Duke Energy 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

PART II

customers and job training in accordance with 2013 North Carolina

Utilities Commission (NCUC) and Public Service Commission of

South Carolina (PSCSC) rate case orders.

Partially offset by:

• A $346 million decrease due to the 2013 impairment and other charges

primarily related to Crystal River Unit 3 and the proposed Levy Nuclear

Station (Levy). See Note 4 to the Consolidated Financial Statements,

“Regulatory Matters,” for additional information;

• A $42 million decrease in property and other taxes primarily due to the

termination of the collection of the North Carolina gross receipts tax as

mentioned above; partially offset by a sales tax reserve as a result of an

Indiana sales tax audit, and higher property taxes; and

• A $22 million decrease due to the 2013 impairment resulting from the

decision to suspend the application for two proposed nuclear units at

Shearon Harris Nuclear Station (Harris).

Other Income and Expenses, net. The variance is primarily due to

recognition of post in-service equity returns for projects that had been completed

prior to being refl ected in customer rates, partially offset by lower AFUDC –

equity, primarily due to placing the Sutton plant into service in late 2013.

Interest Expense. The variance was primarily due to no longer recording

post in-service debt returns on projects now refl ected in customer rates and

a reduction in debt return on the Crystal River Unit 3 regulatory asset now

recovered through fuel revenues.

Income Tax Expense. The variance was primarily due to higher pretax

income and partially offset by a lower effective tax rate of 36.8 percent

compared to 37.8 percent, respectively, for the years ended December 31, 2014

and 2013. The decrease in effective tax rate is primarily due to favorable audit

settlements, a higher manufacturing deduction due to prior year limitations

based on taxable income, and changes in income apportionment for state income

tax, partially offset by the non-deductible litigation reserve related to the criminal

investigation of the Dan River coal ash spill.

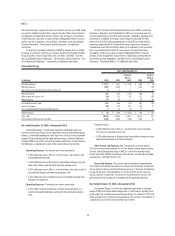

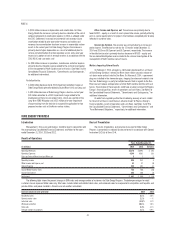

Year Ended December 31, 2013 as Compared to 2012

Regulated Utilities’ results were positively impacted by 2012 impairment

and other charges related to the Edwardsport Integrated Gasifi cation Combined

Cycle (IGCC) plant, higher retail pricing and rate riders, the inclusion of Progress

Energy results for the fi rst six months of 2013, a net increase in wholesale

power revenues, and higher weather-normal sales volumes. These impacts were

partially offset by higher income tax expense, Crystal River Unit 3 charges, lower

AFUDC – equity and higher depreciation and amortization expense. The following

is a detailed discussion of the variance drivers by line item.

Operating Revenues. The variance was driven primarily by:

• A $4,339 million increase due to the inclusion of Progress Energy for the

fi rst six months of 2013;

• A $434 million net increase in retail pricing primarily due to revised

rates approved in all jurisdictions;

• A $76 million net increase in wholesale power revenues, net of sharing,

primarily due to additional volumes and charges for capacity for

customers served under long-term contracts; and

• A $72 million increase in weather-normal sales volumes to retail

customers (net of fuel revenue) refl ecting increased demand.

Partially offset by:

• A $132 million decrease in fuel revenues (including emission allowances)

driven primarily by (i) the impact of lower Florida residential fuel rates,

including amortization associated with the settlement agreement

approved by the Florida Public Service Commission (FPSC) in 2012

(2012 Settlement), (ii) lower fuel rates for electric retail customers in the

Carolinas, Florida and Ohio, and (iii) lower revenues for purchased power,

partially offset by (iv) increased demand from electric retail customers.

Fuel revenues represent sales to retail and wholesale customers.

Operating Expenses. The variance was driven primarily by:

• A $3,393 million increase due to the inclusion of Progress Energy for the

fi rst six months of 2013;

• A $346 million increase in impairment and other charges in 2013

primarily related to Crystal River Unit 3 and Levy; and

• A $102 million increase in depreciation and amortization expense

primarily due to a decrease in the reduction of the cost of removal

component of amortization expense as allowed under the 2012

Settlement.

Partially offset by:

• A $600 million decrease due to 2012 impairment and other charges

related to the Edwardsport IGCC plant. See Note 4 to the Consolidated

Financial Statements, “Regulatory Matters,” for additional information,

and

• A $120 million decrease in fuel expense (including purchased power and

natural gas purchases for resale) primarily related to (i) the application

of the NEIL settlement proceeds in Florida, including amortization

associated with the 2012 Settlement; (ii) lower purchased power costs

in (a) the Carolinas, primarily due to additional generating capacity

placed in service in late 2012 and market conditions, (b) Ohio, primarily

due to reduced sales volumes, and (c) Indiana, refl ective of market

conditions; partially offset by (iii) higher volumes of natural gas used in

electric generation due primarily to additional generating capacity placed

in service; (iv) higher prices for natural gas and coal used in electric

generation; and (v) higher volumes of coal used in electric generation

primarily due to generation mix.

Other Income and Expenses, net. The decrease is primarily due to lower

AFUDC equity, resulting from major projects that were placed into service in late

2012 and the implementation of new customer rates related to the IGCC rider,

partially offset by the inclusion of Progress Energy for the fi rst six months of 2013.

Interest Expense. The variance was primarily driven by the inclusion of

Progress Energy for the fi rst six months of 2013.

Income Tax Expense. The variance was primarily due to an increase in

pretax income. The effective tax rates for the years ended December 31, 2013

and 2012 were 37.8 percent and 35 percent, respectively. The increase in

the effective tax rate was primarily due to an increase in pretax income and a

reduction in AFUDC equity.

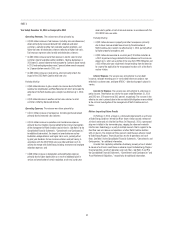

Matters Impacting Future Regulated Utilities Results

On February 2, 2014, a break in a stormwater pipe beneath an ash basin

at the retired Dan River steam station caused a release of ash basin water and

ash into the Dan River. On February 8, 2014, a permanent plug was installed in