Duke Energy 2014 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

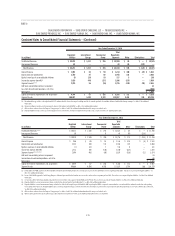

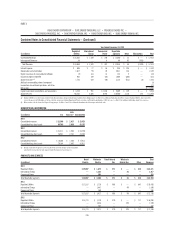

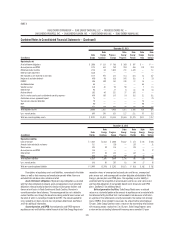

Combined Notes to Consolidated Financial Statements – (Continued)

Duke Energy Kentucky is required to pay dividends solely out of retained

earnings and to maintain a minimum of 35 percent equity in its capital

structure.

Duke Energy Indiana

Duke Energy Indiana must limit cumulative distributions subsequent

to the merger between Duke Energy and Cinergy to (i) the amount of retained

earnings on the day prior to the closing of the merger, plus (ii) any future

earnings recorded. In addition, Duke Energy Indiana will not declare and pay

dividends out of capital or unearned surplus without prior authorization of the

IURC.

The restrictions discussed above were less than 25 percent of Duke

Energy’s net assets at December 31, 2014.

RATE RELATED INFORMATION

The NCUC, PSCSC, FPSC, IURC, PUCO and KPSC approve rates for

retail electric and natural gas services within their states. The FERC approves

rates for electric sales to wholesale customers served under cost-based rates

(excluding Ohio and Indiana), as well as sales of transmission service.

Duke Energy Carolinas

2013 North Carolina Rate Case

On September 24, 2013, the NCUC approved a settlement agreement

related to Duke Energy Carolinas’ request for a rate increase with minor

modifi cations. The NCUC Public Staff (Public Staff) was a party to the

settlement. The settling parties agreed to a three-year step-in rate increase,

with the fi rst two years providing for $204 million, or a 4.5 percent average

increase in rates, and the third year providing for rates to be increased by an

additional $30 million, or 0.6 percent. The agreement is based upon a return

on equity of 10.2 percent and an equity component of the capital structure of

53 percent. The settlement agreement (i) allows for the recognition of nuclear

outage expenses over the refueling cycle rather than when the outage occurs,

(ii) a $10 million shareholder contribution to agencies that provide energy

assistance to low-income customers, and (iii) an annual reduction in the

regulatory liability for costs of removal of $30 million for each of the fi rst two

years. Duke Energy Carolinas has agreed not to request additional base rate

increases to be effective before September 2015. New rates went into effect on

September 25, 2013.

On October 23, 2013, the North Carolina Attorney General (NCAG)

appealed the rate of return and capital structure approved in the agreement.

The NC Waste Awareness and Reduction Network (NC WARN) appealed various

matters in the settlement on October 24, 2013. The North Carolina Supreme

Court (NCSC) denied a motion to consolidate these appeals with other North

Carolina rate case appeals involving Duke Energy Carolinas and Duke Energy

Progress on March 13, 2014. Briefi ng concluded in this matter and oral

argument occurred on September 8, 2014. On January 23, 2015, the NCSC

affi rmed the NCUC’s September 24, 2013 order.

2013 South Carolina Rate Case

On September 11, 2013, the PSCSC approved a settlement agreement

related to Duke Energy Carolinas’ request for a rate increase. Parties to the

settlement agreement were the Offi ce of Regulatory Staff, Wal-Mart Stores East,

LP and Sam’s East, Incorporated, the South Carolina Energy Users Committee,

Public Works of the City of Spartanburg, South Carolina and the South Carolina

Small Business Chamber of Commerce. The parties agreed to a two-year step-

in rate increase, with the fi rst year providing for approximately $80 million, or a

5.5 percent average increase in rates, and the second year providing for rates

to be increased by an additional $38 million, or 2.6 percent. The settlement

agreement is based upon a return on equity of 10.2 percent and a 53 percent

equity component of the capital structure. The settlement agreement (i) allows

for the recognition of nuclear outage expenses over the refueling cycle rather

than when the outage occurs, (ii) approximately $4 million of contributions

to agencies that provide energy assistance to low-income customers and for

economic development, and (iii) a reduction in the regulatory liability for costs of

removal of $45 million for the fi rst year. Duke Energy Carolinas has agreed not

to request additional base rate increases to be effective before September 2015.

New rates went into effect on September 18, 2013.

2011 North Carolina Rate Case

On January 27, 2012, the NCUC approved a settlement agreement related

to Duke Energy Carolinas’ request for a rate increase. On October 23, 2013,

the NCUC issued a second order in the case reaffi rming the rate of return

approved in the settlement agreement, in response to an appeal by the NCAG.

On November 21, 2013, the NCAG appealed the NCUC’s October 2013 order.

On December 19, 2014, the NCSC affi rmed the NCUC’s October 2013 order

concluding the appeal.

William States Lee Combined Cycle Facility

On April 9, 2014, the PSCSC granted Duke Energy Carolinas and NCEMC

a Certifi cate of Environmental Compatibility and Public Convenience and

Necessity (CECPCN) for the construction and operation of a 750 MW combined

cycle natural gas-fi red generating plant at its existing William States Lee

Generating Station in Anderson, South Carolina. On May 16, 2014, Duke Energy

Carolinas announced its intention to begin construction in summer 2015 and

estimated a cost to build of $600 million for its share of the facility, including

AFUDC. The project is expected to be commercially available in late 2017.

NCEMC will own approximately 13 percent of the project. On July 3, 2014,

the South Carolina Coastal Conservation League and Southern Alliance for

Clean Energy jointly fi led a Notice of Appeal with the Court of Appeals of South

Carolina seeking the court’s review of the PSCSC’s decision. Duke Energy

Carolinas’ initial brief in support of the PSCSC’s order granting the CECPCN was

fi led on January 12, 2015. Duke Energy Carolinas cannot predict the outcome of

this matter.

William States Lee III Nuclear Station

In December 2007, Duke Energy Carolinas applied to the NRC for a COL

for two Westinghouse AP1000 (advanced passive) reactors for the proposed

William States Lee III Nuclear Station (Lee Nuclear Station) at a site in Cherokee

County, South Carolina. Submitting the COL application did not commit Duke

Energy Carolinas to build nuclear units. Through several separate orders,

the NCUC and PSCSC concurred with the prudency of Duke Energy Carolinas

incurring certain project development and pre-construction costs, although

recovery of costs is not guaranteed. Duke Energy Carolinas has incurred

approximately $427 million, including AFUDC through December 31, 2014.

This amount is included in Net property, plant and equipment on Duke Energy

Carolinas’ Consolidated Balance Sheets.

Design changes have been identifi ed in the Westinghouse AP1000

certifi ed design that must be addressed before NRC can complete its review of