Duke Energy 2014 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2014 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

178

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, INC. • DUKE ENERGY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

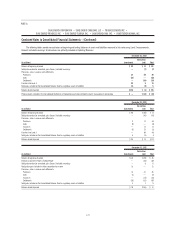

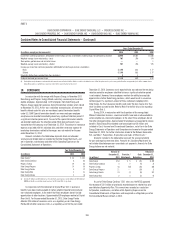

December 31, 2013

Investment Type

Fair Value

(in millions) Valuation Technique Unobservable Input Range

Duke Energy

Natural gas contracts $ (2) Discounted cash fl ow Forward natural gas curves – price per MMBtu $ 3.07 —$ 5.37

FERC mitigation power sale agreements $ (2) Discounted cash fl ow Forward electricity curves – price per MWh $ 25.79 —$ 52.38

FTRs $ 12 RTO auction pricing FTR price – per MWh $ (0.30) —$ 13.80

Electricity contracts $ 23 Discounted cash fl ow Forward electricity curves – price per MWh $ 20.77 —$ 58.90

Commodity capacity option contracts $ 4 Discounted cash fl ow Forward capacity option curves – price per MW day $ 30.40 —$165.10

Reserves $(22) Bid-ask spreads, implied volatility, probability of default

Total Level 3 derivatives $ 13

Duke Energy Carolinas

FERC mitigation power sale agreements $ (2) Discounted cash fl ow Forward electricity curves – price per MWh $ 25.79 —$ 52.38

Duke Energy Ohio

Electricity contracts $ 18 Discounted cash fl ow Forward electricity curves – price per MWh $ 20.77 —$ 58.90

Natural gas contracts $ (2) Discounted cash fl ow Forward natural gas curves – price per MMBtu $ 3.07 —$ 5.37

Reserves $(20) Bid-ask spreads, implied volatility, probability of default

Total Level 3 derivatives $ (4)

Duke Energy Indiana

FTRs $ 12 RTO auction pricing FTR price – per MWh $ (0.30) —$ 13.80

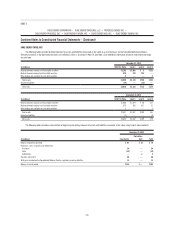

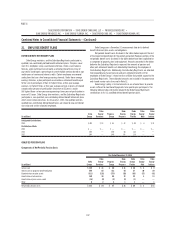

OTHER FAIR VALUE DISCLOSURES

The fair value and book value of long-term debt, including current maturities, is summarized in the following table. Estimates determined are not necessarily

indicative of amounts that could have been settled in current markets. Fair value of long-term debt uses Level 2 measurements.

December 31, 2014 December 31, 2013

(in millions) Book Value Fair Value Book Value Fair Value

Duke Energy $ 40,020 $44,566 $40,256 $42,592

Duke Energy Carolinas $ 8,391 $ 9,626 $ 8,436 $ 9,123

Progress Energy $ 14,754 $16,951 $14,115 $15,234

Duke Energy Progress $ 6,201 $ 6,696 $ 5,235 $ 5,323

Duke Energy Florida $ 4,860 $ 5,767 $ 4,886 $ 5,408

Duke Energy Ohio $ 1,766 $ 1,970 $ 2,188 $ 2,237

Duke Energy Indiana $ 3,791 $ 4,456 $ 3,796 $ 4,171

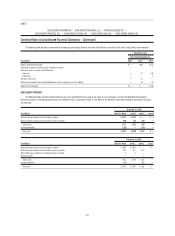

At both December 31, 2014 and December 31, 2013, fair value of cash and cash equivalents, accounts and notes receivable, accounts payable, notes payable

and commercial paper, and non-recourse notes payable of variable interest entities are not materially different from their carrying amounts because of the short-term

nature of these instruments and/or because the stated rates approximate market rates.

17. VARIABLE INTEREST ENTITIES

A VIE is an entity that is evaluated for consolidation using more than

a simple analysis of voting control. The analysis to determine whether an

entity is a VIE considers contracts with an entity, credit support for an entity,

the adequacy of the equity investment of an entity, and the relationship of

voting power to the amount of equity invested in an entity. This analysis is

performed either upon the creation of a legal entity or upon the occurrence of

an event requiring reevaluation, such as a signifi cant change in an entity’s

assets or activities. A qualitative analysis of control determines the party that

consolidates a VIE. This assessment is based on (i) what party has the power

to direct the most signifi cant activities of the VIE that impact its economic

performance, and (ii) what party has rights to receive benefi ts or is obligated

to absorb losses that are signifi cant to the VIE. The analysis of the party that

consolidates a VIE is a continual reassessment.

No fi nancial support was provided to any of the consolidated VIEs during

the years ended December 31, 2014, 2013 and 2012, or is expected to be

provided in the future, that was not previously contractually required.