NEIL

proceeds.

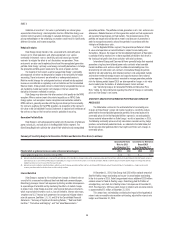

INVESTING CASH FLOWS

The following table summarizes key components of Duke Energy’s

investing cash fl ows for the three most recently completed fi scal years.

(in millions)

Years Ended December 31,

2014 2013 2012

Capital, investment and acquisition expenditures $ (5,528) $ (5,607) $ (5,958)

Available-for-sale securities, net 23 173 (182)

Proceeds from sales of equity investments and

other assets, and sales of and collections on

notes receivable 179 277 212

Other investing items (47) 179 (269)

Net cash used in investing activities $ (5,373) $ (4,978) $ (6,197)

The primary use of cash related to investing activities is capital,

investment and acquisition expenditures, detailed by reportable business

segment in the following table.

(in millions)

Years Ended December 31,

2014 2013 2012

Regulated Utilities $ 4,744 $ 5,049 $ 4,220

Commercial Power 67 268 1,038

International Energy 555 67 551

Other 162 223 149

Total capital, investment and acquisition

expenditures $ 5,528 $ 5,607 $ 5,958

For the year ended December 31, 2014 compared to 2013, the variance

was driven primarily by:

• A $192 million return of collateral related to the Chilean hydro

acquisition in 2013 and

• A $150 million decrease in net proceeds from sales and maturities of

available-for-sale securities, net of purchases.

For the year ended December 31, 2013 compared to 2012, the variance

was driven primarily by:

• A $581 million variance in restricted cash due to posting collateral on a

secured debt issuance related to the Chilean hydro acquisition in 2012

and the return of a portion of this collateral in 2013,

• A $355 million increase in proceeds from the sales of available-for-sale

securities, net of purchases due to the investment of excess cash held

in foreign jurisdictions and

• A $351 million decrease in capital, investment and acquisition

expenditures primarily due to lower spending on Duke Energy’s

renewable energy projects and ongoing infrastructure modernization

program as these projects were completed, net of expenditures on

Progress Energy’s maintenance projects.