Duke Energy 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

PART II

the stormwater pipe, stopping the release of materials into the river. Duke Energy

is a party to multiple lawsuits fi led in regards to the Dan River coal ash release

and operations at other North Carolina facilities with ash basins. The outcome

of these lawsuits could have an adverse impact to Regulated Utilities’ fi nancial

position, results of operations and cash fl ows. See Note 5 to the Consolidated

Financial Statements, “Commitments and Contingencies,” for additional

information.

An order from regulatory authorities disallowing recovery of costs related

to closure of ash basins could have an adverse impact to the Regulated Utilities’

fi nancial position, results of operations and cash fl ows. See Notes 5 and 9 to

the Consolidated Financial Statements, “Commitments and Contingencies” and

“Asset Retirement Obligations,” respectively, for additional information.

In 2015, the Indiana Utility Regulatory Commission (IURC) is examining

intervenors’ allegations that the Edwardsport IGCC was not properly placed in

commercial operation in June 2013 and intervenors’ allegations regarding plant

performance. In addition, the Indiana Court of Appeals remanded the IURC

order in the ninth IGCC rider proceeding back to the IURC for further fi ndings

concerning approximately $61 million of fi nancing charges Joint Intervenors

claimed were caused by construction delay and a ratemaking issue concerning

the in-service date determination for tax purposes. The outcome of these

proceedings could have an adverse impact to Regulated Utilities’ fi nancial

position, results of operations and cash fl ows. Duke Energy cannot predict on

the outcome of these proceedings. See Note 4 to the Consolidated Financial

Statements, “Regulatory Matters,” for additional information.

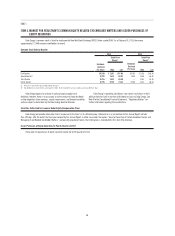

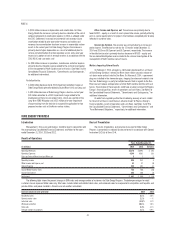

International Energy

Years Ended December 31,

(in millions) 2014 2013

Variance

2014 vs.

2013 2012

Variance

2013 vs.

2012

Operating Revenues $ 1,417 $ 1,546 $ (129) $ 1,549 $ (3)

Operating Expenses 1,007 1,000 7 1,043 (43)

Gains (Losses) on Sales of Other Assets and Other, net 633— 3

Operating Income 416 549 (133) 506 43

Other Income and Expense, net 190 125 65 171 (46)

Interest Expense 93 86 7 76 10

Income Before Income Taxes 513 588 (75) 601 (13)

Income Tax Expense 449 166 283 149 17

Less: Income Attributable to Noncontrolling Interests 914 (5) 13 1

Segment Income $55 $ 408 $ (353) $ 439 $ (31)

Sales, GWh 18,629 20,306 (1,677) 20,132 174

Net proportional MW capacity in operation 4,340 4,600 (260) 4,584 16

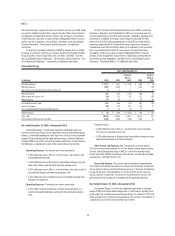

Year Ended December 31, 2014 as Compared to 2013

International Energy’s results were negatively impacted by higher tax

expense resulting from the decision to repatriate historical undistributed foreign

earnings, unfavorable hydrology and exchange rates in Brazil and an unplanned

outage in Chile, partially offset by higher equity earnings in National Methanol

Company (NMC) and a 2013 net currency remeasurement loss in Latin America.

The following is a detailed discussion of the variance drivers by line item.

Operating Revenues. The variance was driven primarily by:

• A $44 million decrease in Peru as a result of lower sales volumes and

unfavorable exchange rates;

• A $35 million decrease in Brazil due to unfavorable exchange rates and

lower sales volumes partially offset by higher average prices;

• A $27 million decrease in Chile as a result of lower sales volumes due to

an unplanned outage, and lower average prices; and

• A $25 million decrease in Argentina due to unfavorable exchange rates

and lower average prices.

Operating Expenses. The variance was driven primarily by:

• A $75 million increase in Brazil due to higher purchased power as a

result of unfavorable hydrology, partially offset by favorable exchange

rates.

Partially offset by:

• A $38 million decrease in Peru as a result of lower purchased power,

transmission, and royalty costs; and

• A $26 million decrease in Argentina due to favorable exchange rates and

lower purchased power and fuel consumption.

Other Income and Expenses, net. The variance is primarily due to a

2013 net currency remeasurement loss in Latin America, higher interest income

in Brazil, and higher equity earnings in NMC as a result of increased methyl

tertiary butyl ether (MTBE) and methanol sales volumes, partially offset by lower

average prices and higher butane costs.

Income Tax Expense. The variance was primarily due to approximately

$373 million of incremental tax expense resulting from the decision to repatriate

all cumulative historical undistributed foreign earnings at that time. The effective

tax rate for the years ended December 31, 2014 and 2013 was 87.3 percent

and 28.3 percent, respectively. The increase in the effective tax rate was also

primarily due to the tax expense associated with the repatriation decision.

Year Ended December 31, 2013 as Compared to 2012

International Energy’s results were negatively impacted by an extended

outage at NMC and unfavorable exchange rates in Latin America, partially offset

by the acquisition of Iberoamericana de Energía Ibener, S.A. (Ibener) in 2012 and

higher average prices and lower purchased power costs in Brazil. The following is

a detailed discussion of the variance drivers by line item.