Duke Energy 2014 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

impact on Duke Energy Ohio’s results of operations, cash fl ows or fi nancial

position of these cases to date has not been material. Based on estimates under

varying assumptions concerning uncertainties, such as, among others: (i) the

number of contractors potentially exposed to asbestos during construction or

maintenance of Duke Energy Ohio generating plants, (ii) the possible incidence

of various illnesses among exposed workers, and (iii) the potential settlement

costs without federal or other legislation that addresses asbestos tort actions,

Duke Energy Ohio estimates that the range of reasonably possible exposure

in existing and future suits over the foreseeable future is not material. This

assessment may change as additional settlements occur, claims are made, and

more case law is established.

Duke Energy Indiana

Edwardsport IGCC

On December 11, 2012, Duke Energy Indiana fi led an arbitration action

against General Electric Company and Bechtel Corporation in connection

with their work at the Edwardsport IGCC facility. Duke Energy Indiana is

seeking damages equaling some or all of the additional costs incurred in the

construction of the project not recovered at the IURC. The arbitration hearing

concluded December 15, 2014. The parties will submit post hearing briefs. Duke

Energy Indiana cannot predict the outcome of this matter.

Other Litigation and Legal Proceedings

The Duke Energy Registrants are involved in other legal, tax and regulatory

proceedings arising in the ordinary course of business, some of which involve

signifi cant amounts. The Duke Energy Registrants believe the fi nal disposition of

these proceedings will not have a material effect on their results of operations,

cash fl ows or fi nancial position.

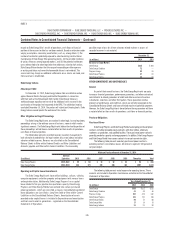

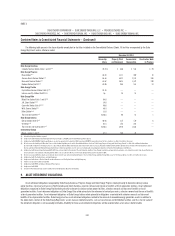

The table below presents recorded reserves based on management’s

best estimate of probable loss for legal matters discussed above, excluding

asbestos related reserves. Reserves are classifi ed on the Consolidated

Balance Sheets in Other within Deferred Credits and Other Liabilities and

Accounts payable and Other within Current Liabilities. The reasonably

possible range of loss for all non-asbestos related matters in excess of

recorded reserves is not material.

December 31,

(in millions) 2014 2013

Reserves for Legal Matters

Duke Energy $323 $ 204

Duke Energy Carolinas 72 —

Progress Energy 93 78

Duke Energy Progress 37 10

Duke Energy Florida 36 43

OTHER COMMITMENTS AND CONTINGENCIES

General

As part of their normal business, the Duke Energy Registrants are party

to various fi nancial guarantees, performance guarantees, and other contractual

commitments to extend guarantees of credit and other assistance to various

subsidiaries, investees, and other third parties. These guarantees involve

elements of performance and credit risk, which are not fully recognized on the

Consolidated Balance Sheets and have unlimited maximum potential payments.

However, the Duke Energy Registrants do not believe these guarantees will have

a material effect on their results of operations, cash fl ows or fi nancial position.

Purchase Obligations

Purchased Power

Duke Energy Progress and Duke Energy Florida have ongoing purchased power

contracts, including renewable energy contracts, with other utilities, wholesale

marketers, co-generators, and qualifi ed facilities. These purchased power contracts

generally provide for capacity and energy payments. In addition, Duke Energy Progress

and Duke Energy Florida have various contracts to secure transmission rights.

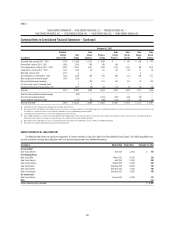

The following table presents executory purchased power contracts,

excluding contracts classifi ed as leases. All contracts represent 100 percent of

net plant output.

Minimum Purchase Amount at December 31, 2014

(in millions)

Contract

Expiration 2015 2016 2017 2018 2019 Thereafter Total

Duke Energy Progress 2019-2022 $ 59 $ 60 $ 61 $ 62 $ 63 $ 93 $ 398

Duke Energy Florida 2023-2043 244 273 291 306 322 1,907 3,343

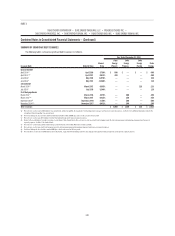

Operating and Capital Lease Commitments

The Duke Energy Registrants lease office buildings, railcars, vehicles,

computer equipment and other property and equipment with various terms

and expiration dates. Additionally, Duke Energy Progress has a capital

lease related to firm gas pipeline transportation capacity. Duke Energy

Progress and Duke Energy Florida have entered into certain purchased

power agreements, which are classified as leases. Consolidated capitalized

lease obligations are classified as Long-Term Debt or Other within Current

Liabilities on the Consolidated Balance Sheets. Amortization of assets

recorded under capital leases is included in Depreciation and amortization

and Fuel used in electric generation – regulated on the Consolidated

Statements of Operations.

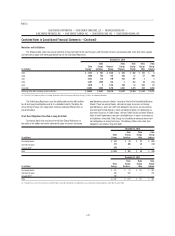

The following table presents rental expense for operating leases. These

amounts are included in Operation, maintenance and other on the Consolidated

Statements of Operations.

Years Ended December 31,

(in millions) 2014 2013 2012

Duke Energy $355 $321 $232

Duke Energy Carolinas 41 39 38

Progress Energy 257 225 232

Duke Energy Progress 161 153 164

Duke Energy Florida 96 72 68

Duke Energy Ohio 17 14 14

Duke Energy Indiana 21 22 20