Duke Energy 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

PART II

Other Income and Expenses, net. The variance was primarily due to the

recognition of post in-service equity returns for projects that had been completed

prior to being refl ected in customer rates.

Interest Expense. The variance was primarily due to no longer recording

post in-service debt returns on projects now refl ected in customer rates, partially

offset by lower interest on bonds.

Income Tax Expense. The effective tax rate for the years ended

December 31, 2014 and 2013 was 35.4 percent and 37.8 percent, respectively.

The decrease in the effective tax rate is primarily due to favorable audit

settlements, changes in apportionment related to state income tax and the tax

benefi t related to the manufacturing deduction in 2014 as the prior year deduction

was limited by taxable income, partially offset by the non-deductible litigation

reserve related to the criminal investigation of the Dan River coal ash spill.

Matters Impacting Future Results

On February 2, 2014, a break in a stormwater pipe beneath an ash basin

at the retired Dan River steam station caused a release of ash basin water and

ash into the Dan River. On February 8, 2014, a permanent plug was installed in

the stormwater pipe, stopping the release of materials into the river. Duke Energy

is a party to multiple lawsuits fi led in regards to the Dan River coal ash release

and operations at other North Carolina facilities with ash basins. The outcome of

these lawsuits could have an adverse impact to Duke Energy Carolinas’ fi nancial

position, results of operations and cash fl ows. See Note 5 to the Consolidated

Financial Statements, “Commitments and Contingencies,” for additional

information.

An order from regulatory authorities disallowing recovery of costs related

to closure of ash basins could have an adverse impact to Duke Energy Carolinas’

fi nancial position, results of operations and cash fl ows. See Notes 5 and 9 to

the Consolidated Financial Statements, “Commitments and Contingencies” and

“Asset Retirement Obligations,” respectively, for additional information.

PROGRESS ENERGY

Introduction

Management’s Discussion and Analysis should be read in conjunction with

the accompanying Consolidated Financial Statements and Notes for the years

ended December 31, 2014, 2013 and 2012.

Basis of Presentation

The results of operations and variance discussion for Progress Energy is

presented in a reduced disclosure format in accordance with General Instruction

(I)(2)(a) of Form 10-K.

Results of Operations

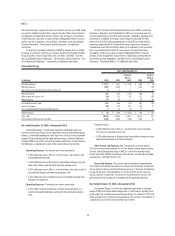

Years Ended December 31,

(in millions) 2014 2013 Variance

Operating Revenues $10,166 $ 9,533 $ 633

Operating Expenses 8,159 7,918 241

Gains (Losses) on Sales of Other Assets and Other, net 11 38

Operating Income 2,018 1,618 400

Other Income and Expense, net 77 94 (17)

Interest Expense 675 680 (5)

Income Before Income Taxes 1,420 1,032 388

Income Tax Expense 540 373 167

Income from Continuing Operations 880 659 221

Discontinued Operations, net of tax (6) 16 (22)

Net Income 874 675 199

Less: Net Income Attributable to Noncontrolling Interests 532

Net Income Attributable to Parent $ 869 $ 672 $ 197

Year Ended December 31, 2014 as Compared to 2013

Operating Revenues. The variance was driven primarily by:

• A $341 million increase in fuel revenues (including emission

allowances) driven primarily by increased demand from wholesale and

retail customers, partially resulting from favorable weather conditions,

and higher fuel rates for wholesale customers refl ective of higher fuel

costs for Duke Energy Progress; and to a higher fuel rate in the current

year related to lower NEIL insurance reimbursements and accelerated

Crystal River Unit 3 regulatory asset cost recovery in 2014 as allowed

by the 2013 Settlement for Duke Energy Florida. Fuel revenues represent

sales to retail and wholesale customers;

• A $149 million increase in retail pricing, which primarily refl ects the

impact of the 2013 North Carolina retail rate case in North Carolina and

the 2014 base rate increase in Florida; and

• A $114 million increase (net of fuel revenue) in GWh sales to retail

customers due to favorable weather conditions. For Duke Energy

Progress, heating degree days in 2014 were 11 percent above normal

compared to 2 percent above normal in 2013 and cooling degree days

were 2 percent below normal compared to 13 percent below normal in

2013. For Duke Energy Florida, heating degree days in 2014 were 51

percent higher and cooling degree days were 4 percent lower compared

to the same period in 2013.

Operating Expenses. The variance was driven primarily by:

• A $344 million increase in fuel expenses (including purchased power).

For Duke Energy Florida the increase is due to the application of the

NEIL settlement proceeds in 2013 and higher sales volumes driven

by increased demand and higher fuel prices in the current year. For

Duke Energy Progress the increase is primarily due to increased sales

volumes;