Duke Energy 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

PART II

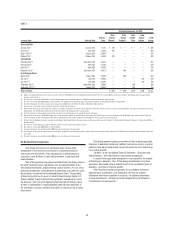

Year Ended December 31, 2013

Issuance Date Maturity Date

Interest

Rate

Duke

Energy

(Parent)

Duke

Energy

Progress

Duke

Energy

Ohio

Duke

Energy

Indiana

Duke

Energy

Unsecured Debt

January 2013(a) January 2073 5.125% $ 500 $ — $ — $ — $ 500

June 2013(b) June 2018 2.100% 500 — — — 500

August 2013(c)(d) August 2023 11.000% — — — — 220

October 2013(e) October 2023 3.950% 400 — — — 400

Secured Debt

February 2013(f)(g) December 2030 2.043% — — — — 203

February 2013(f) June 2037 4.740% — — — — 220

April 2013(h) April 2026 5.456% — — — — 230

December 2013(i) December 2016 0.852% — 300 — — 300

First Mortgage Bonds

March 2013(j) March 2043 4.100% — 500 — — 500

July 2013(k) July 2043 4.900% — — — 350 350

July 2013(k)(l) July 2016 0.619% — — — 150 150

September 2013(m) September 2023 3.800% — — 300 — 300

September 2013(m)(n) March 2015 0.400% — — 150 — 150

Total issuances $1,400 $ 800 $450 $500 $4,023

(a) Callable after January 2018 at par. Proceeds were used to redeem the $300 million 7.10 percent Cumulative Quarterly Income Preferred Securities (QUIPS) and to repay a portion of outstanding commercial paper and for

general corporate purposes.

(b) Proceeds were used to repay $250 million of current maturities and for general corporate purposes, including the repayment of outstanding commercial paper.

(c) Proceeds were used to repay $200 million of current maturities. The maturity date included above applies to half of the instrument. The remaining half matures in August 2018.

(d) The debt is fl oating rate based on a consumer price index and an overnight funds rate in Brazil. The debt is denominated in Brazilian Real.

(e) Proceeds were used to repay commercial paper as well as for general corporate purposes.

(f) Represents the conversion of construction loans related to a renewable energy project issued in December 2012 to term loans. No cash proceeds were received in conjunction with the conversion. The term loans have varying

maturity dates. The maturity date presented represents the latest date for all components of the respective loans.

(g) The debt is fl oating rate. Duke Energy has entered into a pay fi xed-receive fl oating interest rate swap for 95 percent of the loans.

(h) Represents the conversion of a $190 million bridge loan issued in conjunction with the acquisition of Ibener in December 2012. Duke Energy received incremental proceeds of $40 million upon conversion of the bridge loan.

The debt is fl oating rate and is denominated in U.S. dollars. Duke Energy has entered into a pay fi xed-receive fl oating interest rate swap for 75 percent of the loan.

(i) Relates to the securitization of accounts receivable at a subsidiary of Duke Energy Progress; the proceeds were used to repay short-term debt. See Note 17 to the Consolidated Financial Statements, “Variable Interest Entities”

for further details.

(j) Proceeds were used to repay notes payable to affi liated companies as well as for general corporate purposes.

(k) Proceeds were used to repay $400 million of current maturities.

(l) The debt is fl oating rate based on three month LIBOR and a fi xed credit spread of 35 basis points.

(m) Proceeds were used for general corporate purposes including the repayment of short-term notes payable, a portion of which was incurred to fund the retirement of $250 million of fi rst mortgage bonds that matured in the fi rst

half of 2013.

(n) The debt is fl oating rate based on three month LIBOR plus a fi xed credit spread of 14 basis points.

Off-Balance Sheet Arrangements

Duke Energy and certain of its subsidiaries enter into guarantee

arrangements in the normal course of business to facilitate commercial

transactions with third parties. These arrangements include performance

guarantees, stand-by letters of credit, debt guarantees, surety bonds and

indemnifi cations.

Most of the guarantee arrangements entered into by Duke Energy enhance

the credit standing of certain subsidiaries, non-consolidated entities or less

than wholly owned entities, enabling them to conduct business. As such, these

guarantee arrangements involve elements of performance and credit risk, which

are not always included on the Consolidated Balance Sheets. The possibility

of Duke Energy, either on its own or on behalf of Spectra Energy Capital, LLC

(Spectra Capital) through indemnifi cation agreements entered into as part of

the January 2, 2007 spin-off of Spectra Energy Corp (Spectra Energy), having

to honor its contingencies is largely dependent upon the future operations of

the subsidiaries, investees and other third parties, or the occurrence of certain

future events.

Duke Energy performs ongoing assessments of their respective guarantee

obligations to determine whether any liabilities have been incurred as a result of

potential increased non-performance risk by third parties for which Duke Energy

has issued guarantees.

See Note 7 to the Consolidated Financial Statements, “Guarantees and

Indemnifi cations,” for further details of the guarantee arrangements.

Issuance of these guarantee arrangements is not required for the majority

of Duke Energy’s operations. Thus, if Duke Energy discontinued issuing these

guarantees, there would not be a material impact to the consolidated results of

operations, cash fl ows or fi nancial position.

Other than the guarantee arrangements discussed above and normal

operating lease arrangements, Duke Energy does not have any material

off-balance sheet fi nancing entities or structures. For additional information

on these commitments, see Note 5 to the Consolidated Financial Statements,

“Commitments and Contingencies.”