Duke Energy 2014 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

designed to meet the needs identifi ed in requests for proposals by Duke Energy

Carolinas, Duke Energy Progress and Piedmont Natural Gas. Dominion will build

and operate the ACP and will own 45 percent. Duke Energy will own 40 percent

of the pipeline through its Commercial Power segment. The remaining share will

be owned by Piedmont Natural Gas and AGL Resources. Duke Energy Carolinas

and Duke Energy Progress will be customers of the pipeline and enter into

20-year transportation capacity contracts with ACP, subject to state regulatory

approval. In October 2014, the NCUC and PSCSC approved the Duke Energy

Carolinas and Duke Energy Progress requests to enter into certain affi liate

agreements, pay compensation to ACP and to grant a waiver of certain Code

of Conduct provisions relating to contractual and jurisdictional matters. The

project will require FERC approval, which the joint venture will seek to secure by

summer 2016. The estimated in-service date of the pipeline is late 2018.

East Bend Station

On December 30, 2014, Duke Energy Ohio acquired The Dayton Power and

Light Company’s 31 percent interest in East Bend Station for approximately $12.4

million. The purchase price has been refl ected in the accompanying fi nancial

statements with the net purchase amount as an increase to property, plant

and equipment in accordance with FERC guidelines. Duke Energy Ohio expects

FERC approval to present the property, plant and equipment and accumulated

depreciation at The Dayton Power and Light Company’s historical cost.

NC WARN FERC Complaint

On December 16, 2014, NC WARN fi led a complaint with the FERC against

Duke Energy Carolinas and Duke Energy Progress that alleged Duke Energy

Carolinas and Duke Energy Progress manipulated the electricity market by

constructing costly and unneeded generation facilities leading to unjust and

unreasonable rates; Duke Energy Carolinas and Duke Energy Progress failed

to comply with Order 1000 by not effectively connecting their transmission

systems with neighboring utilities which also have excess capacity; the plans

of Duke Energy Carolinas and Duke Energy Progress for unrealistic future

growth leads to unnecessary and expensive generating plants; FERC should

investigate the practices of Duke Energy Carolinas and Duke Energy Progress

and the potential benefi ts of having them enter into a regional transmission

organization; and FERC should force Duke Energy Carolinas and Duke Energy

Progress to purchase power from other utilities rather than construct wasteful

and redundant power plants. A copy of the complaint was fi led with the PSCSC

on January 6, 2015. Duke Energy Carolinas and Duke Energy Progress have

fi led a responses requesting dismissal of the complaint with the FERC and the

PSCSC. Duke Energy Carolinas and Duke Energy Progress cannot predict the

outcome of these proceedings.

Merger Appeals

On January 9, 2013, the City of Orangeburg and NC WARN appealed the

NCUC’s approval of the merger between Duke Energy and Progress Energy.

On April 29, 2013, the NCUC granted Duke Energy’s motion to dismiss certain

exceptions contained in NC WARN’s appeal.

On March 4, 2014, the Court of Appeals issued an opinion affi rming the

NCUC’s approval of the merger. On April 8, 2014, NC WARN fi led a petition

for discretionary review by the North Carolina Supreme Court. On April 21,

2014, Duke Energy and the Public Staff jointly fi led their response opposing NC

WARN’s petition. The City of Orangeburg did not fi le a petition for discretionary

review. On December 19, 2014, the North Carolina Supreme Court denied NC

WARN’s petition, concluding the appeal.

Progress Energy Merger FERC Mitigation

In June 2012, the FERC approved the merger with Progress Energy,

including Duke Energy and Progress Energy’s revised market power mitigation

plan, the Joint Dispatch Agreement (JDA) and the joint Open Access

Transmission Tariff. Several intervenors fi led requests for rehearing challenging

various aspects of the FERC approval. On October 29, 2014, FERC denied all of

the requests for rehearing.

The revised market power mitigation plan provided for the acceleration

of one transmission project and the completion of seven other transmission

projects (Long-Term FERC Mitigation) and interim fi rm power sale agreements

during the completion of the transmission projects (Interim FERC Mitigation).

The Long-Term FERC Mitigation was expected to increase power imported into

the Duke Energy Carolinas and Duke Energy Progress service areas and enhance

competitive power supply options in the service areas. All of these projects were

completed in or before 2014. On May 30, 2014, the Independent Monitor fi led

with FERC a fi nal report stating that the Long-Term FERC Mitigation is complete.

Therefore, Duke Energy Carolinas’ and Duke Energy Progress’ obligations

associated with the Interim FERC Mitigation have terminated. In the second

quarter of 2014, Duke Energy Progress recorded an $18 million partial reversal

of an impairment recorded in the third quarter of 2012. This reversal adjusts the

initial disallowance from the Long-Term FERC mitigation and refl ects updated

information on the construction costs and in-service dates of the transmission

projects.

Following the closing of the merger, outside counsel reviewed Duke

Energy’s mitigation plan and discovered a technical error in the calculations.

On December 6, 2013, Duke Energy submitted a fi ling to the FERC disclosing

the error and arguing that no additional mitigation is necessary. The City of

New Bern fi led a protest and requested that FERC order additional mitigation.

On October 29, 2014, FERC ordered that the amount of the stub mitigation

be increased from 25 MW to 129 MW. The stub mitigation is Duke Energy’s

commitment to set aside for third parties a certain quantity of fi rm transmission

capacity from Duke Energy Carolinas to Duke Energy Progress during summer

off-peak hours. FERC also ordered that Duke Energy operate certain phase

shifters to create additional import capability and that such operation be

monitored by an independent monitor. Duke Energy does not expect the costs to

comply with this order to be material. FERC also referred Duke Energy’s failure

to expressly designate the phase shifter reactivation as a mitigation project in

Duke Energy’s original mitigation plan fi ling in March 2012 to the FERC Offi ce of

Enforcement for further inquiry. Duke Energy cannot predict the outcome of this

additional inquiry.

Planned and Potential Coal Plant Retirements

The Subsidiary Registrants periodically fi le Integrated Resource Plans

(IRP) with state regulatory commissions. The IRPs provide a view of forecasted

energy needs over a long term (10 to 20 years) and options being considered

to meet those needs. Recent IRPs fi led by the Subsidiary Registrants included

planning assumptions to potentially retire certain coal-fi red generating facilities

in Florida, Ohio and Indiana earlier than their current estimated useful lives.

These facilities do not have the requisite emission control equipment, primarily

to meet EPA regulations recently approved or proposed.

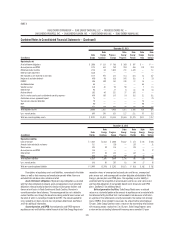

The table below contains the net carrying value of generating facilities

planned for early retirement or being evaluated for potential retirement

included in Net property, plant and equipment on the Consolidated Balance

Sheets, excluding the Duke Energy Carolinas 170 MW Lee Unit 3 which is being

converted to gas in 2015.