Duke Energy 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

Duke Energy Indiana is a regulated public utility primarily engaged in

the generation, transmission, distribution and sale of electricity in portions

of Indiana. Duke Energy Indiana is subject to the regulatory provisions of the

Indiana Utility Regulatory Commission (IURC) and FERC. Substantially all of

Duke Energy Indiana’s operations qualify for regulatory accounting.

Certain prior year amounts have been reclassifi ed to conform to the

current year presentation.

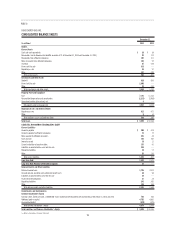

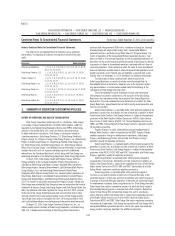

Other Current and Non-Current Assets and Liabilities

Other within Current Assets includes the current portion of deferred tax

assets, which are disclosed in Note 22. Additionally, the following are included

in Other within Current Assets or Current Liabilities in the Consolidated Balance

Sheets of the Duke Energy Registrants at December 31, 2014 and 2013. The

amounts presented exceeded 5 percent of current assets or 5 percent of current

liabilities unless otherwise noted.

December 31,

(in millions) Location 2014 2013

Duke Energy

Accrued compensation Current Liabilities $ 638 $ 621

Duke Energy Carolinas

Accrued compensation Current Liabilities $ 216 $ 198

Collateral liabilities Current Liabilities 128 120

Progress Energy

Income taxes receivable(b) Current Assets $ 718 $ 119

Customer deposits Current Liabilities 360 349

Accrued compensation(a) Current Liabilities 174 214

Derivative liabilities(b) Current Liabilities 271 ––

Duke Energy Progress

Income taxes receivable(b) Current Assets $ 272 $ 15

Customer deposits Current Liabilities 135 129

Accrued compensation Current Liabilities 116 121

Derivative liabilities(b) Current Liabilities 108 38

Duke Energy Florida

Income taxes receivable(b) Current Assets $ 177 $65

Customer deposits Current Liabilities 225 220

Accrued compensation(a) Current Liabilities 57 65

Derivative liabilities(b) Current Liabilities 163 ––

December 31,

(in millions) Location 2014 2013

Duke Energy Ohio

Collateral assets(a) Current Assets $13 $ 122

Duke Energy Indiana

Income taxes receivable Current Assets $98 $56

Accrued compensation(a) Current Liabilities 25 25

Collateral liabilities Current Liabilities 43 40

(a) Does not exceed 5 percent of total current assets or liabilities, as appropriate, on the Consolidated

Balance Sheets at December 31, 2014.

(b) Does not exceed 5 percent of total current assets or liabilities, as appropriate, on the Consolidated

Balance Sheets at December 31, 2013.

Preferred Stock

In March 2013, Duke Energy Progress and Duke Energy Florida redeemed

all series of their outstanding preferred stock at prices ranging from $101.00

to $110.00 per share for Duke Energy Progress and $101.00 to $104.25 per

share for Duke Energy Florida plus accrued dividends for all series. Duke Energy

Progress and Duke Energy Florida redeemed the shares for $62 million and

$34 million, respectively.

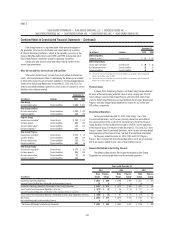

Discontinued Operations

For the year ended December 31, 2014, Duke Energy’s Loss from

Discontinued Operations, net of tax was primarily related to a write-down of

the carrying amount of the assets to the estimated fair value of the Disposal

Group, based on the transaction price included in the PSA, and the operations

of the Disposal Group. For the years ended December 31, 2013 and 2012, Duke

Energy’s Income From Discontinued Operations, net of tax was primarily related

to the operations of the Disposal Group. See Note 2 for additional information.

For the years ended December 31, 2014, 2013 and 2012. Progress

Energy’s (Loss) Income From Discontinued Operations, net of tax was primarily

due to tax impacts related to prior sales of diversifi ed businesses.

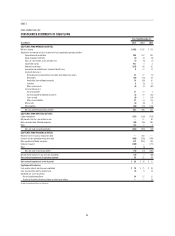

Amounts Attributable to Controlling Interests

The following table presents Net Income Attributable to Duke Energy

Corporation for continuing operations and discontinued operations.

Years ended December 31,

2014 2013 2012

(in millions)

Duke

Energy

Progress

Energy

Duke

Energy

Progress

Energy

Duke

Energy

Progress

Energy

Income from Continuing Operations $ 2,465 $ 880 $ 2,590 $ 659 $ 1,611 $ 355

Income of Continuing Operations Attributable to Noncontrolling Interests 14 5 16 3 18 7

Income from Continuing Operations Attributable to Duke Energy Corporation $ 2,451 $ 875 $ 2,574 $ 656 $ 1,593 $ 348

(Loss) Income From Discontinued Operations, net of tax $ (576) $ (6) $ 86 $ 16 $ 171 $ 52

Loss of Discontinued Operations attributable to Noncontrolling Interests, net of tax (8) — (5) — (4) —

(Loss) Income From Discontinued Operations Attributable to Duke Energy Corporation, net of tax $ (568) $ (6) $ 91 $ 16 $ 175 $ 52

Net Income $ 1,889 $ 874 $ 2,676 $ 675 $ 1,782 $ 407

Net Income Attributable to Noncontrolling Interest 65 11 3 14 7

Net Income Attributable to Duke Energy Corporation $ 1,883 $ 869 $ 2,665 $ 672 $ 1,768 $ 400