Duke Energy 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

PART II

Credit Risk

Credit risk represents the loss that the Duke Energy Registrants would incur

if a counterparty fails to perform under its contractual obligations. To reduce credit

exposure, the Duke Energy Registrants seek to enter into netting agreements with

counterparties that permit them to offset receivables and payables with such

counterparties. The Duke Energy Registrants attempt to further reduce credit risk

with certain counterparties by entering into agreements that enable obtaining

collateral or terminating or resetting the terms of transactions after specifi ed

time periods or upon the occurrence of credit-related events. The Duke Energy

Registrants may, at times, use credit derivatives or other structures and techniques

to provide for third-party credit enhancement of their counterparties’ obligations.

The Duke Energy Registrants also obtain cash or letters of credit from customers to

provide credit support outside of collateral agreements, where appropriate, based

on a fi nancial analysis of the customer and the regulatory or contractual terms

and conditions applicable to each transaction. See Note 14 to the Consolidated

Financial Statements, “Derivatives and Hedging,” for additional information

regarding credit risk related to derivative instruments.

The Duke Energy Registrants’ industry has historically operated under

negotiated credit lines for physical delivery contracts. The Duke Energy

Registrants frequently use master collateral agreements to mitigate certain credit

exposures. The collateral agreements provide for a counterparty to post cash

or letters of credit to the exposed party for exposure in excess of an established

threshold. The threshold amount represents a negotiated unsecured credit

limit for each party to the agreement, determined in accordance with the Duke

Energy Registrants’ internal corporate credit practices and standards. Collateral

agreements generally also provide that the inability to post collateral is suffi cient

cause to terminate contracts and liquidate all positions.

The Duke Energy Registrants’ principal customers for its electric and gas

businesses are commodity clearinghouses, regional transmission organizations,

industrial, commercial and residential end-users, marketers, distribution

companies, municipalities, electric cooperatives and utilities located throughout

the U.S. and Latin America. The Duke Energy Registrants have concentrations of

receivables from such entities throughout these regions. These concentrations

of customers may affect the Duke Energy Registrants’ overall credit risk in that

risk factors can negatively impact the credit quality of the entire sector. Where

exposed to credit risk, the Duke Energy Registrants analyze the counterparties’

fi nancial condition prior to entering into an agreement, establish credit limits and

monitor the appropriateness of those limits on an ongoing basis.

Duke Energy Carolinas has a third-party insurance policy to cover certain

losses related to its asbestos-related injuries and damages above an aggregate

self-insured retention of $476 million. Duke Energy Carolinas’ cumulative payments

began to exceed the self-insurance retention on its insurance policy during the

second quarter of 2008. Future payments up to the policy limit will be reimbursed

by the third-party insurance carrier. The insurance policy limit for potential future

insurance recoveries for indemnifi cation and medical cost claim payments is $864

million in excess of the self-insured retention. Insurance recoveries of $616 million

and $649 million related to this policy are classifi ed in the Consolidated Balance

Sheets in Other within Investments and Other Assets and Receivables as of

December 31, 2014 and 2013, respectively. Duke Energy Carolinas is not aware of

any uncertainties regarding the legal suffi ciency of insurance claims. Management

believes the insurance recovery asset is probable of recovery as the insurance

carrier continues to have a strong fi nancial strength rating.

The Duke Energy Registrants also have credit risk exposure through

issuance of performance guarantees, letters of credit and surety bonds on behalf

of less than wholly owned entities and third parties. Where the Duke Energy

Registrants have issued these guarantees, it is possible that they could be

required to perform under these guarantee obligations in the event the obligor

under the guarantee fails to perform. Where the Duke Energy Registrants have

issued guarantees related to assets or operations that have been disposed of

via sale, they attempt to secure indemnifi cation from the buyer against all future

performance obligations under the guarantees. See Note 7 to the Consolidated

Financial Statements, “Guarantees and Indemnifi cations,” for further information

on guarantees issued by the Duke Energy Registrants.

The Duke Energy Registrants are also subject to credit risk of their

vendors and suppliers in the form of performance risk on contracts including,

but not limited to, outsourcing arrangements, major construction projects and

commodity purchases. The Duke Energy Registrants’ credit exposure to such

vendors and suppliers may take the form of increased costs or project delays in

the event of non-performance.

Credit risk associated with the Duke Energy Registrants’ service to

residential, commercial and industrial customers is generally limited to

outstanding accounts receivable. The Duke Energy Registrants mitigate this

credit risk by requiring customers to provide a cash deposit or letter of credit

until a satisfactory payment history is established, subject to the rules and

regulations in effect in each retail jurisdiction, at which time the deposit is

typically refunded. Charge-offs for retail customers have historically been

insignifi cant to the operations of the Duke Energy Registrants and are typically

recovered through the retail rates. Management continually monitors customer

charge-offs and payment patterns to ensure the adequacy of bad debt reserves.

Duke Energy Ohio and Duke Energy Indiana sell certain of their accounts

receivable and related collections through CRC, a Duke Energy consolidated

variable interest entity. Losses on collection are fi rst absorbed by the equity of

CRC and next by the subordinated retained interests held by Duke Energy Ohio,

Duke Energy Kentucky and Duke Energy Indiana. See Note 17 to the Consolidated

Financial Statements, “Variable Interest Entities.”

Based on the Duke Energy Registrants’ policies for managing credit risk,

their exposures and their credit and other reserves, the Duke Energy Registrants

do not currently anticipate a materially adverse effect on their consolidated

fi nancial position or results of operations as a result of non-performance by any

counterparty.

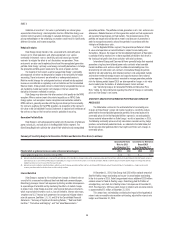

Marketable Securities Price Risk

As described further in Note 15 to the Consolidated Financial Statements,

“Investments in Debt and Equity Securities,” Duke Energy invests in debt

and equity securities as part of various investment portfolios to fund certain

obligations. The vast majority of investments in equity securities are within the

NDTF and assets of the various pension and other post-retirement benefi t plans.

Pension Plan Assets

Duke Energy maintains investments to help fund the costs of providing

non-contributory defi ned benefi t retirement and other post-retirement benefi t

plans. These investments are exposed to price fl uctuations in equity markets

and changes in interest rates. The equity securities held in these pension

plans are diversifi ed to achieve broad market participation and reduce the

impact of any single investment, sector or geographic region. Duke Energy has

established asset allocation targets for its pension plan holdings, which take into

consideration the investment objectives and the risk profi le with respect to the

trust in which the assets are held.

A signifi cant decline in the value of plan asset holdings could require Duke

Energy to increase funding of its pension plans in future periods, which could

adversely affect cash fl ows in those periods. Additionally, a decline in the fair value

of plan assets, absent additional cash contributions to the plan, could increase

the amount of pension cost required to be recorded in future periods, which could

adversely affect Duke Energy’s results of operations in those periods.

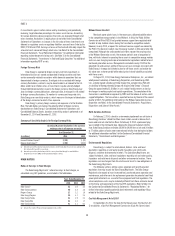

Nuclear Decommissioning Trust Funds

As required by the Nuclear Regulatory Commission (NRC), NCUC, PSCSC

and FPSC, subsidiaries of Duke Energy maintain trust funds to fund the costs of

nuclear decommissioning. As of December 31, 2014, these funds were invested

primarily in domestic and international equity securities, debt securities,

cash and cash equivalents and short-term investments. Per the NRC, Internal

Revenue Code, NCUC, PSCSC and FPSC requirements, these funds may be

used only for activities related to nuclear decommissioning. The investments

in equity securities are exposed to price fl uctuations in equity markets. Duke

Energy actively monitors its portfolios by benchmarking the performance of