Duke Energy 2014 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

7

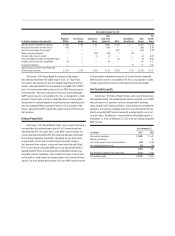

The number of residential, general service and industrial customers

within the Regulated Utilities service territory is expected to increase over time.

However, growth in the near term has been hampered by current economic

conditions. Average usage per residential customer is expected to remain fl at or

decline for the foreseeable future. While total industrial and general service sales

increased in 2014 when compared to 2013, the growth rate was modest when

compared to historical periods.

Seasonality and the Impact of Weather

Regulated Utilities’ costs and revenues are infl uenced by seasonal

patterns. Peak sales of electricity occur during the summer and winter months,

resulting in higher revenue and cash fl ows in these periods. By contrast, lower

sales of electricity occur during the spring and fall, allowing for scheduled plant

maintenance. Peak gas sales occur during the winter months. Residential and

general service customers are most impacted by weather. Estimated weather

impacts are based on actual current period weather compared to normal weather

conditions. Normal weather conditions are defi ned as the long-term average of

actual historical weather conditions.

The estimated impact of weather on earnings is based on the number

of customers, temperature variances from a normal condition and customers’

historic usage levels and patterns. The methodology used to estimate the impact

of weather does not and cannot consider all variables that may impact customer

response to weather conditions such as humidity and relative temperature

changes. The precision of this estimate may also be impacted by applying long-

term weather trends to shorter-term periods.

Degree-day data are used to estimate energy required to maintain

comfortable indoor temperatures based on each day’s average temperature.

Heating-degree days measure the variation in weather based on the extent

the average daily temperature falls below a base temperature. Cooling-degree

days measure the variation in weather based on the extent the average daily

temperature rises above the base temperature. Each degree of temperature

below the base temperature counts as one heating-degree day and each degree

of temperature above the base temperature counts as one cooling-degree day.

Competition

Retail

Regulated Utilities’ businesses operate as the sole supplier of electricity

within their service territories, with the exception of Ohio, which has a

competitive electricity supply market for generation service. Regulated Utilities

owns and operates facilities necessary to transmit and distribute electricity and,

except in Ohio, to generate electricity. Services are priced by state commission

approved rates designed to include the costs of providing these services and

a reasonable return on invested capital. This regulatory policy is intended to

provide safe and reliable electricity at fair prices. Competition in the regulated

electric distribution business is primarily from on-site generation of industrial

customers and distributed generation, such as rooftop solar, at residential,

general service and/or industrial customer sites.

Regulated Utilities is not aware of any proposed legislation in any

jurisdiction that would give its retail customers the right to choose their

electricity provider or otherwise restructure or deregulate the electric industry.

Although there is no pending legislation at this time, if the retail

jurisdictions served by Regulated Utilities become subject to deregulation, the

recovery of stranded costs could become a signifi cant consideration. Stranded

costs primarily include the generation assets of Regulated Utilities whose value

in a competitive marketplace may be less than their current book value, as well

as above-market purchased power commitments from qualifying facilities (QFs).

The Public Utility Regulatory Policies Act of 1978 (PURPA) established a new

class of generating facilities as QFs, typically small power production facilities

that generate power within a utility company’s service territory for which the

utility companies are legally obligated to purchase the energy at an avoided cost

rate. Thus far, all states that have passed restructuring legislation have provided

for the opportunity to recover a substantial portion of stranded costs.

Regulated Utilities’ largest stranded cost exposure is primarily related to

Duke Energy Florida’s purchased power commitments with QFs, under which it

has future minimum expected capacity payments through 2025 of $2.2 billion.

Duke Energy Florida was obligated to enter into these contracts under provisions

of PURPA. Duke Energy Florida continues to seek ways to address the impact

of escalating payments under these contracts. However, the FPSC allows

full recovery of the retail portion of the cost of power purchased from QFs.

For additional information related to these purchased power commitments,

see Note 5 to the Consolidated Financial Statements, “Commitments and

Contingencies.”

In Ohio, Regulated Utilities conducts competitive auctions for electricity

supply. The cost of energy purchased through these auctions is recovered

from retail customers. Regulated Utilities earns retail margin in Ohio on the

transmission and distribution of electricity only and not on the cost of the

underlying energy.

Wholesale

Regulated Utilities competes with other utilities and merchant generators

for bulk power sales, sales to municipalities and cooperatives, and wholesale

transactions. The principal factors in competing for these sales are price,

availability of capacity and power, and reliability of service. Prices are infl uenced

primarily by market conditions and fuel costs.

Increased competition in the wholesale electric utility industry and

the availability of transmission access could affect Regulated Utilities’ load

forecasts, plans for power supply and wholesale energy sales and related

revenues. Wholesale energy sales will be impacted by the extent to which

additional generation is available to sell to the wholesale market and the ability

of Regulated Utilities to attract new customers and to retain existing customers.

Energy Capacity and Resources

Regulated Utilities owns approximately 50,000 megawatts (MW) of

generation capacity. For additional information on Regulated Utilities’ generation

facilities, see Item 2, “Properties.”

Energy and capacity are also supplied through contracts with other

generators and purchased on the open market. Factors that could cause

Regulated Utilities to purchase power for its customers include generating plant

outages, extreme weather conditions, generation reliability, growth and price.

Regulated Utilities has interconnections and arrangements with its neighboring

utilities to facilitate planning, emergency assistance, sale and purchase of

capacity and energy, and reliability of power supply.

Regulated Utilities’ generation portfolio is a balanced mix of energy

resources having different operating characteristics and fuel sources designed

to provide energy at the lowest possible cost to meet its obligation to serve retail

customers. All options, including owned generation resources and purchased

power opportunities, are continually evaluated on a real-time basis to select and

dispatch the lowest-cost resources available to meet system load requirements.