Duke Energy 2014 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

143

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

guarantees expire between 2015 and 2033, with the remaining performance

guarantees having no contractual expiration.

Duke Energy has guaranteed certain issuers of surety bonds, obligating

itself to make payment upon the failure of a wholly owned and former non-

wholly owned entity to honor its obligations to a third party. Under these

arrangements, Duke Energy has payment obligations that are triggered by a

draw by the third party or customer due to the failure of the wholly owned

or former non-wholly owned entity to perform according to the terms of its

underlying contract. At December 31, 2014, Duke Energy had guaranteed

$44 million of outstanding surety bonds, most of which have no set expiration.

Duke Energy uses bank-issued stand-by letters of credit to secure the

performance of wholly owned and non-wholly owned entities to a third party or

customer. Under these arrangements, Duke Energy has payment obligations to

the issuing bank which are triggered by a draw by the third party or customer

due to the failure of the wholly owned or non-wholly owned entity to perform

according to the terms of its underlying contract. At December 31, 2014, Duke

Energy had issued a total of $452 million in letters of credit, which expire

between 2015 and 2020. The unused amount under these letters of credit was

$46 million.

Duke Energy and Progress Energy have issued indemnifi cations

for certain asset performance, legal, tax and environmental matters to

third parties, including indemnifi cations made in connection with sales of

businesses. At December 31, 2014, the estimated maximum exposure for these

indemnifi cations was $107 million, the majority of which expires in 2017. Of this

amount, $7 million has no contractual expiration. For certain matters for which

Progress Energy receives timely notice, indemnity obligations may extend beyond

the notice period. Certain indemnifi cations related to discontinued operations

have no limitations as to time or maximum potential future payments.

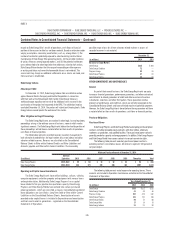

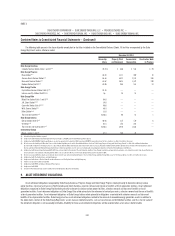

The following table includes the liabilities recognized for the guarantees

discussed above. These amounts are primarily recorded in Other within Deferred

Credits and other Liabilities on the Consolidated Balance Sheets. As current

estimates change, additional losses related to guarantees and indemnifi cations

to third parties, which could be material, may be recorded by the Duke Energy

Registrants in the future.

December 31,

2014 2013

Duke Energy $28 $24

Progress Energy 13 9

Duke Energy Florida 73

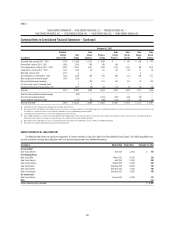

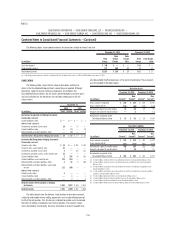

8. JOINT OWNERSHIP OF GENERATING

AND TRANSMISSION FACILITIES

The Duke Energy Registrants hold ownership interests in certain jointly

owned generating and transmission facilities. The Duke Energy Registrants

are entitled to shares of the generating capacity and output of each unit equal

to their respective ownership interests, except as outlined below. The Duke

Energy Registrants pay their ownership share of additional construction costs,

fuel inventory purchases and operating expenses, except in certain instances

where agreements have been executed to limit certain joint owners’ maximum

exposure to the additional costs. The Duke Energy Registrants share of revenues

and operating costs of the jointly owned generating facilities is included within

the corresponding line in the Consolidated Statements of Operations. Each

participant in the jointly owned facilities must provide its own fi nancing, except

in certain instances where agreements have been executed to limit certain joint

owners’ maximum exposure to the additional costs.