Duke Energy 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

PART II

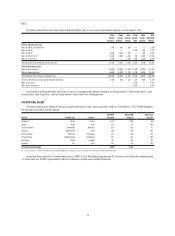

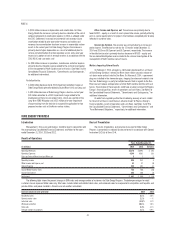

Regulated Utilities

Years Ended December 31,

(in millions) 2014 2013

Variance

2014 vs.

2013 2012

Variance

2013 vs.

2012

Operating Revenues $ 22,271 $ 20,910 $ 1,361 $ 16,080 $ 4,830

Operating Expenses 17,026 16,126 900 12,943 3,183

Gains on Sales of Other Assets and Other, net 47(3) 15 (8)

Operating Income 5,249 4,791 458 3,152 1,639

Other Income and Expense, net 267 221 46 341 (120)

Interest Expense 1,093 986 107 806 180

Income Before Income Taxes 4,423 4,026 397 2,687 1,339

Income Tax Expense 1,628 1,522 106 941 581

Less: Income Attributable to Noncontrolling Interest ——— 2 (2)

Segment Income $ 2,795 $ 2,504 $ 291 $ 1,744 $ 760

Duke Energy Carolinas’ GWh sales 87,645 85,790 1,855 81,362 4,428

Duke Energy Progress’ GWh sales(a) 62,871 60,204 2,667 58,390 1,814

Duke Energy Florida GWh sales(b) 38,703 37,974 729 38,443 (469)

Duke Energy Ohio GWh sales 24,735 24,557 178 24,344 213

Duke Energy Indiana GWh sales 33,433 33,715 (282) 33,577 138

Total Regulated Utilities GWh sales 247,387 242,240 5,147 236,116 6,124

Net proportional MW capacity in operation 49,600 49,607 (7) 49,654 (47)

(a) For Duke Energy Progress, 26,634 gigawatt-hours (GWh) sales for the year ended December 31, 2012, occurred prior to the merger between Duke Energy and Progress Energy.

(b) For Duke Energy Florida, 18,348 GWh sales for the year ended December 31, 2012, occurred prior to the merger between Duke Energy and Progress Energy.

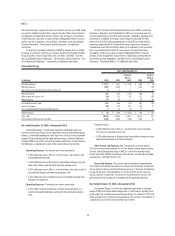

Year Ended December 31, 2014 as Compared to 2013

Regulated Utilities’ results were positively impacted by higher retail pricing

and rate riders, favorable weather, an increase in wholesale power margins,

higher weather-normal sales volumes, and 2013 impairments and other charges.

These impacts were partially offset by higher depreciation and amortization

expense, higher operation and maintenance costs, higher interest expense, and

higher income tax expense. The following is a detailed discussion of the variance

drivers by line item.

Operating Revenues. The variance was driven primarily by:

• A $614 million increase in fuel revenues driven primarily by increased

demand from electric retail customers resulting from favorable weather

conditions, and higher fuel rates for electric retail customers for all

jurisdictions, except North Carolina. Fuel revenues represent sales to

retail and wholesale customers;

• A $556 million net increase in retail pricing primarily due to retail rate

changes and updated rate riders;

• A $216 million increase in electric sales (net of fuel revenue) to retail

customers due to more favorable weather conditions. (i) For the year

ended December 31, 2014 in the Carolinas, cooling degree days were

4 percent below normal as compared with 15 percent below normal

during the same period in 2013, and heating degree days were 11

percent above normal as compared with 4 percent above normal during

the same period in 2013. (ii) For the year ended December 31, 2014

in the Midwest, cooling degree days were 21 percent below normal as

compared with 8 percent below normal during the same period in 2013,

and heating degree days were 18 percent above normal as compared

with 7 percent above normal during the same period in 2013. (iii) For

the year ended December 31, 2014 in Florida, cooling degree days were

3 percent below normal as compared with 2 percent above normal

during the same period in 2013, and heating degree days were 4 percent

above normal as compared with 35 percent below normal during the

same period in 2013;

• A $63 million increase in wholesale power revenues, net of sharing,

primarily due to additional volumes and capacity charges for customers

served under long-term contracts; and

• A $21 million increase in weather-normal sales volumes to retail

customers (net of fuel revenue) refl ecting increased demand.

Partially offset by:

• A $139 million decrease in gross receipts tax revenue due to the North

Carolina Tax Simplifi cation and Rate Reduction Act which terminated the

collection of the North Carolina gross receipts tax effective July 1, 2014.

Operating Expenses. The variance was driven primarily by:

• A $611 million increase in fuel expense (including purchased power and

natural gas purchases for resale) primarily related to (i) higher volumes

of coal, and oil used in electric generation due primarily to increased

generation resulting from favorable weather conditions, (ii) higher natural

gas prices, and (iii) the application of the Nuclear Electric Insurance

Limited (NEIL) settlement proceeds in 2013 for Duke Energy Florida;

• A $436 million increase in depreciation and amortization expense primarily

due to increases in depreciation as a result of additional plant in service

and amortization of regulatory assets, and higher 2013 reductions to cost

of removal reserves in accordance with regulatory orders; and

• A $292 million increase in operating and maintenance expense primarily

due to a litigation reserve related to the criminal investigation of the

Dan River coal ash spill (See Note 5 to the Consolidated Financial

Statements, “Commitments and Contingencies,” for additional

information), higher storm costs, repairs and remediation expenses

associated with the Dan River coal ash discharge and other ash basin

related assessment costs, and higher nuclear costs, including nuclear

outage levelization costs, and higher environmental and operational

costs that are recoverable in rates; partially offset by a 2013 Crystal

River Unit 3 Nuclear Station (Crystal River Unit 3) related settlement

matter, decreased benefi ts costs and 2013 donations for low-income