Duke Energy 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

PART II

DIVIDEND PAYMENTS

In 2014, Duke Energy paid quarterly cash dividends for the 88th

consecutive year and expects to continue its policy of paying regular cash

dividends in the future. There is no assurance as to the amount of future

dividends because they depend on future earnings, capital requirements,

fi nancial condition and are subject to the discretion of the Board of Directors.

The Board of Directors continues to target a payout ratio of 65 to 70

percent, based upon adjusted diluted EPS. Over the past several years, Duke

Energy’s dividend has grown at approximately 2 percent annually, slower than

overall adjusted earnings growth. Duke Energy has now achieved the targeted

payout range and believes it has the fl exibility to grow the dividend at a pace

more consistent with adjusted earnings growth.

Dividend and Other Funding Restrictions of Duke Energy Subsidiaries

As discussed in Note 4 to the Consolidated Financial Statements

“Regulatory Matters,” Duke Energy’s wholly owned public utility operating

companies have restrictions on the amount of funds that can be transferred to

Duke Energy via dividend, advance or loan as a result of conditions imposed by

various regulators in conjunction with merger transactions. Duke Energy Progress

and Duke Energy Florida also have restrictions imposed by their fi rst mortgage

bond indentures and Articles of Incorporation which, in certain circumstances,

limit their ability to make cash dividends or distributions on common stock.

Additionally, certain other Duke Energy subsidiaries have other restrictions, such

as minimum working capital and tangible net worth requirements pursuant to

debt and other agreements that limit the amount of funds that can be transferred

to Duke Energy. At December 31, 2014, the amount of restricted net assets of

wholly owned subsidiaries of Duke Energy that may not be distributed to Duke

Energy in the form of a loan or dividend is less than 25 percent of Duke Energy’s

net assets. Duke Energy does not have any legal or other restrictions on paying

common stock dividends to shareholders out of its consolidated equity accounts.

Although these restrictions cap the amount of funding the various operating

subsidiaries can provide to Duke Energy, management does not believe these

restrictions will have a signifi cant impact on Duke Energy’s ability to access

cash to meet its payment of dividends on common stock and other future funding

obligations.

CASH FLOWS FROM OPERATING ACTIVITIES

The relatively stable operating cash fl ows of Regulated Utilities compose

a substantial portion of Duke Energy’s cash fl ows from operations. Regulated

Utilities’ cash fl ows from operations are primarily driven by sales of electricity

and natural gas and costs of operations. Weather conditions, working capital and

commodity price fl uctuations, and unanticipated expenses, including unplanned

plant outages and storms can affect the timing and level of cash fl ows from

operations.

Duke Energy believes it has suffi cient liquidity resources through the

commercial paper markets, and ultimately, the Master Credit Facility, to support

these operations. Cash fl ows from operations are subject to a number of other

factors, including, but not limited to, regulatory constraints, economic trends and

market volatility (see Item 1A, “Risk Factors,” for additional information).

At December 31, 2014, Duke Energy had cash and cash equivalents and

short-term investments of $2.0 billion, of which approximately $1.7 billion is

held by entities domiciled in foreign jurisdictions. During 2014, Duke Energy

declared a taxable dividend of historical foreign earnings in the form of notes

payable that will result in the repatriation of approximately $2.7 billion of cash

held and expected to be generated by International Energy over a period of up

to eight years. As a result of the decision to repatriate all cumulative historic

undistributed foreign earnings, during the fourth quarter of 2014, Duke Energy

recorded U.S. income tax expense of approximately $373 million. Duke Energy’s

intention is to indefi nitely reinvest prospective undistributed earnings generated

by Duke Energy’s foreign subsidiaries. See Note 22 to the Consolidated Financial

Statements, “Income Taxes,” for additional information.

DEBT ISSUANCES

Depending on availability based on the issuing entity, the credit rating of

the issuing entity, and market conditions, the Subsidiary Registrants prefer to

issue fi rst mortgage bonds and secured debt, followed by unsecured debt. This

preference is the result of generally higher credit ratings for fi rst mortgage bonds

and secured debt, which typically result in lower interest costs. Duke Energy

Corporation primarily issues unsecured debt.

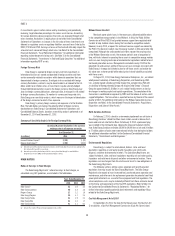

Duke Energy’s capitalization is balanced between debt and equity as

shown in the table below. The 2015 projected capitalization percentages exclude

purchase accounting adjustments of approximately $2.9 billion related to the

merger with Progress Energy, while the 2014 and 2013 percentages include all

debt-related purchase accounting amounts.

Projected

2015 Actual 2014 Actual 2013

Equity 50 % 49 % 50 %

Debt 50 % 51% 50 %

Duke Energy’s fi xed charges coverage ratio, calculated using SEC

guidelines, was 3.2 times for 2014, 3.0 times for 2013 and 2.4 times for 2012.

Restrictive Debt Covenants

Duke Energy’s debt and credit agreements contain various fi nancial and

other covenants. The Master Credit Facility contains a covenant requiring the

debt-to-total capitalization ratio to not exceed 65 percent for each borrower.

Failure to meet those covenants beyond applicable grace periods could result in

accelerated due dates and/or termination of the agreements or sublimits thereto.

As of December 31, 2014, Duke Energy was in compliance with all covenants

related to its signifi cant debt agreements. In addition, some credit agreements

may allow for acceleration of payments or termination of the agreements due

to nonpayment, or to the acceleration of other signifi cant indebtedness of the

borrower or some of its subsidiaries. None of the debt or credit agreements

contain material adverse change clauses.

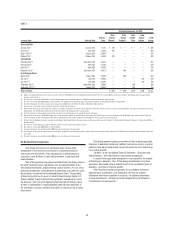

Credit Ratings

The Duke Energy Registrants each hold credit ratings by Fitch Ratings,

Inc. (Fitch), Moody’s Investors Service, Inc. (Moody’s) and Standard & Poor’s

Rating Services (S&P). The following table includes Duke Energy and certain

subsidiaries’ credit ratings and ratings outlook as of February 2015.

Fitch Moody’s S&P

Duke Energy Corporation Stable Stable Positive

Issuer Credit Rating BBB+ A3 BBB+

Senior Unsecured Debt BBB+ A3 BBB

Commercial Paper F-2 P-2 A-2

Duke Energy Carolinas Positive Stable Positive

Senior Secured Debt A+ Aa2 A

Senior Unsecured Debt A A1 BBB+

Progress Energy Stable Stable Positive

Senior Unsecured Debt BBB Baa1 BBB

Duke Energy Progress Stable Stable Positive

Senior Secured Debt A+ Aa2 A

Senior Unsecured Debt A A1 BBB+

Duke Energy Florida Stable Stable Positive

Senior Secured Debt A A1 A

Senior Unsecured Debt A- A3 BBB+

Duke Energy Ohio Stable Stable Positive

Senior Secured Debt A A2 A

Senior Unsecured Debt A- Baa1 BBB+

Duke Energy Indiana Stable Stable Positive

Senior Secured Debt A Aa3 A

Senior Unsecured Debt A- A2 BBB+