Duke Energy 2014 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

141

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

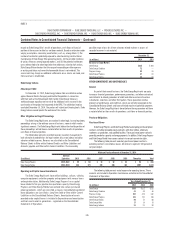

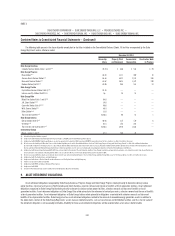

Year Ended December 31, 2013

Issuance Date Maturity Date

Interest

Rate

Duke

Energy

(Parent)

Duke

Energy

Progress

Duke

Energy

Ohio

Duke

Energy

Indiana

Duke

Energy

Unsecured Debt

January 2013(a) January 2073 5.125% $ 500 $ — $ — $ — $ 500

June 2013(b) June 2018 2.100% 500 — — — 500

August 2013(c)(d) August 2023 11.000% — — — — 220

October 2013(e) October 2023 3.950% 400 — — — 400

Secured Debt

February 2013(f)(g) December 2030 2.043% — — — — 203

February 2013(f) June 2037 4.740% — — — — 220

April 2013(h) April 2026 5.456% — — — — 230

December 2013(i) December 2016 0.852% — 300 — — 300

First Mortgage Bonds

March 2013(j) March 2043 4.100% — 500 — — 500

July 2013(k) July 2043 4.900% — — — 350 350

July 2013(k)(l) July 2016 0.619% — — — 150 150

September 2013(m) September 2023 3.800% — — 300 — 300

September 2013(m)(n) March 2015 0.400% — — 150 — 150

Total issuances $ 1,400 $ 800 $ 450 $ 500 $ 4,023

(a) Callable after January 2018 at par. Proceeds were used to redeem the $300 million 7.10% Cumulative Quarterly Income Preferred Securities (QUIPS) and to repay a portion of outstanding commercial paper and for general

corporate purposes.

(b) Proceeds were used to repay $250 million of current maturities and for general corporate purposes, including the repayment of outstanding commercial paper.

(c) Proceeds were used to repay $200 million of current maturities. The maturity date included above applies to half of the instrument. The remaining half matures in August 2018.

(d) The debt is fl oating rate based on a consumer price index and an overnight funds rate in Brazil. The debt is denominated in Brazilian Real.

(e) Proceeds were used to repay commercial paper as well as for general corporate purposes.

(f) Represents the conversion of construction loans related to two renewable energy projects issued in December 2012 to term loans. No cash proceeds were received in conjunction with the conversion. The term loans have

varying maturity dates. The maturity date presented represents the latest date for all components of the respective loans.

(g) The debt is fl oating rate. Duke Energy has entered into a pay fi xed-receive fl oating interest rate swap for 95 percent of the loans.

(h) Represents the conversion of a $190 million bridge loan issued in conjunction with the acquisition of Ibener in December 2012. Duke Energy received incremental proceeds of $40 million upon conversion of the bridge loan.

The debt is fl oating rate and is denominated in U.S. dollars. Duke Energy has entered into a pay fi xed-receive fl oating interest rate swap for 75 percent of the loan.

(i) Relates to the securitization of accounts receivable at a subsidiary of Duke Energy Progress; the proceeds were used to repay short-term debt. See Note 17 for further details.

(j) Proceeds were used to repay notes payable to affi liated companies as well as for general corporate purposes.

(k) Proceeds were used to repay $400 million of current maturities.

(l) The debt is fl oating rate based on three-month LIBOR and a fi xed credit spread of 35 basis points.

(m) Proceeds were used for general corporate purposes including the repayment of short-term notes payable, a portion of which was incurred to fund the retirement of $250 million of fi rst mortgage bonds that matured in the fi rst half of 2013.

(n) The debt is fl oating rate based on three-month LIBOR plus a fi xed credit spread of 14 basis points.

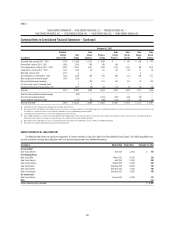

AVAILABLE CREDIT FACILITIES

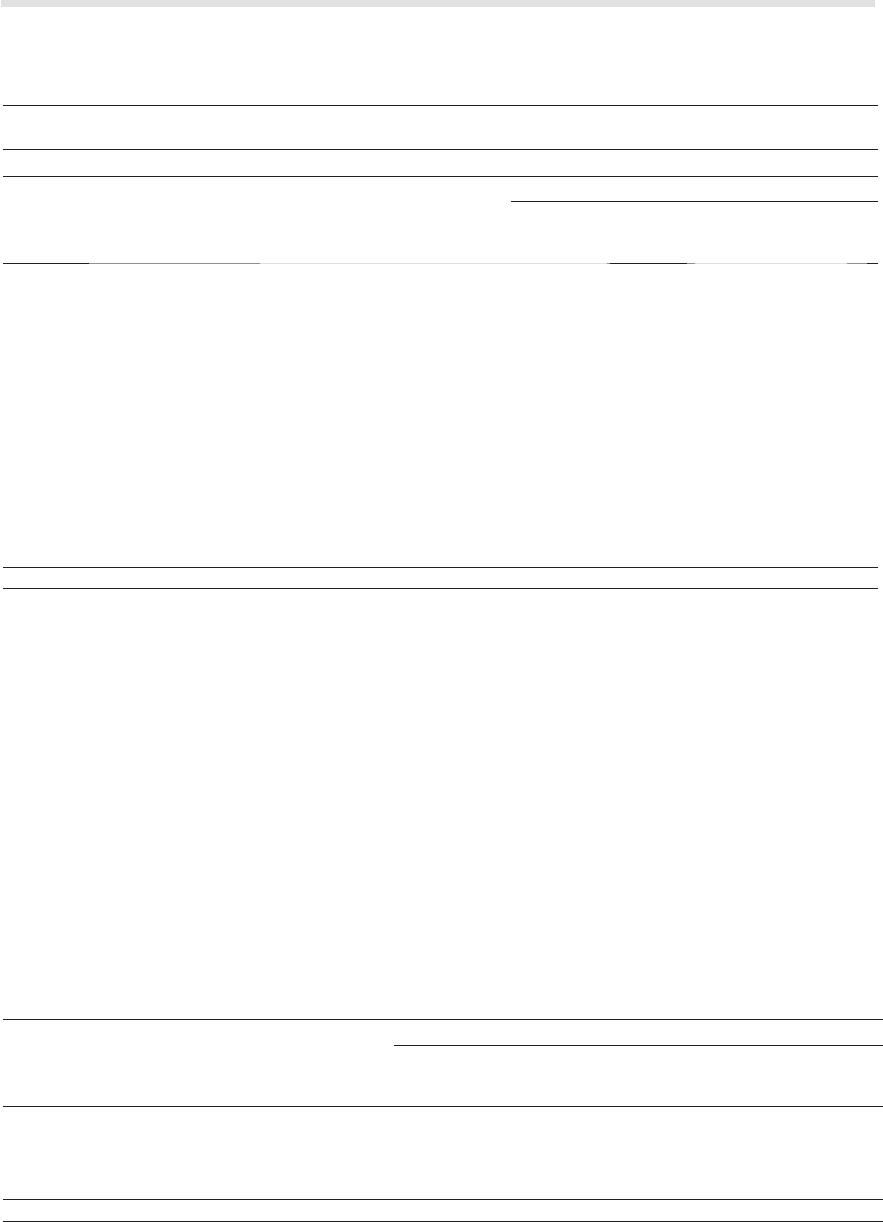

At December 31, 2014, Duke Energy had a Master Credit Facility with a

capacity of $6 billion through December 2018. In January 2015, Duke Energy

amended the Master Credit Facility to increase its capacity to $7.5 billion through

January 2020. The Duke Energy Registrants, excluding Progress Energy, each have

borrowing capacity under the Master Credit Facility up to specifi ed sublimits for

each borrower. Duke Energy has the unilateral ability at any time to increase or

decrease the borrowing sublimits of each borrower, subject to a maximum sublimit

for each borrower. The amount available under the Master Credit Facility has

been reduced to backstop the issuances of commercial paper, certain letters of

credit and variable-rate demand tax-exempt bonds that may be put to the Duke

Energy Registrants at the option of the holder. The table below includes the current

borrowing sublimits and available capacity under the Master Credit Facility.

December 31, 2014

(in millions)

Duke

Energy

Duke

Energy

(Parent)

Duke

Energy

Carolinas

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Facility size(a) $ 6,000 $ 2,250 $ 1,000 $ 750 $ 650 $ 650 $ 700

Reduction to backstop issuances

Commercial paper(b) (2,021) (1,479) (300) — (29) (38) (175)

Outstanding letters of credit (70) (62) (4) (2) (1) — (1)

Tax-exempt bonds (116) — (35) — — — (81)

Available capacity $ 3,793 $ 709 $ 661 $ 748 $ 620 $ 612 $ 443

(a) Represents the sublimit of each borrower.

(b) Duke Energy issued $475 million of commercial paper and loaned the proceeds through the money pool to Duke Energy Carolinas, Duke Energy Ohio and Duke Energy Indiana. The balances are classifi ed as Long-Term Debt

Payable to Affi liated Companies in the Consolidated Balance Sheets.