Duke Energy 2014 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

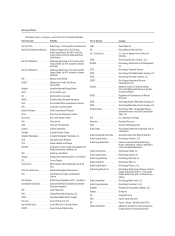

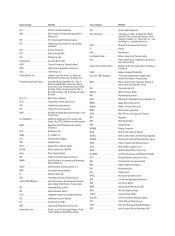

TABLE OF CONTENTS

FORM 10-K FOR THE YEAR ENDED

DECEMBER 31, 2014

Item Page

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

GLOSSARY OF TERMS

PART I.

1. BUSINESS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

DUKE ENERGY. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

GENERAL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

BUSINESS SEGMENTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

GEOGRAPHIC REGIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

EMPLOYEES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

EXECUTIVE OFFICERS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

ENVIRONMENTAL MATTERS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

DUKE ENERGY CAROLINAS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

PROGRESS ENERGY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

DUKE ENERGY PROGRESS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

DUKE ENERGY FLORIDA. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

DUKE ENERGY OHIO . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

DUKE ENERGY INDIANA. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

1A. RISK FACTORS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

1B. UNRESOLVED STAFF COMMENTS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

2. PROPERTIES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

3. LEGAL PROCEEDINGS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

4. MINE SAFETY DISCLOSURES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

PART II.

5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES . . . . . . . . . . . . . . . . . 26

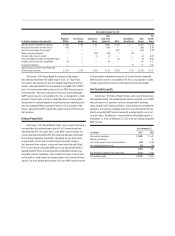

6. SELECTED FINANCIAL DATA. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK . . . . . . . . . 61

8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA . . . . . . . . . . . . . . . . . . . . . 62

9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON

ACCOUNTING AND FINANCIAL DISCLOSURE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 214

9A. CONTROLS AND PROCEDURES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 214

PART III.

10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE . . . . . . . . . . . 214

11. EXECUTIVE COMPENSATION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 214

12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. . . . . . . . . . . . . . . . . 214

13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 214

14. PRINCIPAL ACCOUNTING FEES AND SERVICES . . . . . . . . . . . . . . . . . . . . . . . . . . . 215

PART IV .

15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES. . . . . . . . . . . . . . . . . . . . . . . . 216

SIGNATURES. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 228

EXHIBIT INDEX . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . E-1

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This document includes forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-

looking statements are based on management’s beliefs and assumptions. These forward-looking

statements are identifi ed by terms and phrases such as “anticipate,” “believe,” “intend,”

“estimate,” “expect,” “continue,” “should,” “could,” “may,” “plan,” “project,” “predict,” “will,”

“potential,” “forecast,” “target,” “guidance,” “outlook,” and similar expressions. Forward-

looking statements involve risks and uncertainties that may cause actual results to be materially

different from the results predicted. Factors that could cause actual results to differ materially

from those indicated in any forward-looking statement include, but are not limited to:

• State, federal and foreign legislative and regulatory initiatives, including costs of

compliance with existing and future environmental requirements or climate change,

as well as rulings that affect cost and investment recovery or have an impact on rate

structures or market prices;

• The extent and timing of the costs and liabilities relating to the Dan River ash basin

release and compliance with current and any future regulatory changes related to the

management of coal ash;

• The ability to recover eligible costs, including those associated with future signifi cant

weather events, and earn an adequate return on investment through the regulatory

process;

• The costs of decommissioning nuclear facilities could prove to be more extensive than

are currently identifi ed and all costs may not be fully recoverable through the regulatory

process;

• The risk that the credit ratings of the company or its subsidiaries may be different from

what the companies expect;

• Costs and effects of legal and administrative proceedings, settlements, investigations

and claims;

• Industrial, commercial and residential growth or decline in service territories or customer

bases resulting from customer usage patterns, including energy effi ciency efforts and

use of alternative energy sources, including self-generation and distributed generation

technologies;

• Additional competition in electric markets and continued industry consolidation;

• Political and regulatory uncertainty in other countries in which Duke Energy conducts

business;

• The infl uence of weather and other natural phenomena on operations, including the

economic, operational and other effects of severe storms, hurricanes, droughts and

tornadoes;

• The ability to successfully operate electric generating facilities and deliver electricity to

customers;

• The impact on facilities and business from a terrorist attack, cybersecurity threats, data

security breaches, and other catastrophic events;

• The inherent risks associated with the operation and potential construction of nuclear

facilities, including environmental, health, safety, regulatory and fi nancial risks;

• The timing and extent of changes in commodity prices, interest rates and foreign

currency exchange rates and the ability to recover such costs through the regulatory

process, where appropriate, and their impact on liquidity positions and the value of

underlying assets;

• The results of fi nancing efforts, including the ability to obtain fi nancing on favorable

terms, which can be affected by various factors, including credit ratings and general

economic conditions;

• Declines in the market prices of equity and fi xed income securities and resultant cash

funding requirements for defi ned benefi t pension plans, other post-retirement benefi t

plans, and nuclear decommissioning trust funds;

• Construction and development risks associated with the completion of Duke

Energy Registrants’ capital investment projects in existing and new generation

facilities, including risks related to fi nancing, obtaining and complying with terms of

permits, meeting construction budgets and schedules, and satisfying operating and

environmental performance standards, as well as the ability to recover costs from

customers in a timely manner or at all;

• Changes in rules for regional transmission organizations, including changes in rate

designs and new and evolving capacity markets, and risks related to obligations created

by the default of other participants;

• The ability to control operation and maintenance costs;

• The level of creditworthiness of counterparties to transactions;

• Employee workforce factors, including the potential inability to attract and retain key

personnel;

• The ability of subsidiaries to pay dividends or distributions to Duke Energy Corporation

holding company (the Parent);

• The performance of projects undertaken by our nonregulated businesses and the

success of efforts to invest in and develop new opportunities;

• The effect of accounting pronouncements issued periodically by accounting standard-

setting bodies;

• The impact of potential goodwill impairments;

• The ability to reinvest prospective undistributed earnings of foreign subsidiaries or

repatriate such earnings on a tax-effi cient basis; and

• The ability to successfully complete future merger, acquisition or divestiture plans.

In light of these risks, uncertainties and assumptions, the events described in the

forward-looking statements might not occur or might occur to a different extent or at a different

time than described. Forward-looking statements speak only as of the date they are made; the

Duke Energy Registrants undertake no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise that occur after

that date.