Duke Energy 2014 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

151

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

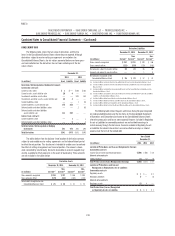

Commercial Power

Investments accounted for under the equity method primarily consist of

Duke Energy’s approximate 50 percent ownership interest in the fi ve Catamount

Sweetwater, LLC wind farm projects (Phase I-V), INDU Solar Holdings, LLC and

DS Cornerstone, LLC. All of these entities own solar or wind power projects

in the United States. Duke Energy also owns a 50 percent interest in Duke

American Transmission Co., LLC, which builds, owns and operates electric

transmission facilities in North America.

Other

On December 31, 2013, Duke Energy completed the sale of its 50 percent

ownership interest in DukeNet, which owned and operated telecommunications

businesses, to Time Warner Cable, Inc. After retiring existing DukeNet debt and

payment of transaction expenses, Duke Energy received $215 million in cash

proceeds and recorded a $105 million pretax gain in the fourth quarter of 2013.

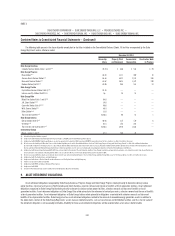

13. RELATED PARTY TRANSACTIONS

The Subsidiary Registrants engage in related party transactions, which are

generally performed at cost and in accordance with the applicable state and federal

commission regulations. Refer to the Consolidated Balance Sheets of the Subsidiary

Registrants for balances due to or due from related parties. Material amounts

related to transactions with related parties included in the Consolidated Statements

of Operations and Comprehensive Income are presented in the following table.

Years Ended December 31,

(in millions) 2014 2013 2012

Duke Energy Carolinas

Corporate governance and shared service expenses(a) $ 851 $ 927 $1,112

Indemnifi cation coverages(b) 21 22 21

JDA revenue(c) 133 121 18

JDA expense(c) 198 116 91

Progress Energy

Corporate governance and shared services provided

by Duke Energy(a) $ 732 $ 290 $ 63

Corporate governance and shared services provided

to Duke Energy(d) —96 47

Indemnifi cation coverages(b) 33 34 17

JDA revenue(c) 198 116 91

JDA expense(c) 133 121 18

Duke Energy Progress

Corporate governance and shared service expenses(a) $ 386 $ 266 $ 254

Indemnifi cation coverages(b) 17 20 8

JDA revenue(c) 198 116 91

JDA expense(c) 133 121 18

Duke Energy Florida

Corporate governance and shared service expenses(a) $ 346 $ 182 $ 186

Indemnifi cation coverages(b) 16 14 8

Duke Energy Ohio

Corporate governance and shared service expenses(a) $ 316 $ 347 $ 358

Indemnifi cation coverages(b) 13 15 15

Duke Energy Indiana

Corporate governance and shared service expenses(a) $ 384 $ 422 $ 419

Indemnifi cation coverages(b) 11 14 8

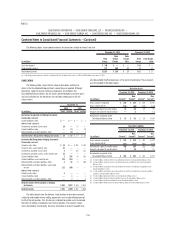

(a) The Subsidiary Registrants are charged their proportionate share of corporate governance and other

shared services costs, primarily related to human resources, employee benefi ts, legal and accounting

fees, as well as other third-party costs. These amounts are recorded in Operation, maintenance and other

on the Consolidated Statements of Operations and Comprehensive Income.

(b) The Subsidiary Registrants incur expenses related to certain indemnifi cation coverages through Bison,

Duke Energy’s wholly owned captive insurance subsidiary. These expenses are recorded in Operation,

maintenance and other on the Consolidated Statements of Operations and Comprehensive Income.

(c) Duke Energy Carolinas and Duke Energy Progress participate in a JDA which allows the collective dispatch

of power plants between the service territories to reduce customer rates. Revenues from the sale of

power under the JDA are recorded in Operating Revenues on the Consolidated Statements of Operations

and Comprehensive Income. Expenses from the purchase of power under the JDA are recorded in Fuel

used in electric generation and purchased power on the Consolidated Statements of Operations and

Comprehensive Income.

(d) In 2013 and 2012, Progress Energy Service Company (PESC), a consolidated subsidiary of Progress

Energy, charged a proportionate share of corporate governance and other costs to consolidated affi liates

of Duke Energy. Corporate governance and other shared costs were primarily related to human resources,

employee benefi ts, legal and accounting fees, as well as other third-party costs. These charges were

recorded as an offset to Operation, maintenance and other in the Consolidated Statements of Operations

and Comprehensive Income. Effective January 1, 2014, PESC was contributed to Duke Energy Corporate

Services (DECS), a consolidated subsidiary of Duke Energy, and these costs were no longer charged out of

Progress Energy. Progress Energy recorded a non-cash after-tax equity transfer related to the contribution

of PESC to DECS in its Consolidated Statements of Changes in Common Stockholder’s Equity.

In addition to the amounts presented above, the Subsidiary Registrants

record the impact on net income of other affi liate transactions, including rental

of offi ce space, participation in a money pool arrangement, other operational

transactions and their proportionate share of certain charged expenses. See

Note 6 for more information regarding money pool. The net impact of these

transactions was not material for the years ended December 31, 2014, 2013

and 2012 for the Subsidiary Registrants.

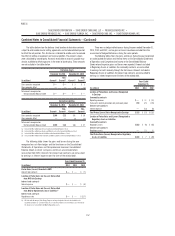

As discussed in Note 17, certain trade receivables have been sold by Duke

Energy Ohio and Duke Energy Indiana to CRC, an affi liate formed by a subsidiary of

Duke Energy. The proceeds obtained from the sales of receivables are largely cash

but do include a subordinated note from CRC for a portion of the purchase price.

In January 2012, Duke Energy Ohio recorded a non-cash equity transfer of

$28 million related to the sale of Vermillion to Duke Energy Indiana. Duke Energy

Indiana recorded a non-cash after-tax equity transfer of $26 million for the

purchase of Vermillion from Duke Energy Ohio. See Note 2 for further discussion.

Duke Energy Commercial Asset Management (DECAM) is a nonregulated,

indirect subsidiary of Duke Energy Ohio that owns generating plants included in

the Disposal Group discussed in Note 2. DECAM’s business activities include the

execution of commodity transactions, third-party vendor and supply contracts,

and service contracts for certain of Duke Energy’s nonregulated entities.

The commodity contracts DECAM enters are accounted for as undesignated

contracts or NPNS. Consequently, mark-to-market impacts of intercompany

contracts with, and sales of power to, nonregulated entities are included in

(Loss) Income from discontinued operations in Duke Energy Ohio’s Consolidated

Statements of Operations and Comprehensive Income. These amounts totaled

net expense of $24 million and $6 million and net revenue of $24 million, for the

years ended December 31, 2014, 2013 and 2012, respectively.

Because it is not a rated entity, DECAM receives credit support from Duke

Energy or its nonregulated subsidiaries, not from the regulated utility operations of

Duke Energy Ohio. DECAM meets its funding needs through an intercompany loan

agreement from a subsidiary of Duke Energy. DECAM also has the ability to loan

money to the subsidiary of Duke Energy. DECAM had an outstanding intercompany

loan payable of $459 million and $43 million for the years ended December 31,

2014 and 2013, respectively, These amounts are recorded in Notes payable to

affi liated companies on Duke Energy Ohio’s Consolidated Balance Sheets.

As discussed in Note 6, in April 2014, Duke Energy issued $1 billion

of senior unsecured notes. Proceeds from the issuances of approximately

$400 million were loaned to DECAM, and such funds were ultimately used to

redeem $402 million of tax-exempt bonds at Duke Energy Ohio. This transaction

substantially completed the restructuring of Duke Energy Ohio’s capital structure