Duke Energy 2014 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

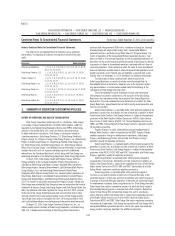

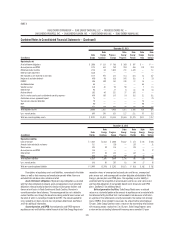

The Disposal Group is included in the Commercial Power segment. The following table presents information related to the Duke Energy Ohio generation plants

included in the Disposal Group.

Facility Plant Type Primary Fuel Location

Total MW

Capacity(c)

Owned MW

Capacity(c)

Ownership

Interest

Stuart(a)(b) Fossil Steam Coal OH 2,308 900 39%

Zimmer(a) Fossil Steam Coal OH 1,300 605 46.5%

Hanging Rock Combined Cycle Gas OH 1,226 1,226 100%

Miami Fort (Units 7 and 8)(a) Fossil Steam Coal OH 1,020 652 64%

Conesville(a)(b) Fossil Steam Coal OH 780 312 40%

Washington Combined Cycle Gas OH 617 617 100%

Fayette Combined Cycle Gas PA 614 614 100%

Killen(a)(b) Fossil Steam Coal OH 600 198 33%

Lee Combustion Turbine Gas IL 568 568 100%

Dick’s Creek Combustion Turbine Gas OH 136 136 100%

Miami Fort Combustion Turbine Oil OH 56 56 100%

Total Midwest Generation 9,225 5,884

(a) Jointly owned with American Electric Power Generation Resources and/or The Dayton Power & Light Company.

(b) Station is not operated by Duke Energy Ohio.

(c) Total MW capacity is based on summer capacity.

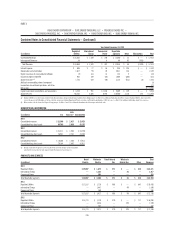

The Disposal Group also includes a retail sales business owned by Duke

Energy. In the second quarter of 2014, Duke Energy Ohio removed Ohio Valley

Electric Corporation’s (OVEC) purchase power agreement from the Disposal

Group as it no longer intended to sell it with the Disposal Group. Duke Energy

Ohio has requested cost-based recovery of its contractual entitlement in OVEC

in its 2014 Electric Security Plan (ESP) application fi led on May 29, 2014. See

Note 4 for information related to the 2014 ESP.

The assets and associated liabilities of the Disposal Group are classifi ed

as held for sale in Duke Energy’s and Duke Energy Ohio’s Consolidated Balance

Sheets at December 31, 2014.

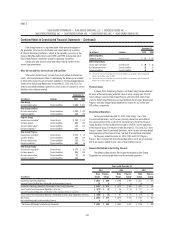

The results of operations of the Disposal Group are classifi ed as

discontinued operations for current and prior periods in the accompanying

Consolidated Statements of Operations and Comprehensive Income. Certain

immaterial costs that that may be eliminated as a result of the sale have

remained in continuing operations. The following table presents the results of

discontinued operations.

Duke Energy

Years Ended December 31,

(in millions) 2014 2013 2012

Operating Revenues $ 1,748 $ 1,885 $ 1,771

Estimated loss on disposition (929) ——

(Loss) Income before income taxes $ (818) $ 141 $ 227

Income tax (benefi t) expense (294) 56 82

(Loss) Income from discontinued operations of the

Disposal Group (524) 85 145

Other, net of tax(a) (52) 126

(Loss) Income from Discontinued Operations, net of tax $ (576) $ 86 $ 171

(a) Other discontinued operations relate to prior sales of businesses and includes indemnifi cations provided

for certain legal, tax and environmental matters, and foreign currency translation adjustments.

Duke Energy Ohio

Years Ended December 31,

(in millions) 2014 2013 2012

Operating Revenues $ 1,299 $ 1,503 $ 1,435

Estimated loss on disposition (959) ——

(Loss) Income before income taxes $ (863) $ 67 $ 195

Income tax (benefi t) expense (300) 32 65

(Loss) Income from Discontinued Operations, net of tax $ (563) $ 35 $ 130

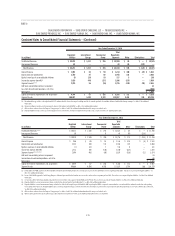

The Duke Energy and Duke Energy Ohio held for sale assets include

net pretax impairments of approximately $929 million and $959 million,

respectively, for the year ended December 31, 2014. The impairment was

recorded to write-down the carrying amount of the assets to the estimated fair

value of the business, based on the expected selling price to Dynegy less cost to

sell. These losses were included in (Loss) Income from Discontinued Operations,

net of tax in the Consolidated Statements of Operations and Comprehensive

Income. The impairment will be updated, if necessary, based on the fi nal

sales price, after any adjustments at closing for working capital and capital

expenditures.

Commercial Power has a revolving credit agreement (RCA) to support the

operations of the nonregulated Midwest generation business. Interest expense

associated with the RCA has been allocated to discontinued operations. No

other interest expense related to corporate level debt has been allocated to

discontinued operations.