Duke Energy 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

PART II

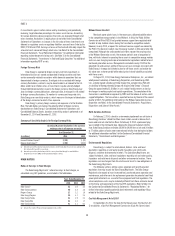

December 31, 2014

(in millions)

Duke

Energy

Duke

Energy

(Parent)

Duke

Energy

Carolinas

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

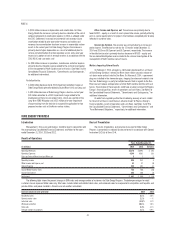

Facility Size(a) $ 6,000 $ 2,250 $1,000 $ 750 $ 650 $650 $ 700

Reduction to backstop issuances

Commercial paper(b) (2,021) (1,479) (300) — (29) (38) (175)

Outstanding letters of credit (70) (62) (4) (2) (1) — (1)

Tax-exempt bonds (116) — (35) — — — (81)

Available capacity $ 3,793 $ 709 $ 661 $748 $620 $612 $ 443

(a) Represents the sublimit of each borrower at December 31, 2014. The Duke Energy Ohio sublimit includes $100 million for Duke Energy Kentucky.

(b) Duke Energy issued $475 million of commercial paper and loaned the proceeds through the money pool to Duke Energy Carolinas, Duke Energy Ohio and Duke Energy Indiana. The balances are included within Long-Term Debt

Payable to Affi liated Companies in the Consolidated Balance Sheets.

On February 20, 2015, Duke Energy Carolinas, Duke Energy Progress and

Duke Energy Business Services LLC (DEBS), a wholly owned subsidiary of Duke

Energy, each entered into a Memorandum of Plea Agreement (Plea Agreements)

in connection with the investigation initiated by the United States Department

of Justice Environmental Crimes Section and the United States Attorneys for the

Eastern District of North Carolina, the Middle District of North Carolina and the

Western District of North Carolina (collectively, the USDOJ). Under the terms

of the Plea Agreements, Duke Energy Carolinas and Duke Energy Progress are

required to each maintain $250 million of available capacity under the Master

Credit Facility as security to meet their obligations under the Plea Agreements,

in addition to certain other conditions set out in the Plea Agreements. The

Plea Agreements are subject to court approval. See Note 5 to the Consolidated

Financial Statements, “Commitments and Contingencies,” for additional

information.

PremierNotes

Duke Energy has an effective registration statement (Form S-3) with the

Securities and Exchange Commission (SEC) to sell up to $3 billion of variable

denomination fl oating rate demand notes, called PremierNotes. The Form S-3

states that no more than $1.5 billion of the notes will be outstanding at any

particular time. The notes are offered on a continuous basis and bear interest

at a fl oating rate per annum determined by the Duke Energy PremierNotes

Committee, or its designee, on a weekly basis. The interest rate payable on notes

held by an investor may vary based on the principal amount of the investment.

The notes have no stated maturity date, are non-transferable and may be

redeemed in whole or in part by Duke Energy or at the investor’s option at any

time. The balance as of December 31, 2014 and December 31, 2013, was $968

million and $836 million, respectively. The notes are short-term debt obligations

and are refl ected as Notes payable and commercial paper on Duke Energy’s

Consolidated Balance Sheets.

Shelf Registration

In September 2013, Duke Energy fi led a Form S-3 with the SEC. Under this

Form S-3, which is uncapped, the Duke Energy Registrants, excluding Progress

Energy may issue debt and other securities in the future at amounts, prices

and with terms to be determined at the time of future offerings. The registration

statement also allows for the issuance of common stock by Duke Energy.

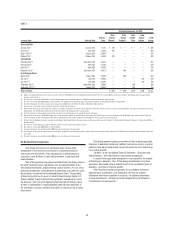

CAPITAL EXPENDITURES

Duke Energy continues to focus on reducing risk and positioning its

business for future success and will invest principally in its strongest business

sectors. Based on this goal, the majority of Duke Energy’s total projected capital

expenditures are allocated to the Regulated Utilities segment. Duke Energy’s

projected capital and investment expenditures for the next three fi scal years are

included in the table below.

(in millions) 2015 2016 2017

New generation $ 825 $ 2,200 $ 850

Environmental 275 300 450

Nuclear fuel 450 475 425

Major nuclear 300 175 150

Customer additions 500 525 550

Grid modernization and other transmission

and distribution projects 1,050 1,375 1,525

Maintenance 2,550 2,775 2,300

Total Regulated Utilities 5,950 7,825 6,250

Commercial Power, International Energy and Other 1,075 775 800

Total committed expenditures 7,025 8,600 7,050

Discretionary expenditures 400 775 775

Total projected capital and investment expenditures $ 7,425 $ 9,375 $ 7,825

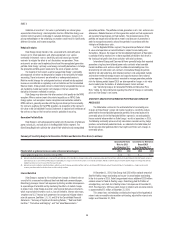

DEBT MATURITIES

The following table shows the signifi cant components of Current maturities

of long-term debt on the Consolidated Balance Sheets. The Duke Energy

Registrants currently anticipate satisfying these obligations with cash on hand

and proceeds from additional borrowings.

(in millions) Maturity Date Interest Rate

December 31,

2014

Unsecured Debt

Duke Energy (Parent) April 2015 3.350% $ 450

First Mortgage Bonds

Duke Energy Ohio March 2015 0.375% 150

Duke Energy Progress April 2015 5.150% 300

Duke Energy Carolinas October 2015 5.300% 500

Duke Energy Florida November 2015 0.650% 250

Duke Energy Florida December 2015 5.100% 300

Duke Energy Progress December 2015 5.250% 400

Tax-exempt Bonds

Duke Energy Progress January 2015 0.108% 243

Other 214

Current maturities of

long-term debt $ 2,807