Duke Energy 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

PART II

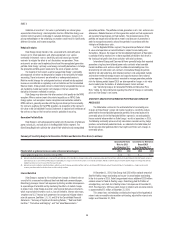

Year Ended December 31, 2014 as Compared to 2013

Operating Revenues. The variance was driven primarily by:

• A $138 million increase in fuel revenues (including emission

allowances) due to an increase in fuel rates as a result of higher fuel

and purchased power costs;

• An $86 million net increase in rate riders primarily due to updates to the

IGCC rider; and

• A $17 million increase in wholesale power revenues primarily due to

higher customer rates.

Operating Expenses. The variance was driven primarily by:

• A $128 million increase in fuel costs primarily driven by higher fuel and

purchased power costs;

• A $71 million increase in depreciation and amortization primarily as a

result of the Edwardsport IGCC plant being placed into service in the

second quarter of 2013;

• A $57 million increase in property and other taxes, primarily as a result

of amounts recorded related to an Indiana sales tax audit; and

• A $21 million increase in operation and maintenance primarily due

to higher operation and maintenance costs, higher outage costs at

generation plants, partially offset by decreased corporate costs.

Income Tax Expense. The effective tax rate for the years ended December

31, 2014 and 2013 was 35.5 percent and 38.4 percent, respectively. The

decrease in the effective tax rate was primarily due to a reduction in the Indiana

statutory corporate state income tax rate, a more favorable state tax credit, and

a prior period adjustment.

Matters Impacting Future Results

Duke Energy Indiana is evaluating converting Wabash River Unit 6 to a

natural gas-fi red unit or retiring the unit earlier than its current estimated useful

life. If Duke Energy Indiana elects early retirement of the unit, recovery of remaining

book values and associated carrying costs totaling approximately $40 million could

be subject to future regulatory approvals and therefore cannot be assured.

In 2015, the IURC is examining intervenors’ allegations that the

Edwardsport IGCC was not properly placed in commercial operation in June 2013

and intervenors’ allegations regarding plant performance. In addition, the Indiana

Court of Appeals remanded the IURC order in the ninth IGCC rider proceeding

back to the IURC for further fi ndings concerning approximately $61 million of

fi nancing charges Joint Intervenors claimed were caused by construction delay

and a ratemaking issue concerning the in-service date determination for tax

purposes. The outcome of these proceedings could have an adverse impact to

Duke Energy Indiana’s fi nancial position, results of operations and cash fl ows.

Duke Energy cannot predict on the outcome of these proceedings. See Note 4

to the Consolidated Financial Statements, “Regulatory Matters,” for additional

information.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Preparation of fi nancial statements requires the application of accounting

policies, judgments, assumptions and estimates that can signifi cantly affect

the reported results of operations and the amounts of assets and liabilities

reported in the fi nancial statements. Judgments made include the likelihood of

success of particular projects, possible legal and regulatory challenges, earnings

assumptions on pension and other benefi t fund investments and anticipated

recovery of costs.

Management discusses these policies, estimates and assumptions with

senior members of management on a regular basis and provides periodic

updates on management decisions to the Audit Committee of the Board of

Directors. Management believes the areas described below require signifi cant

judgment in the application of accounting policy or in making estimates and

assumptions that are inherently uncertain and that may change in subsequent

periods.

Regulatory Accounting

A substantial majority of Regulated Utilities, Duke Energy’s regulated

operations, meet the criteria for application of regulatory accounting treatment.

As a result, Duke Energy records assets and liabilities that would not be recorded

for nonregulated entities. Regulatory assets generally represent incurred costs

that have been deferred because such costs are probable of future recovery in

customer rates. Regulatory liabilities generally represent obligations to make

refunds or reduce rates to customers for previous collections or for costs that

have yet to be incurred.

Management continually assesses whether recorded regulatory assets

are probable of future recovery by considering factors such as applicable

regulatory environment changes, historical regulatory treatment for similar costs

in Duke Energy’s jurisdictions, litigation of rate orders, recent rate orders to

other regulated entities, and the status of any pending or potential deregulation

legislation. If future recovery of costs ceases to be probable, asset write-offs

would be recognized in operating income. Additionally, regulatory agencies can

provide fl exibility in the manner and timing of the depreciation of property, plant

and equipment, recognition of nuclear decommissioning costs and amortization

of regulatory assets or may disallow recovery of all or a portion of certain assets.

For further information on regulatory assets and liabilities, see Note 4 to the

Consolidated Financial Statements, “Regulatory Matters.”

As required by regulated operations accounting, signifi cant judgment can

be required to determine if an otherwise recognizable cost is considered to be an

entity specifi c cost recoverable in future rates and therefore a regulatory asset.

Signifi cant judgment can also be required to determine if revenues previously

recognized are for entity specifi c costs that are no longer expected to be incurred

and are therefore a regulatory liability.

Regulatory accounting rules also require recognition of a loss if it becomes

probable that part of the cost of a plant under construction (or a recently

completed plant or an abandoned plant) will be disallowed for ratemaking

purposes and a reasonable estimate of the amount of the disallowance can be

made. For example, if a cost cap is set for a plant still under construction, the

amount of the disallowance is a result of a judgment as to the ultimate cost of

the plant. Other disallowances can require judgments on allowed future rate

recovery. See Note 4 to the Consolidated Financial Statements, “Regulatory

Matters,” for a discussion of disallowances recorded related to the Edwardsport

IGCC plant and the retired Crystal River Unit 3 Nuclear Station.

When it becomes probable that regulated generation, transmission or

distribution assets will be abandoned, the cost of the asset is removed from

plant in service. The value that may be retained as an asset on the balance

sheet for the abandoned property is dependent upon amounts that may be

recovered through regulated rates, including any return. As such, an impairment

charge could be offset by the establishment of a regulatory asset if rate recovery

is probable. The impairment for a disallowance of costs for regulated plants

under construction, recently completed or abandoned is based on discounted

cash fl ows.

As discussed in Note 2 to the Consolidated Financial Statements,

“Acquisitions, Dispositions and Sales of Other Assets,” Duke Energy Carolinas

and Duke Energy Progress recorded disallowance charges in 2012 in order to

gain FERC approval of the merger between Duke Energy and Progress Energy. In

addition to the disallowances, Duke Energy Carolinas and Duke Energy Progress

guaranteed total fuel savings to customers in North Carolina and South Carolina

of $687 million over the fi ve years in order to gain NCUC and PSCSC approval

of the merger between Duke Energy and Progress Energy. Based on current

estimates of future fuel costs, Duke Energy anticipates that it will meet the